Johnson and Johnson 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J O H N S O N & J O H N S O N 2 0 0 6 A N N U A L R E P O R T

growth. A downturn in economic conditions in one health

care segment may be offset by growth in another segment.

Even more important, our breadth offers four key

advantages that enable us to elevate our performance.

First, because of our closeness to customers—our strong

partnerships with scientists and professionals across so many

fields within human health and across so many geographies

—we can identify and rapidly capitalize on the most attractive

business opportunities emerging in human health. When

we spot an emerging opportunity, our breadth enables us to

quickly deploy the necessary resources to develop it.

Second, breadth allows for strategic transfer of knowledge,

new technology, talent and capabilities internally across

business platforms and across business segments. Several

examples of strategic transfer of knowledge across business

platforms and business segments are highlighted in the

following pages in the stories about the people behind some of

the innovative products introduced in 2006.

Third, our breadth also gives us a clear advantage in

converging technologies. Increasingly, breakthrough innova-

tions in new or adjacent markets are enabled by careful

integration of multiple technologies. Our people are accus-

tomed to working within and across our business segments to

incorporate technological breakthroughs that achieve impor-

tant innovations for customers. It’s like having access to the

know-how, proprietary information and technology resources

of many companies, but all within our own corporation.

Finally, our breadth also allows us to leverage scale in

an increasingly competitive global environment. Through

efficient application and deployment of resources around the

globe, we’ve been able to optimize our cost infrastructure,

particularly in areas such as manufacturing, finance,

procurement and information technology.

STRENGTH IN A DECENTRALIZED APPROACH The decentralized

manner in which we operate our businesses marries the best

qualities of smaller companies—an entrepreneurial drive for

growth and close proximity to customers—with the resources,

know-how and investment capital of a Fortune 50 company.

This strategic approach gives us many advantages over a

centralized operation. One is a strong sense of ownership,

entrepreneurship, agility and accountability seldom seen

in large multinational corporations. The leadership and

employees of our 250 operating companies around the world

are intensely competitive. We look to the leaders of our decen-

tralized businesses to grow their businesses faster than their

competitors. They are driven to innovate . . . to bring greater

value to the marketplace through internal discoveries, applica-

tion of new science, technology, in-licensing and acquisition.

We believe our decentralized approach to running the

business yields better decisions—in the long run—for patients,

health professionals and other customers, because the

decision-makers are close to their customers and are in a

better position to understand their needs.

Finally, our decentralized approach to managing the

business is a tremendous magnet for talent, because it gives

people room to grow and room to explore new ideas, thus

developing their own skills and careers.

STRENGTH IN A FOCUS ON THE LONG TERM We manage our business

as a marathon, rather than a sprint. This too is a source of

enduring financial strength.

Managing our business for the long term keeps us focused

on the underlying performance of our business. While conscious

of ongoing performance in all time frames, we focus on keeping

our businesses healthy for the long term.

This forces us to anticipate and capitalize on change, to

look at the future of our businesses through many different

lenses—through the eyes of new customers, new markets,

new technologies and new fiscal realities. A desire to capitalize

on changes in the global health care environment that favor

consumer-driven health care was part of our rationale for

acquiring Pfizer Consumer Healthcare.

Managing our business for the long term leads us to

intensify investments as needed to maintain our leadership

positions in key growth markets.

A long-term view enables us to take prudent risks on

innovative ideas and completely new ways of doing things

—new and better products and alternative therapeutic

approaches, novel technologies, new and better manufacturing

processes. Some of these long-term investments—such as our

investment in Veridex’s fledgling cellular- and molecular-level

diagnostics platform—have the power to potentially transform

the practice of medicine (see page 14), just as our initial

investment in Ethicon Endo-Surgery, Inc. over 15 years ago

led a revolution in minimally invasive surgery.

Managing for the long term enables us to make smarter

acquisitions that deliver long-term shareholder value. We are

willing to take on important, challenging work, often requiring

sustained efforts, in order to achieve significant—and possibly

4

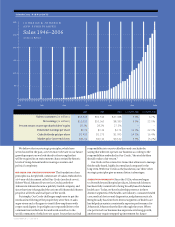

2 0 0 6 S A L E S B Y S EG M E N T

(in billions of dollars)

R E S E A R C H E X P E N SE

(in millions of dollars)

S H A R E H O L D E R RET U R N

(%)

S&P 500 Index

S&P Pharmaceutical Index

S&P Health Care Equip Index

Johnson & Johnson

8.4 7.8

11.7 12.0

10-YEAR COMPOUND ANNUAL GROWTH RATE

Medical Devices

& Diagnostics

$20.3

38%

Pharmaceutical

$23.2

44%

Consumer

$9.8

18%

$ 5 3 . 3 T OTA L

$5,344

2004

$7,125

2006

$6,462

2005