Motorola 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

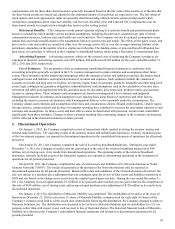

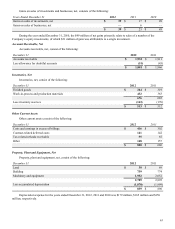

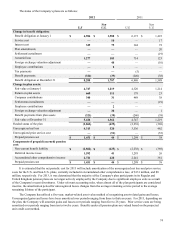

During the years ended December 31, 2011, and 2010, the Company paid $8 million and $23 million, respectively, of

dividends to minority shareholders in connection with subsidiary common stock.

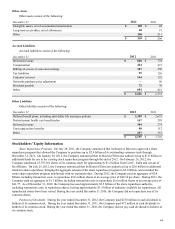

Motorola Mobility Distribution: On January 4, 2011, the distribution of Motorola Mobility from Motorola Solutions was

completed. On January 4, 2011, the stockholders of record as of the close of business on December 21, 2010 (the "Record

Date") received one (1) share of Motorola Mobility common stock for each eight (8) shares of the Company's common stock

held as of the Record Date. The distribution was completed pursuant to an Amended and Restated Master Separation and

Distribution Agreement, effective as of July 31, 2010, among the Company, Motorola Mobility and Motorola Mobility, Inc.

As a result of the distribution on January 4, 2011, certain equity balances were transferred by the Company to Motorola

Mobility including: (i) $1 million in foreign currency translation adjustments, (ii) $9 million in fair value adjustments to

available for sale securities, net of tax of $5 million, and (iii) $8 million in retirement benefit adjustments, net of tax of $4

million. The distribution of net assets and these equity balances were effected by way of a pro rata dividend to Motorola

Solutions stockholders, which reduced Retained earnings and Additional paid in capital by $5.3 billion.

Reverse Stock Split: On January 4, 2011, immediately following the distribution of Motorola Mobility common stock,

the Company completed the Reverse Stock Split. All consolidated per share information presented gives effect to the

distribution of Motorola Mobility and the Reverse Stock Split.

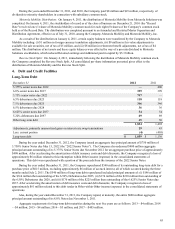

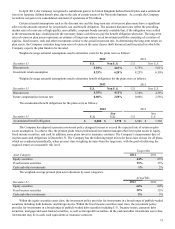

4. Debt and Credit Facilities

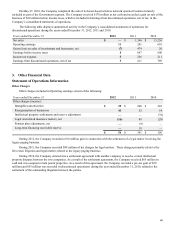

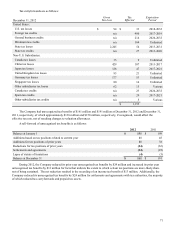

Long-Term Debt

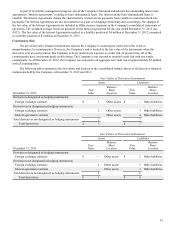

December 31 2012 2011

5.375% senior notes due 2012 —400

6.0% senior notes due 2017 399 399

3.75% senior notes due 2022 747 —

6.5% debentures due 2025 118 118

7.5% debentures due 2025 346 346

6.5% debentures due 2028 36 36

6.625% senior notes due 2037 54 54

5.22% debentures due 2097 89 89

Other long-term debt 45 50

1,834 1,492

Adjustments, primarily unamortized gains on interest rate swap terminations 29 43

Less: current portion (4)(405)

Long-term debt $ 1,859 $ 1,130

During the year ended December 31, 2012, the Company issued an aggregate face principal amount of $750 million of

3.750% Senior Notes due May 15, 2022 (the “2022 Senior Notes”). The Company also redeemed $400 million aggregate

principal amount outstanding of its 5.375% Senior Notes due November 2012 for an aggregate purchase price of approximately

$408 million. After accelerating the amortization of debt issuance costs and debt discounts, the Company recognized a loss of

approximately $6 million related to this redemption within Other income (expense) in the consolidated statements of

operations. This debt was repurchased with a portion of the proceeds from the issuance of the 2022 Senior Notes.

During the year ended December 31, 2011, the Company repurchased $540 million of its outstanding long-term debt for a

purchase price of $615 million, excluding approximately $6 million of accrued interest, all of which occurred during the three

months ended July 2, 2011. The $540 million of long-term debt repurchased included principal amounts of: (i) $196 million of

the $314 million then outstanding of the 6.50% Debentures due 2025, (ii) $174 million of the $210 million then outstanding of

the 6.50% Debentures due 2028, and (iii) $170 million of the $225 million then outstanding of the 6.625% Senior Notes due

2037. After accelerating the amortization of debt issuance costs and debt discounts, the Company recognized a loss of

approximately $81 million related to this debt tender in Other within Other income (expense) in the consolidated statements of

operations.

Also, during the year ended December 31, 2011, the Company repaid, at maturity, the entire $600 million aggregate

principal amount outstanding of its 8.0% Notes due November 1, 2011.

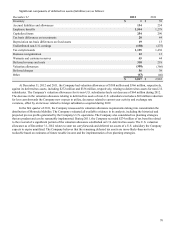

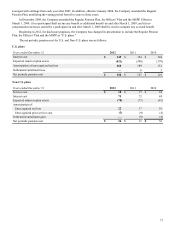

Aggregate requirements for long-term debt maturities during the next five years are as follows: 2013—$4 million; 2014

—$4 million; 2015—$4 million; 2016—$5 million; and 2017—$405 million.