Mercury Insurance 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 ANNUAL REPORT

PROTE CTING

YOUR FUTURE

Table of contents

-

Page 1

PROTECTING YOUR FUTURE 2 0 15 A N N UA L R EP O R T -

Page 2

... us into the future, as we continue to set new goals and adapt to changes in the business environment. They are also the substance behind our commitment to protect the investments of our shareholders and the security of our employees, just as we protect the ï¬nancial well-being of our policyholders... -

Page 3

... TO SHAREHOLDERS MERCURY GENERAL CORPORATION 2015 ANNUAL REPORT Our 2014 operating results and ratios were distorted by an unexpected $27.6 million ï¬ne imposed by the California Insurance Commissioner. Accordingly, all Companywide and California Personal Auto comparisons to 2014 are exclusive of... -

Page 4

... our Homeowners and Commercial lines of business as long as we believe we can do so in a prudent manner. Companywide net premiums written grew 5.6% to $3.0 billion in 2015. California continued to experience positive premium growth as rate increases more than offset lower policy sales. In California... -

Page 5

... a decision is made on the dividend amount. We hope you will be able to attend our annual meeting on May 11, 2016. Sincerely, NUMBER OF AGENTS 12,000 10,000 8,000 6,000 4,000 2,000 0 George Joseph Chairman of the Board Gabriel Tirador President and Chief Executive Officer 2011 2012 2013 2014 2015 -

Page 6

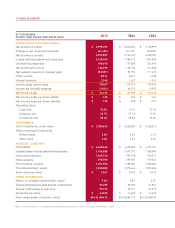

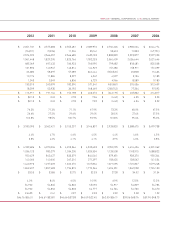

... losses and loss adjustment expenses Unearned premiums Notes payable Policyholders' surplus Total shareholders' equity Book value per share OTHER INFORMATION Return on average shareholders' equity* Diluted weighted average shares outstanding Shares outstanding at year-end Dividends per share Price... -

Page 7

MERCURY GENERAL CORPORATION 2015 ANNUAL REPORT 2012 $ 2,651,731 (76,811) 2,574,920 1,961,448 685,069 131,896 66,...1,497,609 1,857,483 33.86 8.4% 54,845 54,856 2.41 $ $46.61-$33.81 $ $ $ $ $ $ $ 2010 2,555,481 11,204 2,566,685 1,825,766 760,923 143,814 57,089 8,297 6,806 182,390 30,192 152,198 2.78... -

Page 8

... Vice President and Chief Information Officer Vice President and Chief Product Officer Vice President and Chief Claims Officer Vice President, Corporate Affairs and Secretary This Annual Report document includes Mercury General Corporation's ï¬nancial statements and supporting data, management... -

Page 9

..., Los Angeles, California (Address of principal executive offices) 90010 (Zip Code) _____ Registrant's telephone number, including area code: (323) 937-1060 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock New... -

Page 10

The aggregate market value of the Registrant's common equity held by non-affiliates of the Registrant at June 30, 2015 was $1,508,221,904 (which represents 27,101,854 shares of common equity held by non-affiliates multiplied by $55.65, the closing sales price on the New York Stock Exchange for such ... -

Page 11

... Website Access to Information Organization Production and Servicing of Business Underwriting Claims Losses and Loss Adjustment Expenses Reserves and Reserve Development Statutory Accounting Principles Investments Competitive Conditions Reinsurance Regulation Executive Officers of the Company Risk... -

Page 12

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 13

... Companies") in 13 states, principally California. The Company also writes homeowners, commercial automobile, commercial property, mechanical breakdown, and umbrella insurance. The direct premiums written for the years ended December 31, 2015, 2014, and 2013 by state and line of insurance business... -

Page 14

...Mercury General are located in Los Angeles, California. The home office of the Insurance Companies and the information technology center are located in Brea, California. The Company also owns office buildings in Rancho Cucamonga and Folsom, California, which are used to support California operations... -

Page 15

... 2015 Formed or Acquired A+ A+ A+ Non-rated A+ A+ A+ A+ AAAA+ A+ Non-rated CA, AZ, NV, NY, VA CA CA CA IL, PA GA GA IL, MI OK, GA, TX, VA TX TX FL, PA FL, NJ CA Purpose Mercury Select Management Company, Inc. Mercury Insurance Services LLC AIS Management LLC Auto Insurance Specialists LLC ("AIS... -

Page 16

...basis of historical information by line of insurance business. Inflation is reflected in the reserving process through analysis of cost trends and review of historical reserve settlement. The Company's ultimate liability may be greater or less than management estimates of reported loss reserves. The... -

Page 17

... loss severity on California personal automobile lines of insurance business partially offset by adverse development in other states. The increase in the provision for insured events of prior years in 2013 of approximately $3.0 million primarily resulted from Florida claims that were re-opened... -

Page 18

... states where the Company relied on industry data for reserving purposes because it had limited historical data, an unfavorable court decision that was adverse to the insurance industry for Florida PIP losses, and unfavorable development on the Florida homeowners line of insurance business... -

Page 19

... are used to interpret the underwriting experience of property and casualty insurance companies. Under SAP, losses and loss adjustment expenses are stated as a percentage of premiums earned because losses occur over the life of a policy, while underwriting expenses are stated as a percentage of... -

Page 20

... the Insurance Companies' ratios include lines of insurance business other than private passenger automobile that accounted for 22.1% of direct premiums written in 2015, the Company believes its ratios can be compared to the industry ratios. Year Ended December 31, 2015 2014 2013 2012 2011 Loss... -

Page 21

...totaled $2.9 billion and $2.8 billion at fair value and amortized cost, respectively. Competitive Conditions The Company operates in the highly competitive property and casualty insurance industry subject to competition on pricing, claims handling, consumer recognition, coverage offered and product... -

Page 22

...of $545,000 per person and has no maximum limit. Michigan law provides for unlimited lifetime coverage for medical costs caused by automobile accidents. For California homeowners policies, the Company has reduced its catastrophe exposure from earthquakes by placing earthquake risks directly with the... -

Page 23

... that was established to provide a market for earthquake coverage to California homeowners. The Company places all new and renewal earthquake coverage offered with its homeowner policy directly with the CEA. The Company receives a small fee for placing business with the CEA, which is recorded... -

Page 24

... to sell BI liability, property damage liability, medical expense, and uninsured motorist coverage to a proportionate number (based on the insurer's share of the California automobile casualty insurance market) of those drivers applying for placement as "assigned risks." Drivers seek placement as... -

Page 25

... Vice President in 1991, and named Chief Underwriting Officer in 2010. Mr. Minnich, Vice President-Marketing, joined the Company as an underwriter in 1989. In 2007, he joined Superior Access Insurance Services as Director of Agency Operations. In 2008 he rejoined the Company as an Assistant Product... -

Page 26

... order. Risks Related to the Company's Business The Company remains highly dependent upon California to produce revenues and operating profits. For the year ended December 31, 2015, the Company generated 81.0% of its direct automobile insurance premiums written in California. The Company's financial... -

Page 27

... of existing policies accurately; unanticipated court decisions, legislation or regulatory action; ongoing changes in the Company's claim settlement practices; changes in operating expenses; changing driving patterns; extra-contractual liability arising from bad faith claims; weather catastrophes... -

Page 28

... by the changes. As a result, the full extent of liability under the Company's insurance policies may not be known for many years after a policy is issued. Loss of, or significant restriction on, the use of credit scoring in the pricing and underwriting of personal lines products could reduce... -

Page 29

..., and the period-to-period changes in value could vary significantly. Decreases in value may have a material adverse effect on the Company's financial condition or results of operations. Changes in the financial strength ratings of financial guaranty insurers issuing policies on bonds held in the... -

Page 30

... prompt reporting of claims and the Company's right to decline coverage in the event of a violation of that condition. While the Company's insurance product exclusions and limitations reduce the Company's loss exposure and help eliminate known exposures to certain risks, it is possible that a court... -

Page 31

... of its business, including underwriting, policy acquisition, claims processing and handling, accounting, reserving and actuarial processes and policies, and to maintain its policyholder data. The Company is developing and deploying new information technology systems that are designed to manage many... -

Page 32

...identifiable information, for business purposes including underwriting, claims and billing purposes, and relies upon the various information technology systems that enter, process, summarize and report such data. The Company also maintains personally identifiable information about its employees. The... -

Page 33

... new products and attract customers. The Company's success also depends upon the continued contributions of its executive officers, both individually and as a group. The Company's future performance will be substantially dependent on its ability to retain and motivate its management team. The loss... -

Page 34

...the Company's ability to execute its business plan and grow its business. The Company is subject to extensive regulation and supervision by government agencies in each of the states in which its Insurance Companies are domiciled, sell insurance products, issue policies, or manage claims. Some states... -

Page 35

... condition or injury which are funded by either assessments based on paid losses or premium surcharge mechanisms. In addition, as a condition to the ability to conduct business in various states, the Insurance Companies must participate in mandatory property and casualty shared-market mechanisms or... -

Page 36

... claim, coverage, and business practice issues could adversely affect the Company's business by changing the way policies are priced, extending coverage beyond its underwriting intent, or increasing the size of claims. Risks Related to the Company's Stock The Company is controlled by a small number... -

Page 37

... by the Company at December 31, 2015 Location Purpose Size in square feet Brea, CA Folsom, CA Los Angeles, CA Rancho Cucamonga, CA Clearwater, FL Oklahoma City, OK Home office and I.T. facilities (2 buildings) Administrative and Data Center Executive offices Administrative Administrative... -

Page 38

... of Equity Securities Market Information The Company's common shares are listed on the New York Stock Exchange (Symbol: MCY). The following table presents the high and low sales prices per share (as reported on the New York Stock Exchange) during the last two years. 2015 High Low 1st Quarter... -

Page 39

... and the reinvestment of all dividends. Comparative Five-Year Cumulative Total Returns Stock Price Plus Reinvested Dividends 2010 2011 2012 2013 2014 2015 Mercury General Industry Peer Group S&P 500 Index $ 100.00 100.00 100.00 $ 112.60 99.73 102.11 $ 103.77 118.38 118.45 $ 137.55... -

Page 40

... December 31, 2014 2013 2012 (Amounts in thousands, except per share data) 2015 2011 Income Data: Net premiums earned Net investment income Net realized investment (losses) gains Other Total revenues Losses and loss adjustment expenses Policy acquisition costs Other operating expenses Interest... -

Page 41

... courts, regulators and governmental bodies, particularly in California; the Company's ability to obtain and the timing of required regulatory approvals of premium rate changes for insurance policies issued in states where the Company operates; the Company's reliance on independent agents to market... -

Page 42

...% owned insurance agents and direct channels, in thirteen states: Arizona, California, Florida, Georgia, Illinois, Michigan, Nevada, New Jersey, New York, Oklahoma, Pennsylvania, Texas, and Virginia. The Company also offers homeowners, commercial automobile, commercial property, mechanical breakdown... -

Page 43

... and Legal Matters The process for implementing rate changes varies by state. For more detailed information related to insurance rates approval, see "Item 1. Business-Regulation." During 2015, the Company implemented rate changes in thirteen states. In California, the following rate increases were... -

Page 44

... the California Insurance Code. Subsequent to the filing of the Writ, a consumer group petitioned and was granted the right to intervene in the Superior Court action. The court did not order a stay, and the $27.6 million assessed penalty was accrued in 2014 and paid in March 2015. The Company filed... -

Page 45

... for evaluating ultimate losses, particularly in the Company's larger, more established lines of insurance business which have a long operating history. The average severity method analyzes historical loss payments and/or incurred losses divided by closed claims and/ or total claims to calculate an... -

Page 46

...motorists. BI payments are primarily for medical costs and general damages. The following table presents the typical closure patterns of BI claims in the Company's California personal automobile insurance coverage: % of Total Claims Closed Dollars Paid BI claims closed in the accident year reported... -

Page 47

... the end of an accident year and at that point the Company has a high degree of certainty as to what the ultimate claim count will be. There are many other potential factors that can affect the number of claims reported after an accident period ends. These factors include changes in weather patterns... -

Page 48

... on the 2014 and prior accident years' losses and loss adjustment expense reserves, which at December 31, 2014 totaled approximately $1.09 billion. The unfavorable development in 2015 was primarily from the California homeowners and automobile lines of insurance business outside of California, which... -

Page 49

... December 31, 2015 was lower than the statutory tax rate primarily as a result of tax-exempt investment income earned. Contingent Liabilities The Company has known, and may have unknown, potential liabilities which include claims, assessments, lawsuits, or regulatory fines and penalties relating to... -

Page 50

... in 2015 increased 5.6% and 5.8%, respectively, from 2014. The increase in net premiums written was primarily due to higher average premiums per policy arising from rate increases in the California private passenger automobile line of insurance business and growth in the number of homeowner policies... -

Page 51

...adjusted loss ratio was primarily due to higher loss frequency and severity. Expense ratio is calculated by dividing the sum of policy acquisition costs plus other operating expenses by net premiums earned. Excluding the $27.6 million penalty assessed by the California DOI and accrued by the Company... -

Page 52

...market interest rates in 2015. The fair value increases in 2014 were primarily caused by the overall improvement in the municipal bond market. (3) In 2015, the decreases in the fair value of equity securities were primarily due to a decline in the value of the Company's holdings in industrial stocks... -

Page 53

... policy arising from rate increases in the California private passenger automobile and homeowners lines of insurance business. The following is a reconciliation of total net premiums written to net premiums earned: Year Ended December 31, 2014 2013 (Amounts in thousands) Net premiums written Change... -

Page 54

... California DOI penalty assessment, the expense ratio was 26.8% for the year ended December 31, 2014. Income tax expense was $69.5 million and $20.0 million for the years ended December 31, 2014 and 2013, respectively. The increase in income tax expense was mainly due to the increase in underwriting... -

Page 55

...for the Insurance Companies are premiums, sales and maturity of invested assets, and dividend and interest income from invested assets. The principal uses of funds for the Insurance Companies are the payment of claims and related expenses, operating expenses, dividends to Mercury General, payment of... -

Page 56

... due to the increase in paid losses, loss adjustment expenses, and operating expenses, which included the $27.6 million penalty assessed by the California DOI as discussed in "Regulatory and Legal Matters" above, partially offset by an increase in premiums collected. The Company utilized the cash... -

Page 57

...in response to changes in interest rates, anticipated prepayments, risk/reward characteristics, liquidity needs, tax planning considerations, or other economic factors. Short-term investments include money market accounts, options, and short-term bonds that are highly rated short duration securities... -

Page 58

...which 98.4% were tax exempt, represented 85.6% of its fixed maturity portfolio at December 31, 2015, at fair value, and are broadly diversified geographically. To calculate the weighted-average credit quality ratings as disclosed throughout this Annual Report on Form 10-K, individual securities were... -

Page 59

... ratings of the Company's fixed maturity portfolio at fair value. December 31, 2015 By Security Type U.S. government bonds and agencies: Treasuries Government agency Total Municipal securities: Insured Uninsured Total Mortgage-backed securities: Commercial Agencies Non-agencies: Prime Alt-A Total... -

Page 60

... due to high loan-tovalue ratios or limited supporting documentation. The Company had holdings of $37.3 million and $32.5 million ($37.6 million and $32.3 million at amortized cost) in commercial mortgage-backed securities at December 31, 2015 and 2014, respectively. The weighted-average rating of... -

Page 61

...290,000 _____ (1) On July 2, 2013, the Company entered into an unsecured $200 million five-year revolving credit facility. The interest rate on borrowings under the credit facility is based on the Company's debt to total capital ratio and ranges from LIBOR plus 112.5 basis points when the ratio is... -

Page 62

... claims handling, billing, and other practices. The following table presents a summary of current examinations: State Exam Type Period Under Review Status GA CA CA VA Financial Market Conduct Rating and Underwriting Market Conduct 2011 to 2013 2013 to 2014 2014 2014 to 2015 Received draft report... -

Page 63

... losses and loss adjustment expenses is an estimate of amounts necessary to settle all outstanding claims, including IBNR as of December 31, 2015. The Company has estimated the timing of these payments based on its historical experience and expectation of future payment patterns. However, the timing... -

Page 64

... policy on an aggregate risk management basis, as well as their ability to recover their investment on an individual issue basis. Equity price risk Equity price risk is the risk that the Company will incur losses due to adverse changes in the equity markets. At December 31, 2015, the Company... -

Page 65

... overall value of the stock market of 25% Hypothetical reduction in the overall value of the stock market of 50% Interest rate risk $ $ 0.89 62,359 124,717 $ $ 0.98 91,287 182,573 Interest rate risk is the risk that the Company will incur a loss due to adverse changes in interest rates relative... -

Page 66

... FINANCIAL STATEMENTS Page Reports of Independent Registered Public Accounting Firm Consolidated Financial Statements: Consolidated Balance Sheets as of December 31, 2015 and 2014 Consolidated Statements of Operations for the Years Ended December 31, 2015, 2014, and 2013 Consolidated Statements of... -

Page 67

... with the standards of the Public Company Accounting Oversight Board (United States), Mercury General Corporation's internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring... -

Page 68

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Mercury General Corporation and subsidiaries as of December 31, 2015 and 2014, and the related consolidated statements of operations, shareholders' equity, and cash flows for... -

Page 69

... Total receivables Deferred policy acquisition costs Fixed assets, net Current income taxes Deferred income taxes Goodwill Other intangible assets, net Other assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Losses and loss adjustment expenses Unearned premiums Notes payable Accounts payable... -

Page 70

... share data) 2015 Year Ended December 31, 2014 2013 Revenues: Net premiums earned Net investment income Net realized investment (losses) gains Other Total revenues Expenses: Losses and loss adjustment expenses Policy acquisition costs Other operating expenses Interest Total expenses Income before... -

Page 71

...Year Ended December 31, 2014 2013 Common stock, beginning of year Proceeds of stock options exercised Share-based compensation expense Tax benefit on sales of incentive stock options Common stock, end of year Additional paid in capital, beginning of year Share-based compensation expense Exercise of... -

Page 72

... from exercise of stock options Increase in premiums receivable Changes in current and deferred income taxes Increase in deferred policy acquisition costs Increase in unpaid losses and loss adjustment expenses Increase in unearned premiums (Decrease) increase in accounts payable and accrued expenses... -

Page 73

... 13 states, principally California. The Company also writes homeowners, commercial automobile, commercial property, mechanical breakdown, fire, and umbrella insurance. The private passenger automobile line of insurance business was more than 77% of the Company's direct premiums written in 2015, 2014... -

Page 74

... agencies in the states in which they are licensed to operate with fair values totaling $21 million and $18 million at December 31, 2015 and 2014, respectively. Deferred Policy Acquisition Costs Deferred policy acquisition costs consist of commissions paid to outside agents, premium taxes, salaries... -

Page 75

... of each method based on the maturity of the data available and the claims settlement practices for each particular line of insurance business or coverage within a line of insurance business. The Company may also evaluate qualitative factors such as known changes in laws or legal ruling that... -

Page 76

... for evaluating ultimate losses, particularly in the Company's larger, more established lines of insurance business which have a long operating history. The average severity method analyzes historical loss payments and/or incurred losses divided by closed claims and/ or total claims to calculate an... -

Page 77

...-Duration Contracts." ASU 2015-9 requires insurance entities to provide additional disclosures related to claims liabilities. The additional disclosure requirements for the annual reports include: (1) the claims development information by accident year, on a net of reinsurance basis, for the number... -

Page 78

... option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Company has realized a gain or loss. The Company, as writer of an option, bears the market risk of an unfavorable change in the price of the security underlying... -

Page 79

... presents (losses) gains due to changes in fair value of investments that are measured at fair value pursuant to application of the fair value option: Year Ended December 31, 2014 (Amounts in thousands) 2015 2013 Fixed maturity securities Equity securities Short-term investments Total $ $ (39... -

Page 80

... market transaction data for the same or similar instruments. The Company obtained unadjusted fair values on 99.7% of its portfolio from an independent pricing service. For 0.3% of its portfolio, classified as Level 3, the Company obtained specific unadjusted broker quotes based on net fund value... -

Page 81

... yields, reported trades and broker/dealer quotes, for identical or similar assets in active markets. The Company had holdings of $37.3 million and $32.5 million at December 31, 2015 and 2014, respectively, in commercial mortgage-backed securities. Corporate securities/Short-term bonds: Valued based... -

Page 82

... securities Equity securities: Common stock Non-redeemable preferred stock Private equity funds Short-term investments: Short-term bonds Money market instruments Total assets at fair value Liabilities Notes payable: Secured Notes Unsecured Notes Other liabilities: Total return swaps Options sold... -

Page 83

... obligations Equity securities: Common stock: Non-redeemable preferred stock Private equity funds Short-term investments: Short-term bonds Money market instruments Total assets at fair value Liabilities Notes payable: Secured Notes Unsecured Notes Other liabilities: Total return swaps Options sold... -

Page 84

... 31, 2014 (Amounts in thousands) 2015 2013 Balance, beginning of year Policy acquisition costs deferred Amortization Balance, end of year $ $ 197,202 $ 543,791 (539,231) 201,762 $ 194,466 $ 528,944 (526,208) 197,202 $ 185,910 514,073 (505,517) 194,466 7. Notes Payable Notes payable consists... -

Page 85

...equity securities are intended to manage the price risk associated with forecasted purchases or sales of such securities. The Company also enters into derivative contracts to enhance returns on its investment portfolio. On February 13, 2014, Fannette Funding LLC ("FFL"), a special purpose investment... -

Page 86

...Recognized in Income Year Ended December 31, 2015 2014 (Amounts in thousands) 2013 Total return swaps - Net realized investment (losses) gains Options sold - Net realized investment gains Interest rate contract - Other revenue Total $ $ (6,438) $ 3,081 - (3,357) $ (2,969) $ 3,419 - 450 $ 2,176... -

Page 87

...877 30,302 The Company and its subsidiaries file a consolidated federal income tax return. The income tax (benefit) expense consisted of the following components: Year Ended December 31, 2014 (Amounts in thousands) 2015 2013 Federal Current Deferred State Current Deferred Total Current Deferred... -

Page 88

... jurisdictions are 2012 through 2014 for federal taxes and 2003 through 2014 for California state taxes. The Company is currently under examination by the California Franchise Tax Board ("FTB") for tax years 2003 through 2013. The FTB issued Notices of Proposed Assessments to the Company for tax... -

Page 89

... line of business. The decrease in the provision for insured events of prior years in 2014 of approximately $3.2 million primarily resulted from lower than expected loss severity on California personal automobile lines of insurance business partially offset by adverse development in other states... -

Page 90

... provision for insured events of prior years in 2013 of approximately $3.0 million primarily resulted from Florida claims that were re-opened from prior years due to a state supreme court ruling that was adverse to the insurance industry. The Company experienced estimated pre-tax catastrophe losses... -

Page 91

... employees to make salary deferrals under Section 401(k) of the Internal Revenue Code. The matching contributions, at a rate set by the Board of Directors, totaled $8.5 million, $8.0 million, and $8.1 million for 2015, 2014, and 2013, respectively. The Plan also includes an employee stock ownership... -

Page 92

... Committee of the Company's Board of Directors granted performance-based vesting restricted stock unit awards to the Company's senior management and key employees. The following table presents the restricted stock unit grants summary at December 31, 2015: 2015 Grant Year 2014 2013 Three-year... -

Page 93

... the Compensation Committee of the Company's Board of Directors. For 2013, 2014 and 2015 grants, vesting is based on the Company's cumulative underwriting income, annual underwriting income, and net earned premium growth. As of December 31, 2015, 1,000, 8,000, and 6,000 target restricted stock units... -

Page 94

... that was established to provide a market for earthquake coverage to California homeowners. The Company places all new and renewal earthquake coverage offered with its homeowners policies directly with the CEA. The Company receives a small fee for placing business with the CEA, which is recorded... -

Page 95

... the California Insurance Code. Subsequent to the filing of the Writ, a consumer group petitioned and was granted the right to intervene in the Superior Court action. The court did not order a stay, and the $27.6 million assessed penalty was accrued in 2014 and paid in March 2015. The Company filed... -

Page 96

... related losses, and declines in the fair value of the Company's investment portfolio due to the overall decline in the municipal bond markets. Net income during 2013 was also affected by the consolidation of claims and underwriting operations located outside of California into hub locations, which... -

Page 97

... markets. 20. Acquisition Pursuant to an October 22, 2014 Stock Purchase Agreement, the Company purchased all the issued and outstanding shares of Workmen's Auto Insurance Company ("WAIC"), a California domiciled property and casualty insurance company, on January 2, 2015. WAIC is a Los Angeles... -

Page 98

... Company's direct premiums written and net premiums earned by line of insurance business for the years ended: December 31, 2015 Property & Casualty Lines (Amounts in millions) December 31, 2014 Property & Casualty Lines December 31, 2013 Property & Casualty Lines Other (1) Total Other (1) Total... -

Page 99

... the participation of the Company's management, including its Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company's disclosure controls and procedures as of the end of the period covered by this Annual Report on Form 10-K. Based on the... -

Page 100

... Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services Information regarding executive officers of the Company is included in Part I. For other... -

Page 101

...Report of Independent Registered Public Accounting Firm Schedule I-Summary of Investments-Other than Investments in Related Parties Schedule II-Condensed Financial Information... among the Company, George Joseph and Registration Statement on Form S-1, File No. 33-899, and Gloria Joseph. is incorporated... -

Page 102

...2013-1 to the Mercury General Corporation Profit Sharing Plan. Amendment 2014-1 to the Mercury General Corporation Profit Sharing Plan. Amendment 2014-2 to the Mercury General Corporation Profit Sharing Plan. Amendment 2015-1 to the Mercury...as an exhibit to Registrant's Form 10-K for the fiscal year ... -

Page 103

... 2002 between Mercury Insurance Services, LLC and Mercury Insurance Company of Florida and Mercury Indemnity Company of Florida. Management Agreement dated January 22, 1997 between Mercury County Mutual Insurance Company and Mercury Insurance Services, LLC. Director Compensation Arrangements. This... -

Page 104

... is incorporated herein by this reference. Form of Restricted Stock Unit Agreement under the Mercury General Corporation 2015 Incentive Award Plan Form of Stock Option Agreement under the Mercury General Corporation 2015 Incentive Award Plan Subsidiaries of the Company. This document was filed as an... -

Page 105

... XBRL Taxonomy Extension Schema Document XBRL Taxonomy Extension Calculation Linkbase Document XBRL Taxonomy Extension Definition Linkbase Document XBRL Taxonomy Extension Label Linkbase Document XBRL Taxonomy Extension Presentation Linkbase Document Denotes management contract or compensatory... -

Page 106

... GEORGE JOSEPH George Joseph Chairman of the Board President and Chief Executive Officer and Director (Principal Executive Officer) Senior Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) Director Director Director Director Director Director... -

Page 107

...OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Shareholders Mercury General Corporation: Under date of February 9, 2016, we reported on the consolidated balance sheets of Mercury General Corporation and subsidiaries (the Company) as of December 31, 2015 and 2014, and the... -

Page 108

..., 2015 Type of Investment Cost Fair Value (Amounts in thousands) Amounts in the Balance Sheet Fixed maturity securities: U.S. government bonds and agencies Municipal securities Mortgage-backed securities Corporate securities Collateralized loan obligations Other asset-backed securities Total fixed... -

Page 109

...DECEMBER 31, 2014 Type of Investment Cost Fair Value (Amounts in thousands) Amounts in the Balance Sheet Fixed maturity securities: U.S. government bonds and agencies Municipal securities Mortgage-backed securities Corporate securities Collateralized loan obligations Total fixed maturity securities... -

Page 110

...' EQUITY Notes payable Amounts payable to affiliates Income tax payable to affiliates Other liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock Additional paid-in capital Retained earnings Total shareholders' equity Total liabilities and shareholders... -

Page 111

... MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF OPERATIONS Year Ended December 31, 2014 (Amounts in thousands) 2015 2013 Revenues: Net investment income Net realized investment (losses) gains Total revenues Expenses: Other operating expenses Interest Total... -

Page 112

... MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF CASH FLOWS Year Ended December 31, 2014 (Amounts in thousands) 2015 2013 Cash flows from operating activities: Net cash provided by (used in) operating activities Cash flows from investing activities: Capital... -

Page 113

...2013. Business Acquisition Pursuant to an October 22, 2014 Stock Purchase Agreement, Mercury General purchased all the issued and outstanding shares of Workmen's Auto Insurance Company ("WAIC"), a California domiciled property and casualty insurance company, on January 2, 2015. WAIC is a Los Angeles... -

Page 114

... Management Company, Inc. Mercury Insurance Services LLC AIS Management LLC Auto Insurance Specialists LLC PoliSeek AIS Insurance Solutions, Inc. Animas Funding LLC Fannette Funding LLC The method of allocation between the companies is subject to an agreement approved by the Board of Directors... -

Page 115

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 116

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 117

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 118

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 119

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 120

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 121

... Company California General Underwriters Insurance Company, Inc. Mercury Insurance Services LLC Mercury County Mutual Insurance Company* American Mercury Insurance Company American Mercury Lloyds Insurance Company* Mercury Select Management Company, Inc. Auto Insurance Specialists LLC AIS Management... -

Page 122

ENVIRONMENTAL BENEFITS STATEMENT To minimize our environmental impact, the Mercury General Corporation 2015 Annual Report was printed on paper containing fibers from environmentally appropriate, socially beneficial and economically viable forest resources.