JP Morgan Chase 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

credit better, i.e., offer more competitive pricing based

upon our proprietary knowledge of the customer. We’re

working on many other similar initiatives where our

knowledge of the customer pre-emptively positions us in

businesses such as home equity, mortgage, auto, credit

card, retail branches and small business.

Coordinate outreach to specific groups

There are many different subsets of customers we serve

who would appreciate and benefit from a coordinated

approach to their specific needs.

One clear example involves universities. Surprisingly,

we had not coordinated our outreach to this lucrative

market. Retail opened student checking accounts;

Education Finance made student loans; Card Services

issued credit cards to students and alumni; Commercial

Banking financed schools and serviced cash management

needs; and our Asset Management group managed univer-

sity funds. We’re fixing this by working on a synchronized

effort where a specialized sales team can offer a fully coor-

dinated package more effectively and more efficiently.

Expanding to serve consumers outside the United States

International consumer expansion is not without risk.

So one of our first objectives has been to add senior

individuals to our talent pool who are knowledgeable

and experienced in the international consumer area. In

addition, we are now analyzing and developing country-

specific strategies so that we can focus our efforts on the

most important opportunities. We are fortunate to have

developed strong relationships and partnerships over the

years, so we have people and companies we trust and can

rely upon for advice and access to investment opportuni-

ties around the world.

There are some essential principles supporting this effort

that we want our shareholders to understand.

• Because restrictions on acquisitions – and other laws

and regulations – differ by country, our approach must

differ by country. In some areas, we may acquire

partial interests or controlling stakes in companies,

while in others we may start de novo.

• We will not stretch excessively to make investments.

We believe that in many parts of the world, it is not

necessary to feel desperate, as if the opportunities will

exist only for a fleeting moment. We believe that as

JPMorgan Chase grows and strengthens, its opportuni-

ties will increase. We also believe that in five to 10 years,

as some countries develop and change, new and exciting

opportunities will emerge. For example, to the extent

that we would consider a merger or acquisition in

Europe, there are likely to be many more pan-European

banks to choose from in the future. In China or India,

we might be allowed to buy a controlling interest in a

bank. The set of options available to my successor will

be dramatically different from and possibly superior

to the current set of options. With that in mind, the

best thing I can do for her or him is pass on a strong

JPMorgan Chase.

Managing critical risks

The first half of this letter mentions that we were fairly

pleased with how we managed risk in 2006. But manag-

ing risk is a constant challenge.We never stop worrying

about it. Before discussing some specific risk issues, we

believe you should be able to take some comfort from

these key facts:

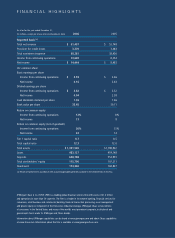

• Our profit margins have increased substantially, creat-

ing our best cushion for risk.

• Our balance sheet is strong and getting stronger.

Tier I Capital at the end of 2006 was 8.7%, and even

with stock buybacks, it should stay strong because of

our improving capital generation.

• Our loan loss reserves are strong, at 1.7% for both

consumer and wholesale at the end of 2006.