Motorola 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

Within the equity securities asset class, the investment policy provides for investments in a broad range of

publicly-traded securities including both domestic and international stocks. Within the fixed income securities asset

class, the investment policy provides for investments in a broad range of publicly-traded debt securities ranging

from US Treasury issues, corporate debt securities, mortgages and asset-backed issues, as well as international debt

securities. In the cash asset class, investments may be in cash and cash equivalents.

Cash contributions of $43 million were made to the retiree healthcare plan in 2005. The Company expects to

make a cash contribution of $45 million to the retiree health care plan in 2006.

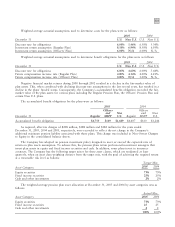

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

2006 $45

2007 43

2008 41

2009 39

2010 37

2011-2015 168

The health care trend rate used to determine the December 31, 2005 accumulated postretirement benefit

obligation is 10.0% for 2006. Beyond 2006 the trend rate is graded down 1.0% per year until it reaches 5.0% by

2011 and then remains flat. The health care trend rate used to determine the December 31, 2004 accumulated

postretirement benefit obligation was 10.0% for 2005 with the trend rate graded down per year until reaching 5.0%

by 2010 and then remaining flat.

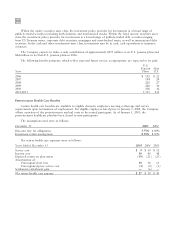

Changing the health care trend rate by one percentage point would change the accumulated postretirement

benefit obligation and the net retiree health care expense as follows:

1% Point 1% Point

Increase Decrease

Effect on:

Accumulated postretirement benefit obligation $24 $(25)

Net retiree health care expense 2 (2)

Due to the Company's lifetime maximum cap on postretirement health care expenses per person, a change in

the discount rate trend assumption has a small impact on the liability and related expense.

The Company has no significant postretirement health care benefit plans outside the United States.