Motorola 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

of these reviews to reflect management's best estimate of potential losses. The resulting net finance receivable

balance is intended to represent the estimated realizable value as determined based on: (i) the fair value of the

underlying collateral, if the receivable is collateralized, or (ii) the present value of expected future cash flows

discounted at the effective interest rate implicit in the underlying receivable.

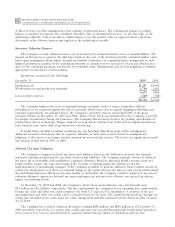

Inventory Valuation Reserves

The Company records valuation reserves on its inventory for estimated obsolescence or unmarketability. The

amount of the reserve is equal to the difference between the cost of the inventory and the estimated market value

based upon assumptions about future demand and market conditions. On a quarterly basis, management in each

segment performs an analysis of the underlying inventory to identify reserves needed for excess and obsolescence

and, for the remaining inventory, assesses the net realizable value. Management uses its best judgment to estimate

appropriate reserves based on this analysis.

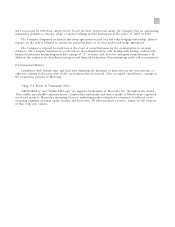

Inventories consisted of the following:

December 31

2005

2004

Finished goods $1,287 $1,429

Work-in-process and production materials 1,784 1,665

3,071 3,094

Less inventory reserves (549) (548)

$2,522 $2,546

The Company balances the need to maintain strategic inventory levels to ensure competitive delivery

performance to its customers against the risk of inventory obsolescence due to rapidly changing technology and

customer requirements. As indicated above, the Company's inventory reserves represented 18% of the gross

inventory balance at December 31, 2005 and 2004. These reserve levels are maintained by the Company to provide

for unique circumstances facing our businesses. The Company has inventory reserves for pending cancellations of

product lines due to technology changes, long-life cycle products, lifetime buys at the end of supplier production

runs, business exits, and a shift of production to outsourcing.

If actual future demand or market conditions are less favorable than those projected by management,

additional inventory writedowns may be required. Likewise, as with other reserves based on management's

judgment, if the reserve is no longer needed, amounts are reversed into income. There were no significant reversals

into income of this type in 2005 or 2004.

Deferred Tax Asset Valuation

The Company recognizes deferred tax assets and liabilities based on the differences between the financial

statement carrying amounts and the tax bases of assets and liabilities. The Company regularly reviews its deferred

tax assets for recoverability and establishes a valuation allowance based on historical taxable income, projected

future taxable income, the expected timing of the reversals of existing temporary differences and the

implementation of tax-planning strategies. If the Company is unable to generate sufficient future taxable income in

certain tax jurisdictions, or if there is a material change in the actual effective tax rates or time period within which

the underlying temporary differences become taxable or deductible, the Company could be required to increase its

valuation allowance against its deferred tax assets resulting in an increase in its effective tax rate and an adverse

impact on operating results.

At December 31, 2005 and 2004, the Company's deferred tax assets related to tax carryforwards were

$2.1 billion and $2.2 billion, respectively. The tax carryforwards are comprised of net operating loss carryforwards,

foreign tax credit and other tax credit carryovers for both U.S. and non-U.S. subsidiaries. A majority of the net

operating losses and other tax credits can be carried forward for 20 years. The carryforward period for foreign tax

credits was extended to ten years, from five years, during 2004 with the enactment of the American Jobs Creation

Act of 2004.

The Company has recorded valuation allowances totaling $896 million and $892 million as of December 31,

2005 and 2004, respectively, for certain state credits and state tax loss carryforwards with carryforward periods of

seven years or less, tax loss carryforwards of acquired entities that are subject to limitations and tax loss