Johnson and Johnson 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C H A I R M A N ’ S L E T T E R

transformational—outcomes. The long

view also gives us the courage to walk away

from the negotiating table when we believe

the price tag on an acquisition will not

deliver a strong long-term return on the

shareholder’s investment.

Managing for the long term also

entails careful evaluation of the long-term

prospects for each of our businesses.

We regularly evaluate our business and

product portfolios; we make tough decisions

to curtail projects and sometimes divest

entire businesses.

Finally, managing for the long term—

along with our shared value system—has

helped earn us a reputation as a company

that is worthy of trust. Being trusted opens

doors to opportunities and growth. It opens

doors to prospective business partners with

new product ideas and new technologies . . .

doors to research institutions working

on the health advances of tomorrow.

It opens doors to policy makers and

advocacy groups who want to hear our

perspective on improving the health care

system in their countries (see stories on

pages 10 and 22).

Managing our business for the long term

allows us to focus on shaping our future

rather than simply reacting to change.

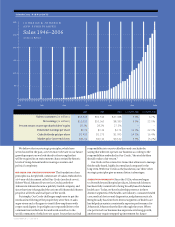

CONSUMER HEALTH CARE HIGHLIGHTS 2006 was

a momentous year for our consumer health

care businesses. The completion of the

acquisition of Pfi zer Consumer Healthcare

(PCH) in December solidifi ed our position

as the world’s premier consumer health care

company, extending our leadership from 13

to 22 consumer health categories. We have

the world’s most diverse consumer health

portfolio of large and sustainable platforms

for growth.

With approximately half of PCH sales

outside the U.S., the acquisition also expands our reach into

attractive high-growth markets. It brings us growing and

enduring brand names that complement our own portfolio

of strong and iconic brands. It broadens our oral health care

business into a signifi cant franchise with more than $1 billion

in sales. Further, it transforms our over-the-counter (OTC)

business, nearly doubling its size and solidifying our position

as the worldwide leader in non-prescription medicines.

The acquisition substantially diversifi es our OTC portfolio

and provides entry into high-potential categories such as

smoking cessation.

Strategically, this acquisition is vitally important, as the

market for consumer health care products becomes

increasingly attractive. Several demographic and social

shifts favor increased demand for consumer health products.

Consumers are taking greater interest in and responsibility

for their own health and well-being. Throughout the world,

they are turning to OTC medicines and other non-prescription

solutions to meet their health needs. Higher levels of dispos-

able income in developing nations are creating increased

demand for consumer health products in regions with

large populations.

Over and above the PCH acquisition, it was another good

year for our consumer health care businesses, which reached

nearly $10 billion in sales. In total, our consumer health

businesses introduced more than 400 new products and

signifi cant line extensions, helping to drive total sales growth

of 7.5 percent (see 2006 Year in Review: Consumer Health Care

on pages 24–25).

We believe the PCH acquisition, along with our access to

scientifi c knowledge and technologies fl owing from our

pharmaceuticals and medical devices and diagnostics

5

Founded on Shared Values The foundation of our strategic principles is a

deeply held, common set of values embodied in a 64-year-old document

called Our Credo. (See page 3.)

Broadly Based in Human Health Being broadly based in three diverse

segments of health care has helped us sustain a consistent superior

performance for Johnson & Johnson shareholders through the years.

Even more important, our breadth offers four key advantages that enable

us to elevate our performance. (See page 3.)

Decentralized Approach The decentralized manner in which we operate

our businesses marries the best qualities of smaller companies with the

resources, know-how and investment capital of a Fortune 50 company.

(See page 4.)

Managed for the Long Term Managing our business for the long term

keeps us focused on the underlying performance of our business. While

conscious of ongoing performance in all time frames, we focus on keeping

our businesses healthy for the long term. (See page 4.)

OUR FOUR STRATEGIC PRINCIPLES

Broadly Based

in

Human Health

Managed

for the

Long Term

Founded on Shared Values

Decentralized

Approach