JP Morgan Chase 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Here are some specific risk issues:

Challenges in the credit world

We continuously analyze and measure our risk. In fact,

during budget planning, we ask our management teams

to prepare – on all levels – for difficult operating envi-

ronments. While the risk comes in many forms, such as

recession, market turmoil and geopolitical turbulence,

one of our largest risks is still the credit cycle. Credit

losses, both consumer and wholesale, have been extreme-

ly low, perhaps among the best we’ll see in our lifetimes.

We must be prepared for a return to the norm in the

credit cycle.

The chart below shows a rough estimate of what could

happen to credit costs over the business cycle – provided

we do a good and disciplined job underwriting credit.

In a tougher credit environment, credit losses could rise

significantly, by as much as $5 billion over time, which

may require increases in loan loss reserves. Investment

Bank revenue could drop, and the yield curve could

sharply invert. This could have a significant negative

effect on JPMorgan Chase’s earnings. That said, these

events generally do not occur simultaneously, and there

would be normal mitigating factors for our earnings

(e.g., compensation pools likely would go down, some

customer fees and spreads would probably go up, and

funding costs could decrease).

It’s important to share these numbers with you, not to

worry you, but to be as transparent as possible about the

potential impact of these negative scenarios and to let you

know how we are preparing for them. We do not know

exactly what will occur or when, but we do know that bad

things happen. There is no question that our company’s

earnings could go down substantially. But if we are pre-

pared, we can both minimize the damage to our company

and capitalize on opportunities in the marketplace.

Subprime mortgages: the good, the bad and possibly

the ugly

THE GOOD

We did a lot of things right:

• We did not originate option ARMs or other negative

amortization loans.

• We applied the same underwriting standards to all

of our subprime loans, whether originated by us or

purchased from third parties.

• We sold substantially all of our 2006 subprime origina-

tions. (We underwrite all of our subprime loans to be

held; in fact, we prefer to hold and service these mort-

gages, but prices at the time of sale were too good to

pass up.)

• We were very careful in certain parts of the United

States and were especially careful to seek accurate

property appraisals.

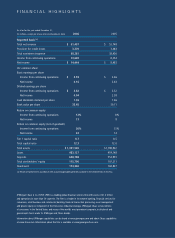

Annual potential net charge-off rates by business

ACTUAL ESTIMATED

2006 THROUGH CYCLE

Investment Bank (0.05%) 1.00%

Commercial Banking 0.05% 0.50%

Card Services 3.33% 5.00%

Retail Financial Services

Home Equity 0.18% 0.30%

Home Lending 0.12% 0.42%

Prime Mortgage

0.04% 0.08%

Subprime Mortgage

0.31% 1.00%

Auto Finance 0.56% 0.75%

Business Banking 0.69% 1.30%