Marks and Spencer 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GOVERNANCEFINANCIAL STATEMENTS OUR PERFORMANCE OUR BUSINESS

17

ANNUAL REPORT AND FINANCIAL STATEMENTS 2015

INVESTING IN OUR INFRASTRUCTURE

Investment to make our supply chain fi t

for the future continued with a focus on our

GM IT systems and logistics network. Upon

completion, these two interdependent

projects will deliver greater supply chain

fl exibility and better availability for our

customers. In IT, we completed the

Allocation & Replenishment element of

our GM4 programme, implementing a new

stock distribution system that allocates

stock to stores based on demand, ensuring

our customers can get the products they

want in the location in which they want

them. In logistics, we continue to reshape

our GM warehouse network, and the

next milestone will be the launch of our

redeveloped Bradford National Distribution

Centre in 2016.

MANAGING OUR PROPERTY PORTFOLIO

We added 1.5% of UK selling space, driven

by our Simply Food growth programme. We

opened 67 new stores this year, including

62 Simply Food stores. We closed 13 stores,

of which fi ve were relocations, as we

continue to reshape our portfolio to ensure

that our stores are in the most convenient

locations. We expect Food space to

increase by 4.5% in 2015/16, again driven

by growth in Simply Food store numbers.

Our strategy is for GM space to remain fl at,

although we will continue to manage our

estate to improve the quality of stores for

our customers.

SUSTAINABLE REPORTING A

Our commitment to Plan A drives us to run

our business e ciently. An e ective,

sustainable business plan ultimately

delivers value for shareholders. Investors

recognise the long-term value of sourcing

responsibly, cutting waste and using

resources e ciently.

As members of the International Integrated

Reporting Council and the Prince’s

Accounting for Sustainability project (A4S),

we are committed to reporting the long-

term value created by sustainable business.

We have participated in projects supporting

natural capital accounting, and we are

taking part in the development of natural

capital protocols led by the Natural Capital

coalition, with the results due in 2016.

We are committed to managing and

reporting our global tax a airs in keeping

with our longstanding values and paying

our fair share of tax. There is further detail

on our tax contribution on page 18.

FIND OUT MORE

Read about Our operating performance on p26-31 See how performance links to Remuneration on p62

See Our plan and Strategic priorities on p08-13

See our Key performance indicators on p14-15

52 weeks ended

28 Mar 15

£m

29 Mar 14

£m % var

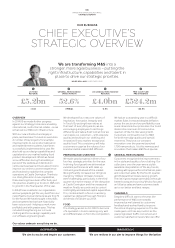

Group revenue110,311.4 10,309.7 Level

UK 9,223.1 9,155.7 +0.7

International11,088.3 1,154.0 -5.7

Underlying operating profi t 762.5 741.9 +2. 8

UK 670.2 619.2 +8.2

International 92.3 12 2.7 -24 . 8

Underlying profi t before tax 661.2 622.9 +6.1

Non-underlying items (61.2) (42.5) -44.0

Profi t before tax 600.0 580.4 +3.4

Underlying basic earnings per share 33.1p 32.2p +2.8

Basic earnings per share 29.7p 32.5p -8.6

Dividend per share (declared) 18.0p 17. 0 p

1. On reported currency basis.

SUMMARY OF RESULTS