Johnson and Johnson 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C H A I R M A N ’ S L E T T E R

diabetes monitoring devices,

to enter the diabetes treatment

market. Even more important,

this acquisition is an initial

step in LifeScan’s plan to

develop integrated solutions

for total management of a

patient’s disease.

Future Medical Systems,

SA, a company that develops,

manufactures and markets

arthroscopic systems, adds

strength to DePuy’s fast-

growing sports medicine

business with an emphasis on

minimally invasive procedures.

The acquisition of Vascular

Control Systems, Inc. by

Ethicon, Inc. adds momentum to Ethicon’s women’s health

portfolio with the addition of less invasive treatment options

for uterine fibroids and related symptoms.

Two acquisitions add critical mass to our cardiovascular

businesses. Ensure Medical adds complementary post-

catheterization closure technology for the femoral artery,

but just as important, it brings critical mass to Cordis

Corporation’s R&D talent pool with a premier advanced

research and development facility for interventional

cardiology near San Francisco. Conor Medsystems has a

unique controlled drug-delivery technology that will be

explored across a range of therapeutic categories. It

immediately contributes to the development of next-

generation technologies aimed at advancing the standard of

care in treatment of cardiac and vascular diseases.

We believe the impressive number of new product intro-

ductions, the many exciting products in our MD&D pipeline

and the acquisitions we made in 2006—many of which bring us

unique competitive advantages—will enable us to remain the

world’s leader in medical technology and accelerate our growth

in this exciting health care segment.

OUR THANKS Before concluding, I’d like to take a moment to

acknowledge two retiring Board members for their exceptional

contributions to our Company.

First, I wish to recognize Ann Jordan, who will retire

from our Board of Directors in April 2007. Mrs. Jordan was

elected to our Board 26 years ago and has brought her deep

experience in health care and social services to bear in helping

guide our Company, especially in her roles as chairman of the

Nomination & Corporate Governance Committee, member of

the Compensation & Benefits Committee and past chairman

of the Public Policy Advisory Committee.

I also wish to thank our recently retired Vice

Chairman, Board of Directors, and Chief Financial Officer,

Robert J. Darretta, for his 39 years of commitment to

Johnson & Johnson and his steady hand at the financial helm

of this corporation during the past decade. Bob has been

instrumental in helping us deliver consistent sustainable,

superior performance and has been a visible and vocal

proponent of our enduring strategic principles.

OUR COMMITMENT TO YOU As

you read the “stories behind

the stories” of some of our key

2006 business developments

on the following pages, I trust

you’ll see why we believe human

health is such an exceptional

business and why the type of

people attracted to this

business—and specifically

to Johnson & Johnson—are

driven by more than an ordinary

desire to serve and succeed

in business.

We remain highly

optimistic about future

growth prospects for our

business of improving human

health and well-being, based on unprecedented demographic,

geographic and social trends.

As the most broadly based and comprehensive company

in this field—one with a well-balanced portfolio of businesses

in consumer health care, medical devices and diagnostics, and

pharmaceuticals—we will harness the benefits of increasing

demand while continuing to work closely with various

stakeholders throughout the health care system.

Our management philosophy, anchored in the value system

embodied in Our Credo, allows us to deal with the complexities

of balancing short-term and long-term growth.

Based on the outlook for growth in health care and our

confidence in our strategic approach—including the unique

benefits of our broadly based health care businesses—we are

committed to delivering capital-efficient, profitable growth by:

· Participating in the fastest-growing segments of human

health care

· Building and sustaining leadership positions based on

superior science and innovation

· Managing our businesses to achieve superior rates of

return for our shareholders

The real strength of this corporation is and always has been

our people . . . their talent, their drive, their passion and their

aspirations to make a difference in this world. These traits

enable us to bring forward innovations that improve the lives

and well-being of people all over the world. These same traits—

embodied in the character and quality of our people—have also

helped us deliver superior performance to our shareholders

and will continue to be the source of our enduring success in

the future.

William C. Weldon

Chairman, Board of Directors,

and Chief Executive Officer

March 14, 2007

7

Our management

philosophy, anchored in

the value system embodied

in Our Credo, allows us to

deal with the complexities

of balancing short-term

and long-term growth.

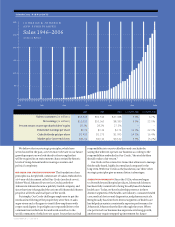

(1)Excludes in-process research and development and the Guidant acquisition agree-

ment termination fee. See Reconciliation of Non-GAAP Financial Measures, page 80.