Marks and Spencer 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT &

FINANCIAL STATEMENTS

2015

Table of contents

-

Page 1

ANNUAL REPORT & FINANCIAL STATEMENTS 2015 -

Page 2

... how we create long-term value through the effective use of our resources and relationships, and clear links between our KPIs and remuneration. PLAN A Plan A is integrated throughout ONLINE INFORMATION To keep S STRATEGIC PRIORITIES A PLAN A R RISK LOOKING AHEAD shareholders fully up-to-date, we... -

Page 3

... EVERY DAY THROUGH THE HIGH QUALITY, OWN BRAND FOOD, CLOTHING AND HOME PRODUCTS WE OFFER IN OUR STORES AND ONLINE BOTH IN THE UK AND INTERNATIONALLY. WHAT'S IN THIS REPORT? OUR BUSINESS At a glance Chairman's statement Creating sustainable value Chief Executive's strategic overview 10 Our plan in... -

Page 4

02 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR BUSINESS AT A GLANCE UK M&S.COM We sell high quality, great value products to 33 million customers through our 852 UK stores and our e-commerce platform. Our business has two divisions: Food, which accounts for 57% of our turnover, and General ... -

Page 5

03 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 INTERNATIONAL PLAN A 2020 A M&S has 480 wholly-owned, jointlyowned or franchised stores in 59 territories across Europe, Asia and the Middle East. Our International business now includes a fast-growing standalone Food operation, meaning that more ... -

Page 6

...Chairman in 2011: we are focused on strategy and execution, people and succession, and values. Having completed the bulk of our major three-year investment programme to transform M&S into an international, multi-channel retailer, the Board's focus again this year was on ensuring that our substantial... -

Page 7

... private investors to use money from their dividend payment to buy an M&S Shareholder Card at a discount. It operates much like a gift card. The initiative reï¬,ects the fact our private investors are also some of our most loyal customers and we value them greatly. Our 'Fit for the Future' programme... -

Page 8

06 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR BUSINESS CREATING SUSTAINABLE VALUE OUR BUSINESS MODEL We create long-term value through the effective use of our resources and relationships. We manage these in line with our core values of Inspiration, Innovation, Integrity and In Touch. These... -

Page 9

... retail parks with a combination of larger full line stores and smaller stores, all supported by our Shop Your Way service that delivers our products wherever and whenever our customers want them. Our expanding Simply Food format means we are well positioned to respond to changing consumer shopping... -

Page 10

...on full price sales and saw customers trade up to our better and best ranges. CHANNELS Despite a difficult start to the year, the performance of M&S.com steadily improved as we listened to customers' feedback and worked hard to improve the online shopping experience. The site made gains on three key... -

Page 11

...on supporting young people facing barriers to employment, is part of Movement to Work, a larger programme we helped to found in 2013. Almost 200 of the UK's biggest companies are now signed up. Engaging with our communities underpins Plan A and this year our employees and customers raised a total of... -

Page 12

... our full range in a larger number of stores we are helping people cater for their busy lives; over 40% of our customers buy food for today or tonight. Our Simply Food format continues to grow strongly. We opened 62 new stores in the UK this year, taking our total to 504. Our franchise partners play... -

Page 13

11 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 OUR PLAN IN ACTION: GM GROSS MARGIN IMPROVEMENT As part of our strategy to improve our margins, we are bringing much of our design in-house. 35% of our clothing is now created, designed and sourced by our own teams, up from 20% at the end of last year... -

Page 14

12 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 STRATEGIC REPORT OUR PLAN IN ACTION: IMPROVE GM PERFORMANCE (WOMENSWEAR) When we see a trend coming, we work quickly to interpret it for our customers. As the UK market leader in Womenswear denim, we knew that the recent denim catwalk trend would ... -

Page 15

... to bring our infrastructure up to date. We are now in a good position to maintain our existing assets while also having the headroom to invest in new ones as we fulï¬l our ambition to be an international, multi-channel retailer. FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE OUR BUSINESS -

Page 16

14 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR PERFORMANCE KEY PERFORMANCE INDICATORS GROUP FINANCIAL OBJECTIVES OBJECTIVE KPI GROUP REVENUE DEFINITION Total Group sales including retail sales for owned business and wholesale sales to franchise partners. Group revenue was broadly ï¬,at year-... -

Page 17

15 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 FIND OUT MORE Read about Our Plan on p09-13 Read more on Remuneration on p52-76 STRATEGIC OBJECTIVES OBJECTIVE KPI FOOD UK REVENUE OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE GENERAL MERCHANDISE UK REVENUE M&S.COM INTERNATIONAL ... -

Page 18

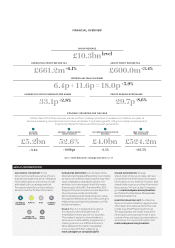

16 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR PERFORMANCE FINANCIAL REVIEW Strong ï¬nancial disciplines are at the heart of how we run the business. HELEN WEIR CHIEF FINANCE OFFICER OVERVIEW In 2014/15, we made progress in the delivery of our strategy, with sales of £10.3bn level on last ... -

Page 19

... our estate to improve the quality of stores for our customers. SUSTAINABLE REPORTING A delivers value for shareholders. Investors recognise the long-term value of sourcing responsibly, cutting waste and using resources efficiently. As members of the International Integrated Reporting Council and... -

Page 20

18 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR PERFORMANCE FINANCIAL REVIEW CONTINUED GROUP REVENUE Group revenues were level (up 0.4% on a constant currency basis). UK revenues were up 0.7% in total with a like-for-like decrease of 1.0%. International revenues were down 5.7% (down 2.1% on a ... -

Page 21

... the market context on pages 20-21 and risk management on pages 23 to 25, was approved by a duly authorised Committee of the Board of the Directors on 19 May 2015, and signed on its behalf by OUR PERFORMANCE UK store environment New UK stores International Supply chain and technology Maintenance... -

Page 22

... than last year. The shift towards convenience store shopping within the food market means there is intense competition for a limited number of sites. In order to help us address this challenge we have put in place a Simply Food surveying team to identify and secure the best located sites and we... -

Page 23

... customers a great experience every time they shop with us. Products & Channels It is crucial that we are in touch with our customers through every channel available. M&S.com uses bespoke content to communicate with our customers 24 hours a day and is regularly updated to take into account customer... -

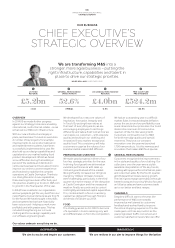

Page 24

... responsibility for UK Retail as well as Multi-channel. Patrick Bousquet-Chavanne took on responsibility for International, as well as Marketing, to help bolster M&S's global brand position. We were delighted to welcome Helen Weir onto our Board as Chief Finance Officer on 1 April 2015. Helen, who... -

Page 25

23 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 OUR PERFORMANCE RISK MANAGEMENT We believe that effective risk management is critical to the achievement of our strategic objectives and the long-term sustainable growth of our business. APPROACH TO RISK MANAGEMENT The Board has overall accountability... -

Page 26

... ethical sourcing standards and continue to drive improvements to product quality. regularly monitored. > Robust and established supplier ethical audit programme in place. led by experienced overseas Sourcing Directors. > End-to-end review of GM design, trading and sourcing underway. INFORMATION... -

Page 27

... and multi-channel businesses as part of our evolution to be a truly international, multi-channel retailer centre operates 24/7 to monitor website availability and performance. > Social media monitored to observe and respond to trends in customer experience. incident reporting and management... -

Page 28

26 MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT OPERATING PERFORMANCE FOOD Our mission in Food is simple: inspire our customers with high quality, great value products in stores full of new ideas. STEVE ROWE EXECUTIVE DIRECTOR, FOOD UK FOOD REVENUE MARKET SHARE1 NUMBER OF NEW LINES £5.2bn ... -

Page 29

27 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 OPERATING PERFORMANCE GENERAL MERCHANDISE We have improved the quality and style of our ranges and delivered strong gross margin growth. OUR BUSINESS A JOHN DIXON EXECUTIVE DIRECTOR, GENERAL MERCHANDISE UK GM REVENUE WOMENSWEAR MARKET SHARE1 ... -

Page 30

... AND SPENCER GROUP PLC DIRECTORS' REPORT OPERATING PERFORMANCE CHANNELS We aim to deliver a consistent, convenient and inspirational experience for our customers whichever way they choose to shop with us. LAURA WADE-GERY EXECUTIVE DIRECTOR, MULTI-CHANNEL TOTAL UK STORES FULL LINE STORES OUTLET... -

Page 31

... ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 OPERATING PERFORMANCE INTERNATIONAL This year, we accelerated the roll-out of our Food stores overseas and continued to focus on our priority markets. OUR BUSINESS R PATRICK BOUSQUET-CHAVANNE EXECUTIVE DIRECTOR, MARKETING & INTERNATIONAL INTERNATIONAL... -

Page 32

... stories that make our products different. PATRICK BOUSQUET-CHAVANNE EXECUTIVE DIRECTOR, MARKETING & INTERNATIONAL PERFORMANCE OVERVIEW One brand, multiple stories. That was our mission this year: to speak in unison across the GM and Food sides of our business, across communication channels, and... -

Page 33

..., international, logistics and design to ensure we have the right capabilities to compete. Training remains key. Our new Customer Assistant Induction programme replaced a workshop-heavy induction process with a PLAN A In 2014 we celebrated a decade of our Marks & Start employability scheme. Along... -

Page 34

... and performance issues impacting delivery in a number of key international markets. The launch of our new website and our distribution centre at Castle Donington represented the completion of two signiï¬cant investments, essential for the long-term growth of our business. This has been a key area... -

Page 35

... we regularly discuss and debate: > Strategy and Company performance > Culture and behaviour > Ecommerce > The M&S brand > International > Supply chain > Risk > Plan A 2020 UK CORPORATE GOVERNANCE CODE The UK Corporate Governance Code 2012 (the 'Code') is the standard against which we were required... -

Page 36

... in developing and marketing brands globally, and a broad knowledge of enhancing business performance and customer experience in a multi-channel environment. Patrick played a key role in creating the new marketing strategy for Womenswear, and continues to lead the transformation of M&S's in-store... -

Page 37

... 38% BOARD EXPERIENCE GROUP SECRETARY N A CC RETAIL 100% CONSUMER 100% N FINANCE 39% E-COMMERCE & TECHNOLOGY 46% INTERNATIONAL EXPERIENCE GOVERNANCE FINANCIAL STATEMENTS Andy Halford Non-Executive Director Appointed: January 2013 Skills, competence and experience: A Chartered Accountant, Andy... -

Page 38

... the right GROUP BOARD MANAGEMENT COMMITTEE EXECUTIVE BOARD PRINCIPAL COMMITTEES Audit Remuneration Nomination balance of independence on the Board; > Effectiveness The review this year EXECUTIVE COMMITTEES Property Board Fire, Health & Safety Business Continuity Customer Insight Unit How... -

Page 39

... Marketing & International performance General Merchandise performance Food performance UK Retail & Multi-channel performance Miranda Curtis Martha Lane Fox Andy Halford Steven Holliday2 (retired 8 July 2014) Executive Director Patrick Bousquet-Chavanne Executive Director John Dixon Executive... -

Page 40

... international presence identiï¬ed. > Accelerated growth in India and against planned objectives. > Acquire, develop and manage the global Hong Kong. > Improved property asset management property portfolio at optimal value. > Deliver new business unit across portfolio. > High level of in-store... -

Page 41

... ways of greater accountability across the business. working throughout the Company to speed up decision-making with the launch of Fit for the Future. > Better buying and supplier models. > Greater design experience in-house OUR PERFORMANCE FINANCIAL STATEMENTS GOVERNANCE Customers Reviewed... -

Page 42

...strategy (including details of all key investment decisions), key people and succession plans; Board procedures including the Governance Framework, Code of Ethics and Behaviours; Board calendar, minutes from previous meetings, effectiveness reviews and action plans; ï¬nances, performance, operating... -

Page 43

...Interim Chief Finance Officer, Head of Internal Audit & Risk, the Group Secretary, the Company's external remuneration consultants, PwC, and the Company's lead Audit Partner from Deloitte. Stage 2 The report was compiled by the evaluation team based on information and views supplied by the Board and... -

Page 44

... consultation and meetings with investors ahead of the approval of our Remuneration Policy at the AGM in July 2014. In addition to these Board changes, throughout the year, the Committee focused on executive director development and senior management talent development and pipeline. We have... -

Page 45

... the key policy objectives during the year, as reported above. In addition, the business has continued to promote diversity with the introduction or continuation of key initiatives: > The annual Board evaluation process OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE School Training... -

Page 46

... Internal Audit supports the business through driving improvements to our control environment and adding value in core business areas. RISK: INTERNATIONAL EXPANSION In support of the Group's international growth plans, Internal Audit reviewed the process to identify and approve new store locations... -

Page 47

... Group Risk process, and used to monitor business activities and decision-making. We believe we have made good progress this year and risk appetite remains a key priority for the Board in 2015/16. OUR PERFORMANCE FINANCIAL STATEMENTS GOVERNANCE OUR BUSINESS 8 International expansion 1 GM customer... -

Page 48

... towards the strategic plan. The updates provide us with an opportunity to challenge, discuss and debate with the presenters whilst sharing our experience and providing an independent perspective. In October 2014, the UK Corporate Governance Code was updated. The Committee is looking closely at the... -

Page 49

... to improve standards in a number of key areas. These include ensuring that information is presented with a culture of 'right ï¬rst time', that the quality of management papers is high, that robust internal systems and controls are maintained, that the audit process is respected and valued by... -

Page 50

... AND SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE ACCOUNTABILITY AUDIT COMMITTEE REPORT CONTINUED AUDIT COMMITTEE UPDATES The Committee receives a detailed update from the business at each Committee meeting, with one or more areas represented. Business updates are planned on a rolling 12-month... -

Page 51

... its review, the Committee was of the opinion that the 2015 Annual Report and Accounts is representative of the year and presents a fair, balanced and understandable overview, providing the necessary information for shareholders to assess the Group's performance, business model and strategy. any... -

Page 52

... planning and reporting, preparing consolidated accounts, capital expenditure, project governance and information security, and the Group's Code of Ethics and Behaviours. INTERNAL ASSURANCE FRAMEWORK COMMITTEES Fire, Health & Safety Plan A* ANNUAL UPDATE BY RELEVANT EXECUTIVE REPORTS Information... -

Page 53

..., the capital markets advisory ï¬rm, continues to provide guidance to our Investor Relations team and undertake an annual audit of our major investors' views on the Company's management and performance. The results are presented to the Board. M&S GOVERNANCE EVENT 2015 The M&S Governance Event is... -

Page 54

... targets for two key business priorities of GM gross margin growth and the delivery of free cash ï¬,ow, as set out in the Company's key performance indicators. While these amendments are within the parameters of the remuneration policy approved by shareholders at last year's AGM, we value the views... -

Page 55

...ts p63 Annual Bonus Scheme p64 REMUNERATION REPORT p62 Performance Share Plan p66 Directors' share interests p68-71 Non-executive directors' remuneration p74 Remuneration Committee p75 The bonus payments outlined on page 64 reï¬,ect both the delivery against corporate or business area targets and... -

Page 56

...motivate high calibre executives needed to deliver our strategy and drive business performance. To provide market competitive beneï¬ts which drive employee engagement and commitment in our business. OPERATION > Payable in cash. > Reviewed annually by the Committee considering a number of factors... -

Page 57

... funding in line with our Company values. To drive annual proï¬tability, strategic change and individual performance in line with our business plan. To recognise and reward individual contributions to the way we do business. The deferral into shares provides alignment with shareholders' long-term... -

Page 58

... formal performance conditions save for continued service. Executive Share Option Scheme (ESOS) Measured against the key drivers of our business plan to deliver sustainable value creation. > Approved by shareholders and HMRC in 2005, the Committee may choose to award share options to directors if... -

Page 59

... the current pay for other executive directors, external market forces, skills and current level of pay at the previous employer in determining the pay on recruitment. > For new appointments to the Board, the Committee may set the rate of pay at the lower end of the rate for other directors with... -

Page 60

... via our Business Involvement Groups are taken into account. The Head of Reward & Global Mobility annually provides these employee representatives with an explanation of the Company's reward principles and director pay arrangements during the year, and is available to answer questions at this time. -

Page 61

... pay, is taken into account. During the year, the Committee consulted with shareholders regarding the minor amendments made to the implementation policy as detailed on page 76. NON-EXECUTIVE DIRECTORS' REMUNERATION POLICY (AS APPROVED ON 8 JULY 2014) OUR PERFORMANCE FINANCIAL STATEMENTS GOVERNANCE... -

Page 62

...' service agreements may be terminated by either party giving three months' notice. In line with the UK Corporate Governance Code, all nonexecutive directors are subject to annual re-election by shareholders at our AGM. Element Fees RECRUITMENT POLICY The Committee takes into account a number of... -

Page 63

...three-year period to 2017/18 (for the PSP), as well as share price performance to the date of the vesting of the share element of the bonus scheme and PSP awards in 2018. FIGURE 7: REMUNERATION ILLUSTRATIONS DIRECTOR KEY ASSUMPTIONS Marc Bolland £000 6,000 £5,674 Patrick Bousquet-Chavanne £000... -

Page 64

...-month average share price from 2 January 2015 - 27 March 2015 as these awards do not vest until after the end of the ï¬nancial year. This value also includes the anticipated value of dividend equivalents which will be payable in July 2015 (and January 2016 for Patrick Bousquet-Chavanne). These... -

Page 65

... which will take effect from 1 July 2015. OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE FIGURE 10: EXECUTIVE DIRECTORS' SALARIES Current annual salary £000 Annual salary as of 1st July 2015 £000 Change in salary % increase Marc Bolland Patrick Bousquet-Chavanne John Dixon Steve... -

Page 66

... house GM sales Food sales M&S.com market share M&S.com performance International Lingerie & Beauty stores GM gross margin Food proposition development New distribution centre service delivery FIGURE 13: ANNUAL BONUS SCHEME 2014/15 PROFITABILITY TARGETS GROUP PBT Target & performance DIRECTOR... -

Page 67

...- 30% 40% Food UK sales Quality and innovation of Food proposition Customer journey Laura Wade-Gery 30% - 30% 40% New distribution centre stability Operating costs Helen Weir 30% 30% - 40% End-to-end supply chain 1. Pre dividend and post returns. Plan A and cultural values underpin -

Page 68

...Performance Share Plan (PSP) is the primary long-term incentive for executive directors and senior managers. The Committee believes that long-term share awards help retain and reward executives for the delivery of long-term business goals. Following the remuneration review undertaken during the year... -

Page 69

... to support the delivery of the strategy to be a leading international, multi-channel retailer. Sales growth targets for awards to be made in 2015/16 have been calibrated to be as challenging as the equivalent revenue targets for 2014/15. During the review process, the Committee determined that the... -

Page 70

... is a straight line between 'threshold' and 'maximum' performance. Excluding Multi-channel. Net of VAT/gross of returns. Excluding Multi-channel/including Republic of Ireland. Measured at the end of the 2015/16 for 2013/14 award and at the end of 2016/17 for 2014/15 award. SHARESAVE (Save As You... -

Page 71

... 223% Unvested DSBP/RSP shares Shareholding requirement OUR PERFORMANCE SHARE CAPITAL & DILUTION Dilution of share capital by employee share plans Awards granted under the Company's Save As You Earn scheme and the Executive Share Option scheme are met by the issue of new shares when the options are... -

Page 72

... MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE REMUNERATION REPORT CONTINUED EXECUTIVE DIRECTORS' REMUNERATION CONTINUED FIGURE 23: EXECUTIVE DIRECTORS' INTERESTS IN THE COMPANY'S SHARE SCHEMES (audited) Maximum receivable at 30 March 2014 Date (or date of of grant appointment) Awarded... -

Page 73

...under the Performance Share Plan is the maximum (100%) number that could be receivable by the executive director if the performance conditions are fully met. The 2011 award vested in July 2014 at 7.6%. 4.7% of the 2012 award will vest in June 2015 (December 2015 for Patrick Bousquet-Chavanne) as set... -

Page 74

... and Spencer Group plc FTSE 100 Index Source: Thomson Reuters 300 250 200 150 100 50 0 28 March 2009 CEO1 3 April 2010 2009/10 29 March 2011 2010/11 2 April 2012 2011/12 30 March 2013 2012/13 29 March 2014 2013/14 28 March 2015 2014/15 CEO single ï¬gure of remuneration (£000) Annual bonus payment... -

Page 75

... by the Company giving 12 months' notice or the director giving six months' notice. Date of appointment Notice period/unexpired term OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE Marc Bolland Patrick Bousquet-Chavanne John Dixon Steve Rowe Laura Wade-Gery 01/05/2010 10/07/2013 09/09... -

Page 76

...shares in the Company within two months of their appointment to the Board. Figure 30 opposite details the shareholding of the non-executive directors who served on the Board during the year as at 28 March 2015 (or upon their date of retiring from the Board). There have been no changes in the current... -

Page 77

... level of the remuneration packages for new senior managers. > Induction of new Remuneration payments for all annual incentive schemes that include executive directors and senior managers. > Agreeing the design, targets and annual 2012/13 PSP awards. > Consideration of the performance Committee... -

Page 78

76 MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE REMUNERATION REPORT CONTINUED REMUNERATION COMMITTEE CONTINUED REMUNERATION COMMITTEE ACTION PLAN 2015/16 > Ensuring the continued strategic alignment of the directors' incentive arrangement with business strategy. > Debating the ... -

Page 79

... is also an annual Board Effectiveness Review and both the Trustee Board and the Investment Committee hold annual strategy days which help drive the long-term agenda and the business plan priorities. Each Trustee Board director has an individual training plan, which is based on the Pension Regulator... -

Page 80

... may at any AGM retire from office and stand for re-election. However, in line with the UK Corporate Governance Code 2012, all directors will stand for annual election at the 2015 AGM. DIRECTORS' CONFLICTS OF INTEREST The Company has procedures in place for managing conï¬,icts of interest. Should... -

Page 81

...the United Kingdom Employees' Save As You Earn Share Option Scheme at prices between 203p and 405p. > 45,389 shares under the terms of the ROI Employees' Save As You Earn Share Option Scheme at prices between 258p and 405p. Details of movements in the Company's issued share capital can be found on... -

Page 82

...involvement throughout the business. Employees are kept well informed of the performance and strategy of the Group through personal brieï¬ngs, regular meetings, email and broadcasts by the Chief Executive and members of the Board at key points in the year to all head office and distribution centre... -

Page 83

... as performance against 2006/07 voluntary baseline, see our 2015 Plan A Report. 2014/15 000 tonnes 2013/14 000 tonnes Direct emissions (scope 1) Indirect emissions from energy (scope 2) Total statutory emissions (scope 1+2) Transport, energy, waste and business travel (scope 3) Total gross/location... -

Page 84

...explanatory notes, in a booklet which accompanies this report. DIRECTORS' RESPONSIBILITIES The Board is of the view that the Annual Report should be truly representative of the year and provide shareholders with the information necessary to assess the Group's performance, business model and strategy... -

Page 85

... ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 FINANCIAL STATEMENTS INDEPENDENT AUDITOR'S REPORT TO THE MEMBERS OF MARKS AND SPENCER GROUP PLC OPINION ON FINANCIAL STATEMENTS OF MARKS AND SPENCER GROUP PLC In our opinion: The ï¬nancial statements give a true and fair view of the state of the Group... -

Page 86

...impairment review. The Group's accounting policy sets out a relevant shelter period for new stores to be taken into account when assessing indicators of impairment during initial years of trading to enable the store to establish itself in the market. costs and general operating costs. The directors... -

Page 87

...upon plans for inventory to go into sale and stock loss based upon the run rate from recent inventory counts. Risk description OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE At 28 March 2015, the Group held inventories of £797.8m. As described in the Accounting Policies in note 1 to... -

Page 88

... the Accounting Policies in note 1 and 17 to the ï¬nancial statements, the Group recognises a reduction in cost of sales as a result of amounts receivable from suppliers, primarily comprising contributions in relation to promotions in the Food business, strategic volume moves and some annual volume... -

Page 89

... the Group has a deï¬ned beneï¬t pension plan for its UK employees, which was closed to new entrants with effect from 1 April 2002, and a funded deï¬ned beneï¬t pension scheme in the Republic of Ireland, OUR BUSINESS BUSINESS OUR FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE where no new bene... -

Page 90

... of the UK business without the involvement of a component team. During the course of our audit, the Group audit team conducted 16 distribution centre and 27 retail store visits in the UK to understand the current trading performance and, at certain locations, perform tests of internal controls and... -

Page 91

... the Corporate Governance Statement relating to the Company's compliance with ten provisions of the UK Corporate Governance Code. We have nothing to report arising from our review. Our duty to read other information in the Annual Report Under International Standards on Auditing (UK and Ireland), we... -

Page 92

90 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS CONSOLIDATED INCOME STATEMENT 52 weeks ended 28 March 2015 Notes Underlying £m Non-underlying £m Total £m 52 weeks ended 29 March 2014 Underlying £m Non-underlying £m Total £m Revenue Operating proï¬t Finance income Finance costs Proï¬t... -

Page 93

... The ï¬nancial statements were approved by the Board and authorised for issue on 19 May 2015. The ï¬nancial statements also comprise the notes on pages 94 to 125. Marc Bolland Chief Executive Officer Helen Weir Chief Finance Officer FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE OUR BUSINESS -

Page 94

92 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Ordinary share capital £m Share Capital premium redemption account reserve £m £m Hedging reserve £m Other reserve¹ £m Retained earnings² £m Total £m Noncontrolling interest £m Total £m... -

Page 95

... to the Marks & Spencer UK Pension Scheme Equity dividends paid Shares issued on exercise of employee share options Purchase of own shares by employee trust Net cash used in ï¬nancing activities Net cash inï¬,ow from activities Effects of exchange rate changes Opening net cash Closing net cash... -

Page 96

94 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS 1 ACCOUNTING POLICIES Basis of preparation The ï¬nancial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) and IFRS Interpretations Committee (IFRS IC) ... -

Page 97

95 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Pensions continued The net interest cost on the net retirement beneï¬t asset/liability is calculated by applying the discount rate, measured at the beginning of the year, to ... -

Page 98

96 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS CONTINUED 1 ACCOUNTING POLICIES CONTINUED Taxation Tax expense comprises current and deferred tax. Tax is recognised in the income statement, except to the extent it relates to items recognised in other ... -

Page 99

... estimation of the eventual sales price of goods to customers in the future. Non-underlying items The directors believe that the underlying proï¬t and earnings per share measures provide additional useful information for shareholders on the underlying performance of the business. These measures are... -

Page 100

.... The UK segment consists of the UK retail business and UK franchise operations. The International segment consists of Marks & Spencer owned businesses in the Republic of Ireland, Europe and Asia, together with international franchise operations. The executive directors assess the performance of the... -

Page 101

... year PricewaterhouseCoopers LLP) as follows: 2015 £m 2014 £m Annual audit of the Company and the consolidated ï¬nancial statements Audit of subsidiary companies Audit-related assurance services Total audit and audit-related assurance services fees Tax compliance services Tax advisory services... -

Page 102

... year relates to the sale of a warehouse site and mock shop in White City on 26 July 2013 to St James Group Ltd for a total consideration of £100m, £25m received on completion and the remaining consideration to be deferred over three years. > International store review in the current year relates... -

Page 103

101 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 NOTES TO THE FINANCIAL STATEMENTS CONTINUED 6 FINANCE INCOME/COSTS 2015 £m 2014 £m Bank and other interest receivable Pension net ï¬nance income (see note 11) Underlying ï¬nance income Interest income on tax repayment (see note 7) Finance income ... -

Page 104

... GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS CONTINUED 7 INCOME TAX EXPENSE CONTINUED B. Taxation reconciliation The effective tax rate was 19.7% (last year 12.8%) and is reconciled below: 2015 £m 2014 £m Proï¬t before tax Notional taxation at the standard UK corporation... -

Page 105

... year ended 28 March 2015 of 11.6p per share amounting to a dividend of £191.1m. It will be paid on 10 July 2015 to shareholders on the Register of Members as at close of business on 29 May 2015, subject to approval of shareholders at the Annual General Meeting, to be held on 7 July 2015. In line... -

Page 106

...ï¬t of its UK employees through the Marks & Spencer UK Pension Scheme (a deï¬ned beneï¬t arrangement which was closed to new entrants with effect from 1 April 2002) and Your M&S Pension Saving Plan (a deï¬ned contribution arrangement which has been open to new members with effect from 1 April... -

Page 107

... a future change in legislation could trigger earlier or higher payments, or an increase in the collateral to be provided by the Group. A. Pensions and other post-retirement liabilities 2015 £m Total market value of assets Present value of scheme liabilities Net funded pension plan asset Unfunded... -

Page 108

... hedge a proportion of interest rate and inï¬,ation risk. The Scheme reduces its foreign currency exposure using forward foreign exchange contracts. At year end, the UK scheme indirectly held 199,032 (last year 199,523) ordinary shares in the Company through its investment in UK Equity Index Funds. -

Page 109

....1) (0.2) 6,540.4 6,528.7 0.7 11.0 6,540.4 GOVERNANCE OUR PERFORMANCE 2015 £m 2014 £m OUR BUSINESS Current service cost Administration costs Past service costs - curtailment charge UK and Ireland one-off pension credits Net interest income Total 82.4 2.0 1.0 - (10.5) 74.9 88.7 3.0 1.0 (27... -

Page 110

...by shareholders at the 2007 AGM. Under the terms of the scheme, the Board may offer options to purchase ordinary shares in the Company once in each ï¬nancial year to those employees who enter into Her Majesty's Revenue & Customs (HMRC) approved Save As You Earn (SAYE) savings contract. The price at... -

Page 111

... of calculating the number of shares awarded, the share price used is the average of the mid-market price for the ï¬ve consecutive dealing days preceding the grant date. OUR BUSINESS January 2009 January 2010 January 2011 January 2012 January 2013 January 2014 January 2015 - - - 1,335,181 7,499... -

Page 112

... planning assumptions used by the Group for investment proposals or for any other assessments. These growth rates do not exceed the long-term average growth rate for the Groups' retail businesses. The pre-tax discount rate is based on the Group's weighted average cost of capital, taking into account... -

Page 113

... key assumptions are as follows: Long-term growth rate 2015 % 2014 % Pre-tax discount rate 2015 % 2014 % The M&S Mode brands are tested based on the regions operating in the European business which are covered under the brand rights acquired. The discount rates used to calculate value in use range... -

Page 114

... market deposits held by Marks and Spencer plc in an escrow account. Non-current unlisted investments are carried as available-for-sale assets. Other ï¬nancial assets are measured at fair value with changes in their value taken to the income statement. 17 TRADE AND OTHER RECEIVABLES 2015 £m 2014... -

Page 115

...: > The Group's funding strategy ensures a mix of funding sources offering sufficient headroom, maturity and ï¬,exibility and cost effectiveness to match the requirements of the Group. > Marks and Spencer plc is ï¬nanced by a combination of retained proï¬ts, bank borrowings, medium-term notes and... -

Page 116

... into sterling using spot rates as of the balance sheet date for the cross-currency interest rate swaps. The present value of ï¬nance lease liabilities is as follows: 2015 £m 2014 £m Within one year Later than one year and not later than ï¬ve years Later than ï¬ve years Total (0.5) (1.0) (47... -

Page 117

...income statement at various dates over the following 16 months (last year 16 months) from the balance sheet date. The Group also holds a number of cross-currency swaps to re-designate its ï¬xed rate US dollar debt to ï¬xed rate sterling debt. These are reported as cash ï¬,ow hedges. The Group uses... -

Page 118

... year 59%) of the Group's gross borrowings. The effective interest rates at the balance sheet date were as follows: 2015 % 2014 % Committed and uncommitted borrowings Medium-term notes Finance leases Derivative ï¬nancial instruments 2015 Assets £m Liabilities £m 0.9 5.3 4.1 1.0 5.3 4.3 2014... -

Page 119

... or the foreign exchange risk is hedged. OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE Net £m Net £m Interest rates: the impact in the income statement due to changes in interest rates reï¬,ects the effect on the Group's ï¬,oating rate debt as at the balance sheet date. The impact... -

Page 120

...the Group maintained an investment grade credit rating of Baa3 (stable) with Moody's and BBB- (stable) with Standard & Poor's. In order to maintain or realign the capital structure, the Group may adjust the number of dividends paid to shareholders, return capital to shareholders, issue new shares or... -

Page 121

119 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 NOTES TO THE FINANCIAL STATEMENTS CONTINUED 22 PROVISIONS 2015 Property £m Restructuring £m Other £m Total £m 2014 Total £m At start of year Provided in the year Released in the year Utilised during the year Exchange differences Discount rate ... -

Page 122

...with the Marks & Spencer UK Pension Scheme. C. Commitments under operating leases The Group leases various stores, offices, warehouses and equipment under non-cancellable operating lease agreements. The leases have varying terms, escalation clauses and renewal rights. 2015 £m 2014 £m Total future... -

Page 123

... position and related notes Cash and cash equivalents (see note 18) Current ï¬nancial assets (see note 16) Bank loans and overdrafts (see note 20) Medium-term notes - net of hedging derivatives Finance lease liabilities (see note 20) Partnership liability to the Marks & Spencer UK Pension Scheme... -

Page 124

... Marks & Spencer UK Pension Scheme are set out in notes 11 and 12. E. Key management compensation 2015 £m 2014 £m Salaries and short-term beneï¬ts Share-based payments Total 7.5 0.8 8.3 7.3 3.2 10.5 Key management comprises the Board directors only. Further information about the remuneration... -

Page 125

... notes on pages 124 and 125. Marc Bolland Chief Executive Officer Helen Weir Chief Finance Officer OUR PERFORMANCE Total £m COMPANY STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Ordinary share capital £m Share premium account £m Capital redemption reserve £m Merger reserve £m Retained earnings... -

Page 126

... statement or statement of comprehensive income. C2 EMPLOYEES The Company had no employees during the current or prior year. Directors received emoluments in respect of their services to the Company during the year of £960,000 (last year £986,000). The Company did not operate any pension schemes... -

Page 127

125 ANNUAL REPORT AND FINANCIAL STATEMENTS 2015 NOTES TO THE COMPANY FINANCIAL STATEMENTS CONTINUED C6 RELATED PARTY TRANSACTIONS During the year, the Company has received dividends from Marks and Spencer plc of £282.2m (last year £273.6m) and decreased its loan from Marks and Spencer plc by £... -

Page 128

126 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS GROUP FINANCIAL RECORD 2015 52 weeks £m 2014 52 weeks £m 2013 52 weeks £m 2012 52 weeks £m 2011 52 weeks £m Income statement Revenue¹ UK International Operating proï¬t¹ UK International Total operating proï¬t Net interest payable ... -

Page 129

... communication. >Receive trading updates by email. >View all of their shareholdings in one place. >Update their records following a change of address. >Have dividends paid into their bank account. >Vote in advance of company general meetings. To ï¬nd out more information about the services offered... -

Page 130

128 MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: FINANCIAL STATEMENTS SHAREHOLDER INFORMATION CONTINUED CHANGING YOUR ADDRESS You should inform Equiniti of your new address as soon as possible to avoid missing important correspondence relating to your shareholding. If you hold 1,500 shares or ... -

Page 131

... reserve I Income statement Intangible assets Interests in voting rights International International Financial Reporting Standards Inventories Investment property K Key performance indicators M Management Committee Marketplace M&S.com N Nomination Committee Non-underlying items P Plan A Political... -

Page 132