Medco 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Medco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PHARMACY.SMARTER.

Clients and members are at the center

of everything we do.

2014 Annual Report

Table of contents

-

Page 1

PHARMACY.SMARTER. Clients and members are at the center of everything we do. 2014 Annual Report -

Page 2

...Express Scripts provides integrated pharmacy beneï¬t management services, including network-pharmacy claims processing, home delivery, specialty beneï¬t management, beneï¬t-design consultation, drug utilization review, formulary management, and medical and drug data analysis services. The company... -

Page 3

... complex regulations to achieve 5-star Medicare Part D prescription drug plans, or delivering more than $2 billion in client savings through formulary management. And then, of course, there are our extraordinary efforts in improving hepatitis C care. 1 Express Scripts 2014 Annual Report -

Page 4

... in 2014 were consistent with what we have done historically to improve care and lower costs. We have leveraged competition in the marketplace for the beneï¬t of our clients and patients - increasing generic utilization and narrowing pharmacy networks, as two signiï¬cant examples. By focusing... -

Page 5

... solutions, driven by 30,000 committed and skilled employees who share a passion for patient care and client alignment. The value of what Express Scripts does has never been more clear. Simply put, we are a consequential company that improves healthcare for the nation. By staying focused on pharmacy... -

Page 6

... following graph shows changes over the past ï¬ve-year period in the value of $100 invested in: (1) Our Common Stock; (2) S&P 500 Index; (3) S&P 500 Health Care Index. $260 Express Scripts $200 S&P 500 Index $140 S&P 500 - Healthcare $0 2009 2010 2011 2012 2013 2014 Years Ending Total Return... -

Page 7

...Exchange Act). Yes ¨ No x The aggregate market value of Registrant's voting stock held by non-affiliates as of June 30, 2014, was $51,583,566,968 based on 744,029,525 shares held on such date by non-affiliates and a closing sale price for the Common Stock on such date of $69.33 as reported... -

Page 8

... Services ("CMS"). In response to cost pressures being exerted on health benefit providers such as managed care organizations, health insurers, employers and unions, pharmacy benefit management ("PBM") companies work to develop innovative strategies that make the use of prescription drugs safer... -

Page 9

...consultation drug utilization review drug formulary management a flexible array of Medicare, Medicaid and Health Insurance Marketplace ("Public Exchange") offerings to support clients' benefits administration of a group purchasing organization consumer health and drug information Our Other Business... -

Page 10

Products and Services Pharmacy Benefit Management Services Overview. Our core PBM services involve management of outpatient prescription drug utilization to drive high quality, cost-effective pharmaceutical care. We consult with our clients to assist in the selection of plan design features that ... -

Page 11

... clinically appropriate, moving drug coverage from medical to pharmacy benefit and to lower-cost sites of care. Retail Network Pharmacy Administration. We contract with retail pharmacies to provide prescription drugs to members of the pharmacy benefit plans we manage. In the United States, Puerto... -

Page 12

... and related goods and services from pharmaceutical manufacturers and suppliers, as well as providing strategic analysis and advice regarding pharmacy procurement contracts for the purchase and sale of goods and services. Consumer Health and Drug Information. Express Scripts empowers member decision... -

Page 13

... ESI entered into a 10-year contract under which we provide pharmacy benefits management services to members of the affiliated health plans of Anthem. Subsequent to this acquisition, we integrated NextRx's PBM clients into our existing systems and operations. 7 11 Express Scripts 2014 Annual Report -

Page 14

... costs and include health claims adjudication and processing services, benefit-design consultation, drug-utilization review, formulary management and medical and drug data analysis services. In addition, we provide an active home delivery service in Canada which dispenses maintenance prescription... -

Page 15

... member impact of pharmacy benefits. The formation of predictive models and other analytical tools supports the development and improvement of our products and services. The team also produces the Express Scripts Drug Trend Report which examines trends in pharmaceutical utilization and cost, as well... -

Page 16

... coverage and services to Medicare Part D beneficiaries. We also, through our core PBM business, provide Medicare Part D-related products and services to other Medicare Part D PDP sponsors, Medicare Advantage Prescription Drug Plans and other employers and clients offering Medicare Part D benefits... -

Page 17

... benefit plans subject to ERISA are subject to certain rules, published by the DOL, relating to annual Form 5500 reporting obligations. The rules include certain reporting requirements for direct and indirect compensation received by plan service providers such as PBMs. However, in February 2010... -

Page 18

... required to use network providers, but must instead be provided with benefits even if they choose to use non-network providers. Other states have enacted legislation purporting to prohibit health plans from offering members financial incentives for use of home delivery pharmacies. Medicare and some... -

Page 19

... of Financial Risk Plans. Fee-for-service prescription drug plans generally are not subject to financial regulation by the states. However, if a PBM offers to provide prescription drug coverage on a capitated basis or otherwise accepts material financial risk in providing the benefit, various... -

Page 20

... "THERAPEUTIC RESOURCE CENTER®" with the United States Patent and Trademark Office. Our rights to these marks will continue so long as we comply with the usage, renewal filings and other legal requirements relating to the usage and renewal of service marks. 14 Express Scripts 2014 Annual Report 18 -

Page 21

...pharmaceutical products by our home delivery pharmacies, our Other Business Operations, including the distribution of specialty drugs, and the services rendered in connection with our disease management operations, may subject us to litigation and liability for damages. Commercial insurance coverage... -

Page 22

... 2011. Patriot Coal Corporation filed a Chapter 11 bankruptcy petition in July 2012 and emerged in December 2013. Available Information We make available through our website (www.express-scripts.com) access to our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form... -

Page 23

..., investigations or other proceedings which could subject us to significant monetary damages or penalties and/or require us to change our business practices, or the costs incurred in connection with such proceedings 17 21 Express Scripts 2014 Annual Report • • • • • • • • • -

Page 24

... PBMs, including us, to reduce the prices charged for core products and services while sharing a greater portion of the formulary fees and related revenues received from pharmaceutical manufacturers with clients. We cannot assume positive trends such as lower drug purchasing costs, increased generic... -

Page 25

... of our pharmacy network contracts wholesale distributor laws legislation imposing benefit plan design restrictions and requirements, which limit how our clients can design their drug benefit plans various licensure laws, such as managed care and third-party administrator licensure laws drug pricing... -

Page 26

... that affect certain of our clients closing of the so-called donut hole under Medicare Part D by lowering beneficiary coinsurance amounts elimination of the tax deduction for employers who receive Medicare Part D retiree drug subsidy payments 20 Express Scripts 2014 Annual Report 24 • • -

Page 27

... could, temporarily or indefinitely, significantly reduce, or partially or totally eliminate our ability to process and dispense prescriptions and provide products and services to our clients and members. Any such service disruption at these facilities or to 21 25 Express Scripts 2014 Annual Report -

Page 28

...D PDP and EGWP sponsors, certain subsidiaries are required to comply with federal Medicare Part D laws and regulations and are also required to be licensed as insurers or may otherwise be subject to aspects of state laws regulating the business of insurance. 22 Express Scripts 2014 Annual Report 26 -

Page 29

...providing pharmacy benefit coverage to retirees, instead allowing retirees to choose their own Medicare Part D plans, which could cause a reduction in utilization for our services. Extensive competition among Medicare Part D plans could also result in the loss of Medicare members by our managed care... -

Page 30

... manufacturers which provide us with, among other things discounts for drugs we purchase to be dispensed from our home delivery pharmacies rebates based on distributions of drugs from our home delivery pharmacies and through pharmacies in our retail networks administrative fees for managing rebate... -

Page 31

Changes in drug pricing or industry pricing benchmarks could materially impact our financial performance. Contracts in the prescription drug industry, including our contracts with retail pharmacy networks and with PBM and specialty pharmacy clients, generally use "average wholesale price" or "AWP," ... -

Page 32

... be completed in 2015, and we anticipate total capital expenditures of approximately $75.0 million. We believe our facilities generally have been well maintained, are in good operating condition and have adequate capacity to meet our current business needs. 26 Express Scripts 2014 Annual Report 30 -

Page 33

... a class of all pharmacies and pharmacists that contracted with Medco and California pharmacies that indirectly purchased prescription drugs from Merck. Plaintiffs assert claims for violation of the Sherman Act, California antitrust law and California law 27 31 Express Scripts 2014 Annual Report -

Page 34

... health care program clients in violation of an alleged fiduciary duty and/or in violation of alleged contractual obligations. Morgan also alleges that ESI and Medco failed to properly process and/or adjudicate claims for payment for prescription drugs dispensed to federal healthcare beneficiaries... -

Page 35

...of this matter. On April 8, 2014, the Company received a subpoena from the United States Department of Labor, Employee Benefits Security Administration requesting information regarding ESI's and Medco's client relationships from 2009 to the present. The Company intends to cooperate with the inquiry... -

Page 36

("ARVCO"). On November 19, 2014, the Company received another subpoena requesting additional information relating to Medco's internal investigation of its business dealings with ARVCO and certain other related matters. The Company intends to cooperate with the inquiry and is not able to predict with... -

Page 37

...there were 83.7 million shares remaining under the Share Repurchase Program. Additional share repurchases, if any, will be made in such amounts and at such times as we deem appropriate based upon prevailing market and business conditions and other factors. 31 35 Express Scripts 2014 Annual Report -

Page 38

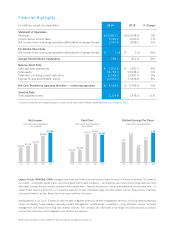

... ("UBC") line of business, Europa Apotheek Venlo B.V. ("EAV") and our European operations. Discontinued operations as of December 31, 2010 include Phoenix Marketing Group ("PMG"). (in millions, except per share data) 2014 2013 2012 (1) 2011 2010 Statement of Operations Data (for the Year Ended... -

Page 39

... per share data) 2014 2013 2012 (1) 2011 2010 Balance Sheet Data (as of December 31): Cash and cash equivalents Working capital (deficit) Total assets Debt: Short-term debt Long-term debt Capital lease obligation Stockholders' equity Network claims-continuing operations(5)(6) Home delivery... -

Page 40

...Scripts per adjusted claim, are affected by the changes in claim volumes between network and home delivery, specialty and other, the relative representation of brand-name, generic and specialty pharmacy drugs, as well as the level of efficiency in the business. 34 Express Scripts 2014 Annual Report... -

Page 41

... services to providers and patients, retail network pharmacy administration, benefit design consultation, drug utilization review, drug formulary management, Medicare, Medicaid and Public Exchange offerings, administration of a group purchasing organization and consumer health and drug information... -

Page 42

...2012. A transition agreement was in place throughout 2013, during which time patients moved in tranches off of the Medco platform. Due to this transition of UnitedHealth Group, claims volume and related revenues and cost of revenues decreased throughout 2013. 36 Express Scripts 2014 Annual Report... -

Page 43

... the acquisition of Medco effective April 2, 2012. (2) Includes retail pharmacy co-payments of $10,272.7, $12,620.3 and $11,668.6 for the years ended December 31, 2014, 2013 and 2012, respectively. (3) Includes home delivery and specialty claims including drugs we distribute to other PBMs' clients... -

Page 44

... of transaction and integration costs for 2013 compared to $697.2 million for 2012, and decreased management incentive compensation. PBM operating income increased $697.3 million, or 24.9%, in 2013 from 2012, based on the various factors described above. 38 Express Scripts 2014 Annual Report 42 -

Page 45

... millions) 2014 2013 2012(1) Product revenues Service revenues Total Other Business Operations revenues Cost of Other Business Operations revenues Other Business Operations gross profit Other Business Operations SG&A Other Business Operations operating income (loss) Claims Home delivery, specialty... -

Page 46

...-CONTROLLING INTEREST Net income attributable to non-controlling interest represents the share of net income allocated to members in our consolidated affiliates. Changes in these amounts are directly impacted by profitability of our consolidated affiliates. 40 Express Scripts 2014 Annual Report 44 -

Page 47

... as well as decreases in accruals. Employee stock-based compensation expense decreased $53.7 million in 2014 from 2013 due to acceleration of stock-based compensation expense and award vesting associated with the termination of certain Medco employees following the Merger. Changes in working capital... -

Page 48

...Per the terms of the Merger Agreement, upon consummation of the Merger on April 2, 2012, each share of Medco common stock was converted into (i) the right to receive $28.80 in cash, without interest and (ii) 0.81 shares of Express Scripts stock. Holders of Medco stock options, restricted stock units... -

Page 49

... the consummation of the Merger on April 2, 2012, several series of senior notes issued by Medco are reported as debt obligations of Express Scripts. The below description reflects the redemption activity of the Company for the years ended December 31, 2014 and 2013. See Note 7 - Financing for... -

Page 50

.... IMPACT OF INFLATION Changes in prices charged by manufacturers and wholesalers for pharmaceuticals affect our revenues and cost of revenues. Most of our contracts provide we bill clients based on a generally recognized price index for pharmaceuticals. 44 Express Scripts 2014 Annual Report 48 -

Page 51

... which have an indefinite life, are amortized on a straight-line basis, which approximates the pattern of benefit, over periods from 5 to 20 years for customer-related intangibles, 10 years for trade names and 3 to 30 years for other intangible assets. 45 49 Express Scripts 2014 Annual Report -

Page 52

...December 2012. In 2012, as a result of our plan to dispose of our Liberty line of business, an impairment charge totaling $23.0 million was recorded against intangible assets to reflect fair value based on the contracted sales price of the business (Level 2). The write-down was comprised of customer... -

Page 53

... by CMS in cases of low-income membership. Our cost of revenues includes the cost of drugs dispensed by our home delivery pharmacies or retail network for members covered under our Medicare Part D PDP product offerings and is recorded at cost as incurred. 47 51 Express Scripts 2014 Annual Report -

Page 54

... interest under our credit agreement. A hypothetical increase in interest rates of 1% would result in an increase in annual interest expense of approximately $13.2 million (pre-tax), assuming obligations subject to variable interest rates remained constant. 48 Express Scripts 2014 Annual Report 52 -

Page 55

... listed in the index appearing under Item 15a(1) present fairly, in all material respects, the financial position of Express Scripts Holding Company and its subsidiaries at December 31, 2014 and December 31, 2013, and the results of their operations and their cash flows for each of the three years... -

Page 56

..., $0.01 par value per share; shares issued: 848.6 and 834.0, respectively; shares outstanding: 726.1 and 773.6, respectively Additional paid-in capital Accumulated other comprehensive income Retained earnings Common stock in treasury at cost, 122.5 and 60.4 shares, respectively Total Express Scripts... -

Page 57

...04) 1.80 1.80 (0.04) 1.76 1,345.2 (32.3) 1,312.9 (1) Includes retail pharmacy co-payments of $10,272.7, $12,620.3 and $11,668.6 for the years ended December 31, 2014, 2013 and 2012, respectively. See accompanying Notes to Consolidated Financial Statements 51 55 Express Scripts 2014 Annual Report -

Page 58

EXPRESS SCRIPTS HOLDING COMPANY CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year Ended December 31, (in millions) 2014 2013 2012 Net income Other comprehensive (loss) income, net of tax: Foreign currency translation adjustment Comprehensive income Less: Comprehensive income attributable to non-... -

Page 59

... of common shares in connection with Merger activity Common stock issued under employee plans, net of forfeitures and stock redeemed for taxes Amortization of unearned compensation under employee plans Exercise of stock options Tax benefit relating to employee stock compensation Distributions... -

Page 60

... Repayment of long-term debt Proceeds from long-term debt, net of discounts Net proceeds from employee stock plans Excess tax benefit relating to employee stock-based compensation Distributions paid to non-controlling interest Deferred financing fees Repayment of revolving credit line, net Proceeds... -

Page 61

... services to providers and patients, retail network pharmacy administration, benefit design consultation, drug utilization review, drug formulary management, Medicare, Medicaid and Public Exchange offerings, administration of a group purchasing organization and consumer health and drug information... -

Page 62

... $25.3 million and $18.7 million at December 31, 2014 and 2013, respectively. We maintain our trading securities to offset changes in certain liabilities related to our deferred compensation plan described in Note 10 - Employee benefit plans and stock-based 56 Express Scripts 2014 Annual Report 60 -

Page 63

.... The customer contract related to our asset acquisition of the SmartD Medicare Prescription Drug Plan is being amortized over an estimated useful life of 10 years. All other intangible assets, excluding legacy ESI trade names which have an indefinite life, are amortized on a straight-line basis... -

Page 64

... co-payments, which we instructed retail pharmacies to collect from members, of $10,272.7 million, $12,620.3 million and $11,668.6 million for the years ended December 31, 2014, 2013 and 2012, respectively, are included in revenues and cost of revenues. 58 Express Scripts 2014 Annual Report 62 -

Page 65

... amounts are reconciled with CMS and the corresponding receivable or payable is settled. The cost share is treated consistently as other co-payments derived from providing PBM services, a component of revenues on the consolidated statement of operations. 59 63 Express Scripts 2014 Annual Report -

Page 66

Our cost of revenues includes the cost of drugs dispensed by our home delivery pharmacies or retail network for members covered under our Medicare Part D PDP product offerings. These amounts are recorded at cost as incurred. We receive a catastrophic reinsurance subsidy from CMS for approximately 80... -

Page 67

... revenues upon transfer of goods or services to customers in amounts that reflect the consideration which the company expects to receive in exchange for those goods or services. The new guidance is effective for financial statements issued for annual reporting periods beginning after December... -

Page 68

.... Nonperformance risk refers to the risk the obligation will not be fulfilled and affects the value at which the liability would be transferred to a market participant. This risk did not have a material impact on the fair value of our liabilities. 62 Express Scripts 2014 Annual Report 66 -

Page 69

... opening price of Express Scripts' stock on April 2, 2012, the purchase price was comprised of the Cash paid to Medco stockholders(1) Value of shares of common stock issued to Medco stockholders(2) Value of stock options issued to holders of Medco stock options(3)(4) Value of restricted stock units... -

Page 70

... liabilities. Express Scripts finalized the purchase price allocation and push down accounting as of March 31, 2013. Following is a summary of Express Scripts' estimates of the fair values of the assets acquired and liabilities assumed in the Merger: Amounts Recognized as of Acquisition Date (in... -

Page 71

...in the accompanying consolidated statement of operations for the year ended December 31, 2013. Our disposed UBC operations were included within our Other Business Operations segment before being classified as discontinued operations as of December 31, 2012. 65 Express Scripts 2014 Annual Report 69 -

Page 72

...fair value was determined utilizing the contracted sales price of the business (Level 2). This charge is included in the SG&A line item in the accompanying consolidated statement of operations for the year ended December 31, 2012. The write-down was comprised of impairments to customer relationships... -

Page 73

... operations was $15.8 million and $10.1 million at December 31, 2014 and 2013, respectively. During 2011, we ceased fulfilling prescriptions from our home delivery dispensing pharmacy in Bensalem, Pennsylvania. The related lease expired during 2014. 67 71 Express Scripts 2014 Annual Report -

Page 74

....4 (22.5) (2.0) 29,280.9 $ $ (1) Goodwill associated with the Merger has been adjusted due to the finalization of the purchase price allocation during 2013. (2) Goodwill has been adjusted to correct certain deferred taxes related to prior acquisitions. 68 Express Scripts 2014 Annual Report 72 -

Page 75

...D PDP in September 2013. During 2014, we finalized the purchase price related to the customer contract, resulting in a reduction of the asset value by $2.2 million. This new intangible asset has a useful life of 10 years. The asset acquisition added approximately 87,000 covered Medicare lives to our... -

Page 76

... Merger (as described in Note 3 - Changes in business), to repay existing indebtedness and to pay related fees and expenses. Subsequent to consummation of the Merger on April 2, 2012, the revolving facility is available for general corporate purposes. The term 70 Express Scripts 2014 Annual Report... -

Page 77

... to the redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 20 basis points with respect to any September 2015 Senior Notes being redeemed, or 25 basis points with respect to any 71 75 Express Scripts 2014 Annual Report -

Page 78

... and unconditionally (subject to certain customary release provisions, including sale, exchange, transfer or liquidation of the guarantor subsidiary) guaranteed on a senior unsecured basis by most of our current and future 100% owned domestic subsidiaries. 72 Express Scripts 2014 Annual Report 76 -

Page 79

... of current maturities, excluding unamortized discounts and premiums, for our long-term debt as of December 31, 2014 (in millions): Year Ended December 31, 2015 2016 2017 2018 2019 Thereafter $ 2,552.6 1,763.2 2,000.0 1,200.0 1,500.0 4,450.0 $ 13,465.8 73 77 Express Scripts 2014 Annual Report -

Page 80

... tax rate recognized in discontinued operations was (115.1)% and (30.5)% for the years ended December 31, 2013 and 2012, respectively. Our income tax provision from discontinued operations was $28.7 million and $7.5 million for 2013 and 2012, respectively. 74 Express Scripts 2014 Annual Report... -

Page 81

...provided a valuation allowance of $85.5 million against these deferred tax assets. A reconciliation of our beginning and ending amount of unrecognized tax benefits is as follows: (in millions) 2014 2013 2012 Balance at January 1 Additions for tax positions related to prior years Reductions for tax... -

Page 82

... share repurchases, if any, will be made in such amounts and at such times as the Company deems appropriate based upon prevailing market and business conditions and other factors. Current year repurchases were funded through internally generated cash and debt. 76 Express Scripts 2014 Annual Report... -

Page 83

...market value of our common stock on the last business day of the participation period. During 2014, 2013 and 2012, approximately 224,000, 289,000 and 229,000 shares of our common stock were issued under the plan, respectively. Our common stock reserved for future employee purchases under the plan is... -

Page 84

.... The tax benefit related to employee stock compensation recognized during the years ended December 31, 2014, 2013 and 2012 was $37.3 million, $60.0 million and $153.9 million, respectively. Effective upon the closing of the Merger, the Company assumed the sponsorship of the Medco Health Solutions... -

Page 85

... Express Scripts may grant stock options and SSRs to certain officers, directors and employees to purchase shares of Express Scripts Holding Company common stock at fair market value on the date of grant. The SSRs and stock options granted under the 2000 LTIP, 2011 LTIP and 2002 Stock Incentive Plan... -

Page 86

... of Medco's pension benefit obligation, which was re-measured and recorded at fair value on the date of the Merger. Express Scripts has elected to determine the projected benefit obligation as the value of the benefits to which employees would be entitled if they separated from service immediately... -

Page 87

... in passive bond market index lending funds and a short-term investment fund. (5) The inclusion of a hedge fund serves to further diversify the fund and the volatility of the hedge fund portfolio returns are expected to be less than that of global equities. 81 85 Express Scripts 2014 Annual Report -

Page 88

... to be used in our Fair Lawn, New Jersey facility. The lease terminates in December 2016 and contains an option for the Company to purchase the equipment for one dollar at that time. As of December 31, 2014, the capitalized lease obligation was $28.4 million. 82 Express Scripts 2014 Annual Report 86 -

Page 89

...reasonably likely to have a material adverse effect on our cash flow or financial condition. We also believe that any amount that could be reasonably estimated in excess of accruals, if any, for such proceedings is not material. However, an unexpected adverse 83 87 Express Scripts 2014 Annual Report -

Page 90

... of a bi-annual survey of retail drug prices. In March 2014, the Ninth Circuit Court of Appeals remanded the case to the district court for further proceedings. (i) Brady Enterprises, Inc., et al. v. Medco Health Solutions, Inc. (ii) North Jackson Pharmacy, Inc., et al. v. Express Scripts, Inc., et... -

Page 91

...segments. The following table presents information about our reportable segments, including a reconciliation of operating income from continuing operations to income before income taxes from continuing operations for the respective years ended December 31. 85 89 Express Scripts 2014 Annual Report -

Page 92

... of 2014 and 2013 due to the structure of the contract. (2) Includes retail pharmacy co-payments of $10,272.7, $12,620.3 and $11,668.6 for the years ended December 31, 2014, 2013 and 2012, respectively. (3) Includes home delivery and specialty, including drugs we distribute to other PBMs' clients... -

Page 93

PBM product revenues consist of revenues from the sale of prescription drugs by retail pharmacies in our retail pharmacy networks, revenues from the dispensing of prescription drugs from our home delivery pharmacies and revenues from the sale of certain fertility and specialty drugs. Other Business ... -

Page 94

...share attributable to Express Scripts Diluted earnings per share attributable to Express Scripts Fiscal 2013 Total revenues(2) Cost of revenues(2) Gross profit Selling, general and administrative Operating income Net income from continuing operations Net loss from discontinued operations, net of tax... -

Page 95

... Holding Company to Express Scripts, Inc. and Guarantors and expense being allocated between Guarantors, resulting in higher Express Scripts, Inc. net income and lower Medco Health Solutions, Inc. net income on the condensed consolidating statements of operations for the year ended December 31, 2014... -

Page 96

...Express Scripts Holding Company Express Scripts, Inc. Medco Health Solutions, Inc. NonGuarantors (in millions) Guarantors Eliminations Consolidated As of December 31, 2014....2 3,137.3 2,836.1 2,555.3 17,016.9 11,012.7 - 4,923.2 782.1 9.8 20,054.2 53,798.9 90 Express Scripts 2014 Annual Report 94 -

Page 97

...Express Scripts Holding Company Express Scripts, Inc. Medco Health Solutions, Inc. NonGuarantors (in millions) Guarantors Eliminations Consolidated As of December 31, 2013....0 1,982.2 1,584.0 1.3 13,235.3 12,363.0 - 5,440.6 664.4 0.1 7.4 21,837.4 53,548.2 91 95 Express Scripts 2014 Annual Report -

Page 98

Condensed Consolidating Statement of Operations Express Scripts Holding Company Express Scripts, Inc. Medco Health Solutions, Inc. NonGuarantors (in millions) Guarantors Eliminations Consolidated For the year ended December 31, 2014 Revenues Operating expenses Operating income Other (expense) ... -

Page 99

... Company Express Scripts, Inc. Medco Health Solutions, Inc. NonGuarantors (in millions) Guarantors Eliminations Consolidated For the year ended December 31, 2012 Revenues Operating expenses Operating income (loss) Other (expense) income, net Income (loss) before income taxes Provision (benefit... -

Page 100

... Express Scripts Holding Company Express Scripts, Inc. Medco Health Solutions, Inc. NonGuarantors (in millions) Guarantors Eliminations Consolidated For the year ended December 31, 2014 Net cash flows provided by (used in) operating activities Cash flows from investing activities: Purchases... -

Page 101

... Express Scripts Holding Company Express Scripts, Inc. Medco Health Solutions, Inc. NonGuarantors (in millions) Guarantors Eliminations Consolidated For the year ended December 31, 2013 Net cash flows provided by (used in) operating activities Cash flows from investing activities: Purchases... -

Page 102

... Express Scripts Holding Company Express Scripts, Inc. Medco Health Solutions, Inc. NonGuarantors (in millions) Guarantors Eliminations Consolidated For the year ended December 31, 2012 Net cash flows provided by (used in) operating activities Cash flows from investing activities: Purchases... -

Page 103

... 13a-15(f) and 15d-15(f) under the Exchange Act) occurred during the quarter ended December 31, 2014 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting. Item 9B - Other Information None. 97 101 Express Scripts 2014 Annual Report -

Page 104

... and Related Party Transactions" and "Corporate Governance." Item 14 - Principal Accounting Fees and Services The information required by this item will be incorporated by reference from the Proxy Statement under the heading "Principal Accountant Fees." 98 Express Scripts 2014 Annual Report 102 -

Page 105

... the SEC, upon request, copies of any longterm debt instruments that authorize an amount of securities constituting 10% or less of the total assets of Express Scripts Holding Company and its subsidiaries on a consolidated basis. 99 103 Express Scripts 2014 Annual Report -

Page 106

... Director Director February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 February 23, 2015 100 Express Scripts 2014 Annual Report... -

Page 107

Col. A (in millions) Description EXPRESS SCRIPTS HOLDING COMPANY Schedule II - Valuation and Qualifying Accounts and Reserves of Continuing Operations Years Ended December 31, 2014, 2013 and 2012 Col. B Balance at Beginning of Period Charges to Costs and Expenses Col. C Additions Charges to Other ... -

Page 108

... 2.1 to Express Scripts, Inc.'s Current Report on Form 8-K filed July 22, 2011, File No. 000-20199. Amendment No. 1 to Agreement and Plan of Merger, dated as of November 7, 2011, by and among Express Scripts, Inc., Medco Health Solutions, Inc., Express Scripts Holding Company (formerly Aristotle... -

Page 109

... to Express Scripts, Inc.'s Current Report on Form 8-K filed November 25, 2011, File No. 000-20199. Eighth Supplemental Indenture, dated as of April 2, 2012, among Express Scripts, Inc., Express Scripts Holding Company, Medco Health Solutions, Inc., the other subsidiaries of Express Scripts Holding... -

Page 110

... Company's Quarterly Report on Form 10Q for the quarter ended June 30, 2012. Form of Restricted Stock Unit Grant Notice for Non-Employee Directors used with respect to grants of restricted stock units by Express Scripts Holding Company under the Express Scripts, Inc. 2011 Long-Term Incentive Plan... -

Page 111

... Medco Health Solutions, Inc., incorporated by reference to Exhibit 10.4 to Medco Health Solutions, Inc.'s Annual Report on Form 10-K for the fiscal year ended December 27, 2003, File No. 001-31312. Executive Employment Agreement dated as of January 13, 2014, between Express Scripts Holding Company... -

Page 112

... Agreement with members of Express Scripts Holding Company's board of directors and each of its executive officers, incorporated by reference to Exhibit 10.1 to Express Scripts Holding Company's Current Report on Form 8-K filed March 5, 2014. Form of Executive Employment Agreement with... -

Page 113

Intentionally left blank 111 Express Scripts 2014 Annual Report -

Page 114

Intentionally left blank Express Scripts 2014 Annual Report 112 -

Page 115

... exhibits to Express Scripts' Annual Report on Form 10-K for the ï¬scal year ended December 31, 2014. These and other exhibits will be furnished by the Investor Relations department upon request. Investor Relations Contact 314.810.3115 [email protected] Board of Directors Gary... -

Page 116

... Annual Report on recycled stocks that are certiï¬ed by the Forest Stewardship Council® (FSC®). The cover and ï¬nancial pages are printed on paper stock that has 10% post-consumer waste content. Express Scripts One Express Way St. Louis, MO 63121 Express-Scripts.com/Corporate © 2015 Express...