Mitsubishi 1999 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 1999 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

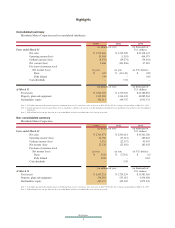

Consolidated summary

Mitsubishi Motors Corporation and its Consolidated Subsidaries.

1990 1991 1992 1993

Years ended March 31 (in millions of yen)

Net Sales ¥ 2,360,702 ¥ 2,797,770 ¥ 3,087,136 ¥ 3,180,430

Operating income 63,270 89,725 86,802 77,091

Ordinary income (loss) 50,228 55,750 60,541 50,225

Net income (loss) 21,133 25,852 29,514 25,832

Per share of common stock (in yen):

Net income (loss): (in yen)

Basic ¥ 26.59 ¥ 30.28 ¥ 34.56 ¥ 30.25

Fully diluted – – – –

Cash dividends 5.50 6.50 7.00 7.00

At March 31 (in millions of yen)

Total assets ¥ 1,771,504 ¥ 2,039,608 ¥ 2,284,928 ¥ 2,388,753

Property, plant and equipment 485,166 625,420 722,444 805,106

Stockholders' equity 336,801 357,672 382,260 401,475

Non-consolidated summary

Mitsubishi Motors Corporation

1990 1991 1992 1993

Years ended March 31 (in millions of yen)

Net Sales ¥ 2,025,715 ¥ 2,313,636 ¥ 2,554,055 ¥ 2,615,959

Operating income (loss) 48,774 65,822 56,186 57,493

Ordinary income (loss) 41,419 50,214 50,540 46,567

Net income (loss) 20,242 25,208 27,023 20,232

Per share of common stock (in yen):

Net income (loss): (in yen)

Basic ¥ 25.47 ¥ 29.52 ¥ 31.65 ¥ 23.69

Fully diluted – – – –

Cash dividends 5.50 6.50 7.00 7.00

At March 31 (in millions of yen)

Total assets ¥ 1,352,076 ¥ 1,554,119 ¥ 1,667,680 ¥ 1,731,985

Property, plant and equipment 331,941 395,545 462,220 491,010

Stockholders' equity 324,164 344,135 365,041 379,140

Note 1 :U.S.dollar amounts in this annual report are translated from yen, for convenience only, at the rate of ¥120.55=U.S.$1, the exchange rate prevailing on March 31, 1999.

Note 2: Fully diluted net income per share for the year ended March 1998 is not available due to the loss for the period.

Note 1 :U.S.dollar amounts in this annual report are translated from yen, for convenience only, at the rate of ¥120.55=U.S.$1, the exchange rate prevailing on March 31, 1999.

Note 2: Certain amounts previously reported have been reclassified to conform to the current year. The principal reclassification are detailed in 1 (n) of Notes the Consolidated Statements.

Note 3: Fully diluted net income per share for the year ended March 1998 is not available due to the loss for the period.

The Japanese economy has floundered since the collapse of

the asset-driven bubble in 1990. Today, the birth pains con-

tinue as it shifts from a bureaucracy-managed pattern to

something more akin to the market-driven economies of the

United States and Europe.

In fiscal 1998, Mitsubishi Motors Corporation(MMC)

made good its pledge to turn the deficit incurred in fiscal

1997–the result of slack sales on the Japanese market and in-

creased costs–into a profit. This achievement is the result of

major reforms implemented under the RM2001 (Renewal

Mitsubishi) mid-term management plan, which provides the

blueprint for MMC's transformation into a sound and prof-

itable company at the earliest possible date.

Details of RM2001 and of the progress achieved to date

are given elsewhere in this report. In a nutshell, however,

RM2001's principal thrust is directed at major reductions in

costs, at the same time as charting strategies for bolstering its

production and sales organizations, for giving added impetus

to new model development, and for promoting the ongoing

evolution of the GDI(Gasoline Direct Injection) engine tech-

nology that has gained a significant competitive edge for the

company. Other reforms currently under consideration in-

clude: the setting up of a holding company; the outsourcing

of corporate functions; and greater management emphasis on

consolidated performance, on market-price accounting and

on earnings.

The reforms piloted by RM2001 extend beyond the

shores of Japan, while giving due consideration to differ-

ences in cultures and approaches encountered in all countries

where the company operates. "Customer satisfaction",

"Innovative and creative", "Fair and open", "Speedy and sim-

ple": these keywords epitomize the company's corporate

ideals in its operations worldwide.

MMC has a mission: To extend its global presence in the

auto industry. To be fair and open in all aspects of its busi-

ness. To continue to strengthen its financial base and achieve

sustainable profitability. The company is focused on this

mission so that it may earn maximum customer satisfaction,

create value and reward its stockholders and employees.

Contents

Highlights 1

Making it work, making it pay 2

Senior officers 5

RM2001 6

On the analyst's couch 8

Product & technology development 12

Environment 14

Models 20

Operational review 22

Financial review 32

Consolidated balance sheets 36

Consolidated statements of operations 38

Consolidated statements of stockholders' equity 39

Consolidated statements of cash flows 40

Notes to consolidated financial statements 42

Report of the independent public accountants 53

Corporate data 54

Financial summary 58

The report is printed on recycled and recyclable paper.