Motorola 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

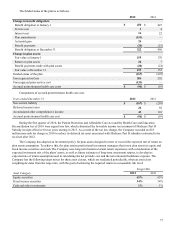

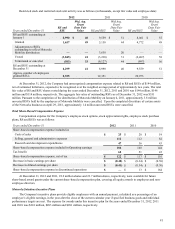

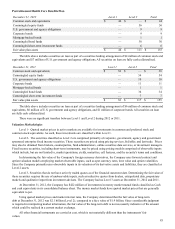

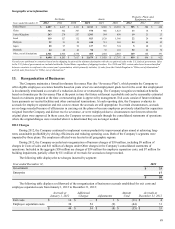

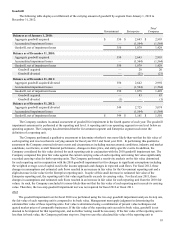

Credit Quality of Customer Financing Receivables and Allowance for Credit Losses

An aging analysis of financing receivables at December 31, 2012 and December 31, 2011 is as follows:

December 31, 2012

Tota l

Long-term

Receivable

Current Billed

Due

Past Due

Under 90 Days

Past Due

Over 90 Days

Municipal leases secured tax exempt $ 23 $ — $ — $ —

Commercial loans and leases secured $ 78 $ 1 $ 2 $ 4

Total gross long-term receivables, including

current portion $101$1$2$4

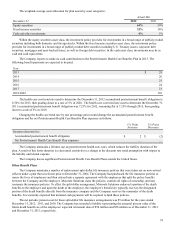

December 31, 2011

Tota l

Long-term

Receivable

Current Billed

Due

Past Due

Under 90 Days

Past Due

Over 90 Days

Municipal leases secured tax exempt $ 14 $ — $ — $ —

Commercial loans and leases secured $ 61 $ 1 $ 2 $ —

Commercial loans unsecured $102$—$—$—

Total gross long-term receivables, including

current portion $177$1$2$—

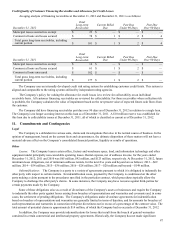

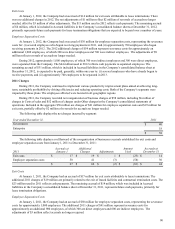

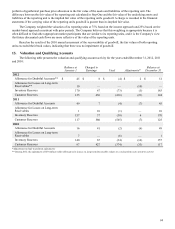

The Company uses an internally developed credit risk rating system for establishing customer credit limits. This system is

aligned and comparable to the rating systems utilized by independent rating agencies.

The Company’s policy for valuing the allowance for credit losses is to review for collectability on an individual

receivable basis. All customer financing receivables are reviewed for collectability. For those receivables where collection risk

is probable, the Company calculates the value of impairment based on the net present value of expected future cash flows from

the customer.

The Company did have financing receivables past due over 90 days as of December 31, 2012 in relation to a single loan.

The Company is no longer accruing interest on this loan as of December 31, 2011. A $10 million reserve was established for

this loan due to collectability issues at December 31, 2011, all of which is classified as current as of December 31, 2012.

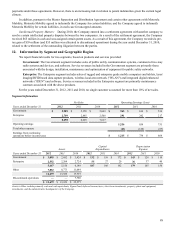

11. Commitments and Contingencies

Legal

The Company is a defendant in various suits, claims and investigations that arise in the normal course of business. In the

opinion of management, based on the current facts and circumstances, the ultimate disposition of these matters will not have a

material adverse effect on the Company’s consolidated financial position, liquidity or results of operations.

Other

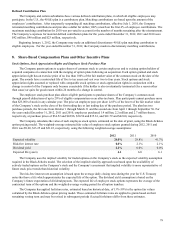

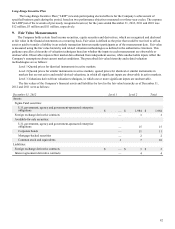

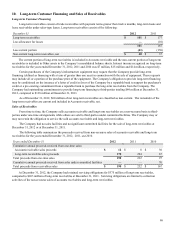

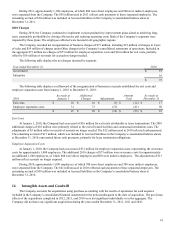

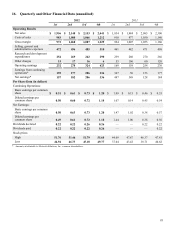

Leases: The Company leases certain office, factory and warehouse space, land, and information technology and other

equipment under principally non-cancelable operating leases. Rental expense, net of sublease income, for the years ended

December 31, 2012, 2011 and 2010 was $65 million, $92 million, and $123 million, respectively. At December 31, 2012, future

minimum lease obligations, net of minimum sublease rentals, for the next five years and beyond are as follows: 2013—$69

million; 2014—$54 million; 2015—$36 million; 2016—$28 million; 2017—$20 million and beyond—$149 million.

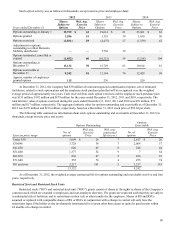

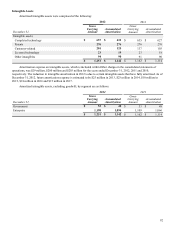

Indemnifications: The Company is a party to a variety of agreements pursuant to which it is obligated to indemnify the

other party with respect to certain matters. In indemnification cases, payment by the Company is conditioned on the other

party making a claim pursuant to the procedures specified in the particular contract, which procedures typically allow the

Company to challenge the other party's claims. In some instances, the Company may have recourse against third-parties for

certain payments made by the Company.

Some of these obligations arise as a result of divestitures of the Company's assets or businesses and require the Company

to indemnify the other party against losses arising from breaches of representations and warranties and covenants and, in some

cases, the settlement of pending obligations. The Company's obligations under divestiture agreements for indemnification

based on breaches of representations and warranties are generally limited in terms of duration, and for amounts for breaches of

such representation and warranties in connection with prior divestitures not in excess of a percentage of the contract value. The

total amount of potential claims is approximately $14 million, of which the Company had no accruals at December 31, 2012.

In addition, the Company may provide indemnifications for losses that result from the breach of general warranties

contained in certain commercial and intellectual property agreements. Historically, the Company has not made significant