Mercury Insurance 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

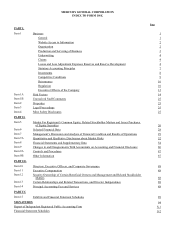

9

Investment Portfolio

The following table presents the composition of the Company’s total investment portfolio:

December 31,

2015 2014 2013

Cost(1) Fair Value Cost(1) Fair Value Cost(1) Fair Value

(Amounts in thousands)

Taxable bonds $ 426,905 $ 414,396 $ 350,343 $ 350,705 $ 329,521 $ 331,506

Tax-exempt state and municipal bonds 2,377,370 2,465,607 2,153,151 2,267,695 2,193,521 2,229,147

Total fixed maturities 2,804,275 2,880,003 2,503,494 2,618,400 2,523,042 2,560,653

Equity securities 313,528 315,362 387,851 412,880 223,933 281,883

Short-term investments 185,353 185,277 373,180 372,542 315,886 315,776

Total investments $ 3,303,156 $ 3,380,642 $ 3,264,525 $ 3,403,822 $ 3,062,861 $ 3,158,312

__________

(1) Fixed maturities and short-term bonds at amortized cost; and equities and other short-term investments at cost.

The Company applies the fair value option to all fixed maturity and equity securities and short-term investments at the time

the eligible item is first recognized. For more detailed discussion on the Company's investment portfolio, including credit ratings,

see "Liquidity and Capital Resources—Invested Assets" in "Item 7. Management’s Discussion and Analysis of Financial Condition

and Results of Operations" and Note 3. Investments, of the Notes to Consolidated Financial Statements in "Item 8. Financial

Statements and Supplementary Data."

Investment Results

The following table presents the investment results of the Company for the most recent five years:

Year Ended December 31,

2015 2014 2013 2012 2011

(Dollars in thousands)

Average invested assets at cost(1) (3) $ 3,293,948 $ 3,204,592 $ 3,028,198 $ 3,011,143 $ 3,004,588

Net investment income(2)

Before income taxes $ 126,299 $ 125,723 $ 124,538 $ 131,896 $ 140,947

After income taxes $ 110,382 $ 111,456 $ 109,506 $ 115,359 $ 124,708

Average annual yield on investments(2)

Before income taxes 3.8% 3.9% 4.1% 4.4% 4.7%

After income taxes 3.4% 3.5% 3.6% 3.8% 4.2%

Net realized investment gains (losses) after

income taxes $ (54,474) $ 52,770 $ (7,424) $ 43,147 $ 37,958

__________

(1) Fixed maturities and short-term bonds at amortized cost; and equities and other short-term investments at cost. Average

invested assets at cost are based on the monthly amortized cost of the invested assets for each respective period.

(2) For 2015, net investment income before income taxes increased slightly due to higher average invested asset balances. Net

investment income and average annual yields on investments after income taxes decreased slightly primarily due to the

maturity and replacement of higher yielding investments purchased when market interest rates were higher, with lower

yielding investments purchased during low interest rate environments, and a higher effective tax rate on investment income

due to a greater proportion of taxable investments in 2015 compared to 2014.

(3) At December 31, 2015, fixed maturity securities with call features totaled $2.9 billion and $2.8 billion at fair value and

amortized cost, respectively.

Competitive Conditions

The Company operates in the highly competitive property and casualty insurance industry subject to competition on pricing,

claims handling, consumer recognition, coverage offered and product features, customer service, and geographic coverage. Some