Mercury Insurance 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

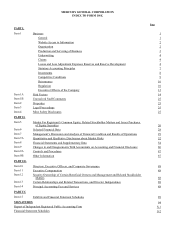

2

The Company offers the following types of homeowners coverage: dwelling, liability, personal property, fire, and other

hazards.

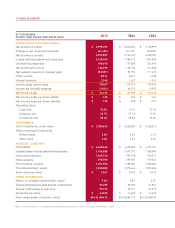

The following table presents the Company's published maximum limits of liability, net of reinsurance:

Insurance type Published maximum limits of liability

Private Passenger Automobile - bodily injury (BI) $250,000 per person; $500,000 per accident (1)

Private Passenger Automobile - property damage $250,000 per accident (1)

Commercial Automobile (combined policy limits) $1,000,000 per accident

Homeowner property no maximum (2) (3)

Homeowner liability $1,000,000 (3)

Umbrella liability $5,000,000 (4)

(1) The majority of the Company’s automobile policies have liability limits that are equal to or less than $100,000 per

person and $300,000 per accident for BI and $50,000 per accident for property damage.

(2) The Company obtains facultative reinsurance above a Company retention limit of up to $7 million.

(3) The majority of the Company’s homeowner policies have liability limits of $300,000 or less and a replacement value

of $500,000 or less.

(4) The majority of the Company’s umbrella policies have liability limits of $1,000,000.

The principal executive offices of Mercury General are located in Los Angeles, California. The home office of the Insurance

Companies and the information technology center are located in Brea, California. The Company also owns office buildings in

Rancho Cucamonga and Folsom, California, which are used to support California operations and future expansion, and in

Clearwater, Florida and in Oklahoma City, Oklahoma, which house Company employees and several third party tenants. The

Company has approximately 4,300 employees. The Company maintains branch offices in a number of locations in California;

Clearwater, Florida; Bridgewater, New Jersey; Oklahoma City, Oklahoma; and Austin and San Antonio, Texas.

The Company consolidated its non-California office based claims and underwriting operations into hubs located in

Clearwater, Florida; Bridgewater, New Jersey; and Austin, Texas, which resulted in a net workforce reduction of approximately

135 employees and a $10 million pre-tax expense in the first quarter of 2013.

Available Information

The Company’s website address is www.mercuryinsurance.com. The Company's website address is not intended to function

as a hyperlink and the information contained on the Company’s website is not, and should not be considered part of, and is not

incorporated by reference into, this Annual Report on Form 10-K. The Company makes available on its website its Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and amendments to such

periodic reports and proxy statements (the "SEC Reports") filed with or furnished to the Securities and Exchange Commission

(the "SEC") pursuant to Section 13(a) or 15(d) of the Securities ExchangeAct of 1934, as amended, as soon as reasonably practicable

after each SEC Report is filed with or furnished to the SEC. In addition, copies of the SEC Reports are available, without charge,

upon written request to the Company’s Chief Financial Officer, Mercury General Corporation, 4484 Wilshire Boulevard, Los

Angeles, California 90010. The Company's SEC Reports may be read and copied at the SEC's Public Reference Room at 100 F

Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the

SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains the SEC Reports that the Company has

filed or furnished electronically with the SEC.

Organization

Mercury General, an insurance holding company, is the parent of Mercury Casualty Company, a California automobile

insurer founded in 1961 by George Joseph, the Company’s Chairman of the Board of Directors.