Mercury Insurance 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

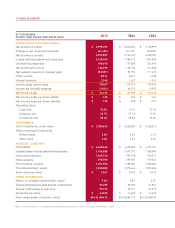

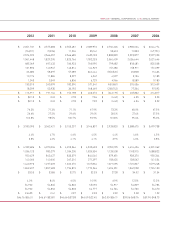

10 YEAR SUMMARY

*

Ratio of (i) net income less net realized investment (losses) gains, net of tax to (ii) average shareholders’ equity

2015 2014 2013

OPERATING RESULTS (GAAP BASIS)

Net premiums written $ 2,999,392 $ 2,840,922 $ 2,728,999

Change in net unearned premiums (41,495) (44,727) (30,812)

Net premiums earned 2,957,897 2,796,195 2,698,187

Losses and loss adjustment expenses 2,145,495 1,986,122 1,962,690

Underwriting expenses 790,070 775,589 724,995

Net investment income 126,299 125,723 124,538

Net realized investment (losses) gains (83,807) 81,184 (11,422)

Other income 8,911 8,671 9,738

Interest expense 3,168 2,637 1,260

Income (loss) before taxes 70,567 247,425 132,096

Income tax (benefit) expense (3,912) 69,476 19,953

Net income (loss) $ 74,479 $ 177,949 $ 112,143

Net income (loss) per share (basic) $ 1.35 $3.23 $ 2.04

Net income (loss) per share (diluted) $ 1.35 $ 3.23 $ 2.04

Operating ratios

Loss ratio 72.5% 71.0% 72.7%

Expense ratio 26.7% 27.7% 26.9%

Combined ratio 99.2% 98.8% 99.6%

INVESTMENTS

Total investments, at fair value $ 3,380,642 $ 3,403,822 $ 3,158,312

Yield on average investments

Before taxes 3.8% 3.9% 4.1%

After taxes 3.4% 3.5% 3.6%

FINANCIAL CONDITION

Total assets $ 4,628,645 $ 4,600,289 $ 4,315,181

Unpaid losses and loss adjustment expenses 1,146,688 1,091,797 1,038,984

Unearned premiums 1,049,314 999,798 953,527

Notes payable 290,000 290,000 190,000

Policyholders’ surplus 1,451,950 1,438,281 1,528,682

Total shareholders’ equity 1,820,885 1,875,446 1,822,486

Book value per share $ 33.01 $ 34.02 $ 33.15

OTHER INFORMATION

Return on average shareholders’ equity* 7.0% 6.8% 6.5%

Diluted weighted average shares outstanding 55,209 55,020 54,964

Shares outstanding at year-end 55,164 55,121 54,975

Dividends per share $ 2.4725 $ 2.4625 $ 2.4525

Price range (bids) of common stock $60.31-$45.12 $59.68-$41.70 $51.00-$36.03

IN THOUSANDS,

EXCEPT PER SHARE AND RATIO DATA