Marks and Spencer 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

MARKS AND SPENCER GROUP PLC

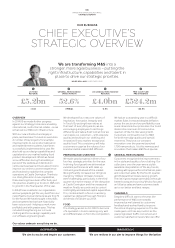

STRATEGIC REPORT

OUR PERFORMANCE

KEY PERFORMANCE

INDICATORS

Reduce

impact

GROUP FINANCIAL OBJECTIVES

NON-FINANCIAL MEASURES

GROUP

REVENUE

UNDERLYING

GROUP PROFIT

BEFORE TAX

RETURN

ON CAPITAL

EMPLOYED

(ROCE)

UNDERLYING

EARNINGS

PER SHARE

FREE CASH

FLOW (PRE

DIVIDEND)

PRODUCTS

WITH A

PLAN A QUALITY

GROSS

GREENHOUSE

GAS EMISSIONS

GROSS GREENHOUSE

GAS EMISSIONS

PER 1,000 SQ FT

Total Group sales including retail sales for

owned business and wholesale sales to

franchise partners.

Group revenue was broadly fl at year-on-

year, with the growth in Food sales o set

by the decline in GM and International.

Underlying profi t provides additional

useful information on the underlying

performance of the business adjusting for

income and signifi cant one-o charges.

Underlying PBT grew as a result of a

signifi cantly improved performance in

the UK business.

Return on capital employed is a relative

profi t measurement that demonstrates

the return the business is generating from

its net operating assets.

The reduction in ROCE from last year

refl ects an increase in average net

operating assets, partially o set by

an increase in underlying earnings.

Earnings per Share (EPS) is the underlying

profi t divided by the average number of

ordinary shares in issue.

The weighted average number of shares

in issue during the period was 1,635.6m

(last year 1,615.0m).

Free cash fl ow is the net cash generated

by the business in the period before

dividend payment.

Improvement was driven by better

working capital management and

improvements in underlying EBITDA.

A quality or feature regarded as a

characteristic or inherent part of a

product which has a demonstrable

positive or signifi cantly lower

environmental and/or social impact

during its sourcing, production, supply,

use and/or disposal.

Total gross CO2e emissions resulting

from M&S operated activities worldwide.

We co ntinue to o set emissions to a

net fi gure of zero (carbon neutrality).

Total gross CO2e emissions

per 1,000 sq ft resulting from M&S

operated activities worldwide.

Looking ahead Our aim is for all

M&S p ro duc ts to have at le ast one

Pla nA q ua l it y by 2020. We h ave

targets to improve energy e ciency

by 50% and reduce refrigeration gas

emissions by 80% by 2020. We also

plan to continue to o set our gross

greenhouse gas emissions to zero

(carbon neutral).

OBJECTIVE KPI DEFINITION 2014/15 DATA

£10.3bn

Level

£661.2m

14.7%

33.1p

£524.2m

64%

592,000 CO2e

30 t CO2e/1,000sq ft

+6.1%

LY14.8%

+2.8%

+22.5%

+7%

+4.4%2

Level

13/14 £622.9m

13/14 £427.9m

13/14 14.8%

13/14 32.2p

13/14 17.0p

12/13 £648.1m

11/12 £705.9m1

12/13 £204.1m

11/12 £385.2m

12/13 15.8%

11/12 16.4%1

12/13 31.9p

11/12 34.9p1

12/13 17.0p

11/12 17.0p

Group revenue £bn

11/ 12 12 /13 13/14 14 /15

9.9 10.0 10.3 10.3

M&S pro

d

ucts

2013/14 57%

6

4

%

2020 target 100%

Plan A quality

Grow Group

revenue

Strong

cash

generation

Improve

product

sustainability

Increase

earnings

and returns

DIVIDEND

PER SHARE

Dividend per share declared in respect

of the year.

The Board is recommending a fi nal

dividend of 11.6p per share, resulting

in a to t al divide n d of 18. 0 p, 1. 0p ab ove

last year.

18.0p

+1.0p

S

A

A

A