JP Morgan Chase 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006

ANNUAL REPORT

JPMORGAN CHASE & CO.

Table of contents

-

Page 1

J P M O R G A N C H A S E & C O. ANNUAL REPORT 2006 -

Page 2

... operations Net income Cash dividends declared per share Book value per share Return on common equity Income from continuing operations Net income Return on common equity (net of goodwill) Income from continuing operations Net income Tier 1 capital ratio Total capital ratio Total assets Loans... -

Page 3

... by line of business(a) (in millions) Retail Financial Services $3,213 Card Services $3,206 24% 24% 7% Investment Bank $3,674 Commercial Banking $1,010 27% 10% 8% Treasury & Securities Services $1,090 Asset Management $1,409 Net revenue from continuing operations (in billions) Income from... -

Page 4

... from continuing operations, up significantly from the year before; we grew our major businesses - and the growth was high quality; and we positioned ourselves extremely well for 2007 and beyond. In this letter, I will review and assess our 2006 performance and describe key initiatives and issues we... -

Page 5

... of dollars to revenue and create happier clients. Growing credit card sales through retail branches In 2006, we opened more than one million credit card accounts through our retail branches, up 74% over 2005. Retail and Card Services teams drove this progress by working together and analyzing... -

Page 6

... the swap of our Corporate Trust business for 339 Bank of New York retail branches and the bank's commercial banking business. We also did smaller deals to supplement our student loan, hedge fund processing, asset management, trading and credit card businesses. • These investments are not confined... -

Page 7

... to protect our company from major rate changes. • We materially improved the quality, consistency and level of our trading results - a major focus in 2006. And we specifically mean results versus trading volatility. We want to earn a better average return on capital with growing revenue. We will... -

Page 8

... reporting and reviews, particularly of large risk positions; c) increasing focus and accountability on specific trading risk; and d) more actively managing overall exposures. • We clearly can do better on Mortgage Servicing Rights (MSRs) than we did in 2006. MSRs are the present value of net... -

Page 9

... Credit card marketing: Last year we did a good job reducing our costs of attracting, opening and servicing new credit card accounts. But to maximize opportunities, we need to become better at matching products to customers; differentiating between the profitability of Now that our merger work and... -

Page 10

... and even equity investing. We already had the clients. They just were going elsewhere for these products. • Private Bank: We're making it easier for qualified individuals to do business with us, beginning with how they open new Private Bank accounts. In the past, they had to review at least... -

Page 11

... to this lucrative market. Retail opened student checking accounts; Education Finance made student loans; Card Services issued credit cards to students and alumni; Commercial Banking financed schools and serviced cash management needs; and our Asset Management group managed university funds. We're... -

Page 12

... the damage to our company and capitalize on opportunities in the marketplace. Annual potential net charge-off rates by business ACTUAL 2006 ESTIMATED THROUGH CYCLE Investment Bank Commercial Banking Card Services Retail Financial Services Home Equity Home Lending (0.05%) 0.05% 3.33% 1.00... -

Page 13

..., our renewable energy portfolio has invested in 26 wind farms, now totaling approximately $1 billion. • We published a series of corporate research reports concerning business and environmental linkages, including legal and regulatory risks related to climate change, and issues and opportunities... -

Page 14

... year, we are launching our "Community Renaissance Initiative" in eight key U.S. markets, dedicating a large percentage of our philanthropic funding, energy and expertise to substantially strengthen high-need neighborhoods. III. A FEW CLOSING COMMENTS Corporate governance: Board of Directors We... -

Page 15

...financial planning services. • We believe pay should relate to building a company with sustained good performance. There is no magic in a single quarter or year, and we try to recognize when a friendly market, rather than excellent performance, lifts results. • We provide senior managers limited... -

Page 16

... institutional investors. We offer our clients a full range of investment banking products and services in all major capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, sophisticated risk management, marketmaking in cash securities and... -

Page 17

... double-digit growth in branch sales of mortgages, investments and credit cards. Invest in 125 to 150 additional branch locations annually, using disciplined and analytical approach to select markets and sites within markets. Convert The Bank of New York branches to the Chase technology platform... -

Page 18

... our employees, advertising and innovative products and services. Drive superior long-term growth in profits, customers, managed loans and sales by building customer value and reducing operating cost per account through investments in marketing and technology initiatives. Expand the markets we... -

Page 19

... positions us to deliver extensive product capabilities - including lending, treasury services, investment banking and asset management - to meet our clients' U.S. and international financial needs. 2 0 0 7 A N D B E YO N D #1 commercial bank in market penetration in Chase's retail branch... -

Page 20

...the Year (The Banker ) and #1 Global Liquidity Capabilities (Euromoney ). MAJOR 2006 ACCOMPLISHMENTS Completed the purchase of the middle- and back-office operations of Paloma Partners Management Company, an investment funds management group, and closed the sale of select corporate trust businesses... -

Page 21

... the world. We offer global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity, including both money market instruments and bank deposits. We also provide trust and estate and banking services to high-net-worth clients, and retirement services for... -

Page 22

... commitment by any bank focused on mortgages, small-business lending and community development. In 2006, we committed $87 billion, with total investment to date of $241 billion in the third year of the program. Played a leadership role in the creation of The New York Acquisition Fund, along with 15... -

Page 23

... 55 Balance sheet analysis 57 Capital management 59 Off-balance sheet arrangements and contractual cash obligations 61 Risk management 62 Liquidity risk management 64 Credit risk management 77 Market risk management 81 Private equity risk management 81 Operational risk management 82 Reputation... -

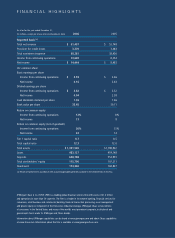

Page 24

... Cash dividends declared per share Book value per share Common shares outstanding Average: Basic Diluted Common shares at period-end Share price(b) High Low Close Market capitalization Selected ratios Return on common equity ("ROE"): Income from continuing operations Net income Return on assets... -

Page 25

... and institutional investors. The Firm offers a full range of investment banking products and services in all major capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, sophisticated risk management, market-making in cash securities and... -

Page 26

... the world. AM offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity, including both money market instruments and bank deposits. AM also provides trust and estate and banking services to high-net-worth clients, and retirement services... -

Page 27

... private-label credit card portfolio; acquiring the middle and back office operations of Paloma Partners to expand the Firm's hedge fund administration capabilities; and announcing a strategic alliance with Fidelity Brokerage to provide new issue equity and fixed income products. In 2006, the global... -

Page 28

... year. Revenue benefited from investments in key business initiatives, increased market share and higher global capital markets activity. Record investment banking fees were driven by record debt and equity underwriting fees and strong advisory fees. Fixed income markets revenue set a new record... -

Page 29

...' equity of $115.8 billion, and a Tier 1 capital ratio of 8.7%. The Firm purchased $3.9 billion, or 91 million shares of common stock during the year. Card Services anticipates growth in managed receivables and sales volume, both of which are expected to benefit from marketing initiatives and new... -

Page 30

...$ 42,372 Investment banking fees $ 5,520 Principal transactions 10,346 Lending & deposit related fees 3,468 Asset management, administration and commissions 11,725 Securities gains (losses) (543) Mortgage fees and related income 591 Credit card income 6,913 Other income 2,175 Noninterest revenue Net... -

Page 31

...Also contributing to the higher level of revenue was an increase in Assets under management, reflecting net asset inflows in equity-related products and global equity market appreciation. In addition, Assets under custody were up due to market value appreciation and new business. Commissions rose as... -

Page 32

... to ongoing investments in the retail distribution network, which included the incremental expense from The Bank of New York branches, partially offset by merger-related savings and other operating efficiencies. The slight increase in Technology, communications and equipment expense for 2006 was due... -

Page 33

... with The Bank of New York on October 1, 2006, the results of operations of the selected corporate trust businesses (i.e., trustee, paying agent, loan agency and document management services) were reported as discontinued operations. The Firm's Income from discontinued operations (after-tax) were as... -

Page 34

... share and ratio data) Revenue Investment banking fees $ Principal transactions Lending & deposit related fees Asset management, administration and commissions Securities gains (losses) Mortgage fees and related income Credit card income Other income Noninterest revenue Net interest income Total net... -

Page 35

... managed assets(b) (including average securitized credit card receivables) Overhead ratio Total noninterest expense / Total net revenue * Represents Net income applicable to common stock (a) The Firm uses Return on common equity less goodwill, a non-GAAP financial measure, to evaluate the operating... -

Page 36

... Market-Making and Trading: - Fixed income - Equities • Corporate Lending • Principal Investing Card Services Businesses: • Credit Card • Merchant Acquiring Commercial Banking Businesses: • Middle Market Banking • Mid-Corporate Banking • Real Estate Banking • Chase Business Credit... -

Page 37

...33,972 Year ended December 31, (in millions, except ratios) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset Management Corporate(b) Total (a) Represents reported results on a tax-equivalent basis and excludes the impact of credit card... -

Page 38

... and institutional investors. The Firm offers a full range of investment banking products and services in all major capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, sophisticated risk management, market-making in cash securities and... -

Page 39

... in Global Equity & Equity-related transactions. The Firm improved its position in Global Long-term Debt to #3 from #4. According to Dealogic, the Firm was ranked #1 in Investment Banking fees generated during 2006, based upon revenue. Selected average balances Total assets $ 647,569 Trading assets... -

Page 40

...in deposit-related and branch production fees, higher automobile operating lease revenue and The Bank of New York transaction. This benefit was offset by lower net mortgage servicing revenue, the sale of the insurance business and losses related to loans transferred to held-for-sale. In 2006, losses... -

Page 41

...billion of mortgage loans transferred to held-for-sale. Results benefited from The Bank of New York transaction; the acquisition of Collegiate Funding Services; growth in deposits and home equity loans; and increases in deposit-related fees and credit card sales. These benefits were offset partially... -

Page 42

... six months heritage JPMorgan Chase results. Retail branch business metrics Year ended December 31, (in millions, except where otherwise noted) Investment sales volume Number of: Branches ATMs Personal bankers(a) Sales specialists(a) Active online customers (in thousands)(b) Checking accounts (in... -

Page 43

Mortgage Banking Selected income statement data Year ended December 31, (in millions, except ratios and where otherwise noted) Production revenue Net mortgage servicing revenue: Servicing revenue Changes in MSR asset fair value: Due to inputs or assumptions in model Other changes in fair value ... -

Page 44

... and lease related assets Average loans and lease related assets Loans outstanding(a) Lease financing receivables Operating lease assets Total average loans and lease related assets Average assets Average equity Credit quality statistics 30+ day delinquency rate Net charge-offs Loans Lease financing... -

Page 45

.... Net interest income benefited from an increase in average managed loan balances and lower revenue reversals associated with lower charge-offs. These increases were offset by attrition of mature, higher spread balances as a result of higher payment rates and higher cost of funds on balance growth... -

Page 46

... purchases, balance transfers and cash advance activity. • Net accounts opened - Includes originations, purchases and sales. • Merchant acquiring business - Represents an entity that processes payments for merchants. JPMorgan Chase is a partner in Chase Paymentech Solutions, LLC. - Bank card... -

Page 47

... for credit losses(b) Balance sheet - average balances(a) Total average assets Reported data for the period Securitization adjustments Managed average assets Credit quality statistics(a) Net charge-offs Reported net charge-offs data for the period Securitization adjustments Managed net charge-offs... -

Page 48

... product capabilities - including lending, treasury services, investment banking and asset management - to meet its clients' U.S. and international financial needs. On October 1, 2006, JPMorgan Chase completed the acquisition of The Bank of New York's consumer, business banking and middle-market... -

Page 49

... • Equity underwriting • Loan syndications • Investment-grade debt • Asset-backed securities • Private placements • High-yield bonds • Derivatives • Foreign exchange hedges • Securities sales Selected metrics Year ended December 31, (in millions, except headcount and ratios) 2006... -

Page 50

...TSS, the Merger and the acquisition of Vastera. Leading the product revenue growth was an increase in assets under custody to $10.7 trillion, primarily driven by market value appreciation and new business, along with growth in wholesale card, securities lending, foreign exchange, trade, clearing and... -

Page 51

... Treasury & Securities Services firmwide liability balances(f) 262,678 220,781 163,169 (a) International electronic funds transfer includes non-US$ ACH and clearing volume. (b) Wholesale cards issued include domestic commercial card, stored value card, prepaid card, and government electronic benefit... -

Page 52

...major market throughout the world. AM offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity, including both moneymarket instruments and bank deposits. AM also provides trust and estate and banking services to high-net-worth clients, and... -

Page 53

... and families worldwide, including investment management, capital markets and risk management, tax and estate planning, banking, capital raising and specialty-wealth advisory services. Private Client Services offers high-net-worth individuals, families and business owners in the United States... -

Page 54

... Private Bank Private Client Services Total Assets under supervision Assets by geographic region U.S./Canada International Total Assets under management U.S./Canada International Total Assets under supervision Mutual fund assets by asset class Liquidity Fixed income Equities Total mutual fund assets... -

Page 55

... managed. Private Equity includes the JPMorgan Partners and ONE Equity Partners businesses. Treasury manages the structural interest rate risk and investment portfolio for the Firm. The corporate staff units include Central Technology and Operations, Internal Audit, Executive Office, Finance... -

Page 56

...net revenue Net income (loss) Private equity Treasury Corporate other(a)(b)(c) Merger costs 2006 2005 2004(e) $ 1,211 81 (523) $ 769 Selected income statement and balance sheet data Year ended December 31, (in millions) Treasury Securities gains (losses)(a) Investment portfolio (average) Investment... -

Page 57

... manage the Firm's cash positions, risk-based capital requirements, and to maximize liquidity access and minimize funding costs. In 2006, Federal funds sold increased in connection with higher levels of funds that were available for short-term investments. JPMorgan Chase & Co. / 2006 Annual Report... -

Page 58

...of selected corporate trust businesses to The Bank of New York; purchase accounting adjustments associated with the 2005 fourth-quarter acquisition of the Sears Canada credit card business; the 2006 second quarter sale of the insurance business; and a reduction related to reclassifying net assets of... -

Page 59

... 83-85 and 121-123, respectively, of this Annual Report. Line of business equity (in billions) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset Management Corporate(a) Total common stockholders' equity Yearly Average 2006 $ 20.8 14.6 14... -

Page 60

... fund investments and commitments in the Private Equity portfolio to cover the potential loss associated with a decline in equity markets and related asset devaluations. The following tables show that JPMorgan Chase maintained a well-capitalized position based upon Tier1and Total capital ratios... -

Page 61

... investment products for clients. These arrangements are an important part of the financial markets, providing market liquidity by facilitating investors' access to specific portfolios of assets and risks. For example, SPEs are integral to the markets for mortgage-backed securities, commercial paper... -

Page 62

..., at the option of the Firm. For further discussion of lending-related commitments and guarantees and the Firm's accounting for them, see Credit risk management on pages 64-76 and Note 29 on pages 132-134 of this Annual Report. Contractual cash obligations In the normal course of business, the Firm... -

Page 63

... Chase for its own investment account, that fall outside the scope of the Firm's private equity and other principal finance activities. Operating Committee Asset-Liability Committee Investment Committee Treasury and Chief Investment Office (Liquidity Risk and Nontrading Interest Rate and Foreign... -

Page 64

... Report. Additional sources of funds include a variety of both short- and long-term instruments, including federal funds purchased, commercial paper, bank notes, long-term debt, and trust preferred capital debt securities. This funding is managed centrally, using regional expertise and local market... -

Page 65

... rates. For the year ended December 31, 2005, net cash of $12.9 billion was used in investing activities, primarily attributable to growth in consumer loans, primarily home equity and in CS, reflecting growth in new account originations and the acquisition of the Sears Canada credit card business... -

Page 66

... portfolio reporting of industry, customer and geographic concentrations occurs monthly, and the appropriateness of the allowance for credit losses is reviewed by senior management at least on a quarterly basis. Through the risk reporting and governance structure, credit risk trends and limit... -

Page 67

... NA NA NA NA Total credit portfolio As of or for the year ended December 31, (in millions, except ratios) Total credit portfolio Loans - reported(a) Loans - securitized(b) Total managed loans(c) Derivative receivables Interests in purchased receivables(d) Total managed credit-related assets Lending... -

Page 68

... activity, including financings associated with client acquisitions, securitizations and loan syndications. Wholesale As of or for the year ended December 31, (in millions) Loans - reported(a) Derivative receivables Interests in purchased receivables Total wholesale credit-related assets Lending... -

Page 69

...internal risk ratings and is presented on an S&P-equivalent basis. Wholesale exposure December 31, 2006 (in billions, except ratios) Loans Derivative receivables Interests in purchased receivables(a) Lending-related commitments(a) Total excluding HFS Loans held-for-sale(b) Total exposure Net credit... -

Page 70

...2006 and 2005. Wholesale credit exposure - selected industry concentration Noninvestment-grade December 31, 2006 (in millions, except ratios) Top 10 industries(a) Banks and finance companies Real estate Healthcare State and municipal governments Consumer products Utilities Asset managers Securities... -

Page 71

... in this category is rated investment-grade. Real estate: This industry, as the second largest segment of the Firm's wholesale credit portfolio, continued to grow in 2006, primarily due to improving market fundamentals and increased capital demand for the asset class supported by the relatively low... -

Page 72

... receivables marked to market ("MTM") Notional amounts(b) December 31, (in billions) Interest rate Foreign exchange Equity Credit derivatives Commodity Total, net of cash collateral(a) Liquid securities collateral held against derivative receivables Total, net of all collateral 2006 $ 50,201 2,520... -

Page 73

... for structured portfolio protection; the Firm retains the first risk of loss on this portfolio. In managing wholesale credit exposure, the Firm purchases single-name and portfolio credit derivatives; this activity does not reduce the reported level of assets on the balance sheet or the level of... -

Page 74

...basis. Loan interest and fees are generally recognized in Net interest income, and impairment is recognized in the Provision for credit losses. This asymmetry in accounting treatment, between loans and lending-related commitments and the credit derivatives utilized in portfolio management activities... -

Page 75

...refinement of pricing and risk management models. The following table presents managed consumer credit-related information for the dates indicated: Consumer portfolio As of or for the year ended December 31, (in millions, except ratios) Retail Financial Services Home equity Mortgage Auto loans and... -

Page 76

... through securitization. Managed credit card receivables were $152.8 billion at December 31, 2006, an increase of $10.6 billion from year-end 2005, reflecting organic growth and acquisitions, partially offset by higher customer payment rates. The managed credit card net charge-off rate decreased to... -

Page 77

... Financial Officer and the Controller of the Firm, and discussed with the Risk Policy and Audit Committees of the Board of Directors of the Firm. The allowance is reviewed relative to the risk profile of the Firm's credit portfolio and current economic conditions and is adjusted if, in management... -

Page 78

... bankruptcy-related charge-offs. At December 31, 2006, securitized credit card outstandings were $3.6 billion lower compared with the prior year end. Year ended December 31, (in millions) Investment Bank Commercial Banking Treasury & Securities Services Asset Management Corporate Total Wholesale... -

Page 79

...and securities and derivatives used to manage the Firm's asset/liability exposures. Unrealized gains and losses in these positions are generally not reported in Principal transactions revenue. Trading risk Fixed income risk (which includes interest rate risk and credit spread risk), foreign exchange... -

Page 80

... value of Principal transactions revenue less Private Equity gains/losses plus any trading-related net interest income, brokerage commissions, underwriting fees or other revenue. The following histogram illustrates the daily market risk-related gains and losses for IB trading businesses for the year... -

Page 81

...Earnings-at-risk tests measure the potential change in the Firm's Net interest income over the next 12 months and highlight exposures to various rate-sensitive factors, such as the rates themselves (e.g., the prime lending rate), pricing strategies on deposits, optionality and changes in product mix... -

Page 82

... product liquidity, business trends and management experience. Market risk management regularly reviews and updates risk limits. Senior management, including the Firm's Chief Executive Officer and Chief Risk Officer, is responsible for reviewing and approving risk limits at least once a year. Market... -

Page 83

..., monitoring, reporting and analysis, the Firm categorizes operational risk events as follows Client service and selection Business practices Fraud, theft and malice Execution, delivery and process management Employee disputes Disasters and public safety Technology and infrastructure failures Risk... -

Page 84

.... The members of these committees are senior representatives of the business and support units in the region. The committees may escalate transaction review to the Policy Review Office. Fiduciary risk management The risk management committees within each line of business include in their mandate the... -

Page 85

.... Fair value of financial instruments, MSRs and commodities inventory A portion of JPMorgan Chase's assets and liabilities are carried at fair value, including trading assets and liabilities, AFS securities, private equity investments and mortgage servicing rights ("MSRs"). Held-for-sale loans and... -

Page 86

... and loans with similar characteristics. If market prices are not available, fair value is based upon the estimated cash flows adjusted for credit risk that is discounted using an interest rate appropriate for the maturity of the applicable loans. 84 JPMorgan Chase & Co. / 2006 Annual Report -

Page 87

...In addition, analysis using market-based trading and transaction multiples, where available, are used to assess the reasonableness of the valuations derived from the discounted cash flow models. ACCOUNTING AND REPORTING DEVELOPMENTS Accounting for share-based payments Effective January 1, 2006, the... -

Page 88

... plan assets or benefit obligations, or on how the Firm determines its net periodic benefit costs. For additional information related to SFAS 158, see Note 7 on pages 100-105 of this Annual Report. Accounting for uncertainty in income taxes and changes in timing of cash flows related to income taxes... -

Page 89

...contracts are primarily energy-related contracts. The following table summarizes the changes in fair value for nonexchange-traded commodity derivative contracts for the year ended December 31, 2006: For the year ended December 31, 2006 (in millions) Net fair value of contracts outstanding at January... -

Page 90

... public accounting firm, who also audited the Firm's financial statements as of and for the year ended December 31, 2006, as stated in their report which is included herein. James Dimon Chairman and Chief Executive Officer Michael J. Cavanagh Executive Vice President and Chief Financial Officer... -

Page 91

... on management's assessment and on the effectiveness of the Company's internal control over financial reporting based on our audit. We conducted our audit of internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States... -

Page 92

... Chase & Co. Year ended December 31, (in millions, except per share data) Revenue Investment banking fees Principal transactions Lending & deposit related fees Asset management, administration and commissions Securities gains (losses) Mortgage fees and related income Credit card income Other income... -

Page 93

..., except share data) Assets Cash and due from banks Deposits with banks Federal funds sold and securities purchased under resale agreements Securities borrowed Trading assets (including assets pledged of $82,474 at December 31, 2006, and $79,657 at December 31, 2005) Securities: Available-for-sale... -

Page 94

... stock for purchase accounting acquisitions Balance at end of year Capital surplus Balance at beginning of year Issuance of common stock and options for purchase accounting acquisitions Shares issued and commitments to issue common stock for employee stock-based compensation awards and related tax... -

Page 95

... benefit Investment securities (gains) losses Private equity unrealized (gains) losses Gains on disposition of businesses Stock based compensation Originations and purchases of loans held-for-sale Proceeds from sales and securitizations of loans held-for-sale Net change in: Trading assets Securities... -

Page 96

... VIEs are reflected on JPMorgan Chase's Consolidated balance sheets or in the Notes to consolidated financial statements. For a discussion of the accounting for private equity investments, see Note 4 on pages 98-99 of this Annual Report. Assets held for clients in an agency or fiduciary capacity by... -

Page 97

... policy can be found: Business changes and developments Principal transactions activities Other noninterest revenue Pension and other postretirement employee benefit plans Employee stock-based incentives Noninterest expense Securities Securities financing activities Loans Allowance for credit losses... -

Page 98

... Retail Financial Services distribution network in the New York Tri-state area. The Bank of New York businesses acquired were valued at a premium of $2.3 billion; the Firm's corporate trust businesses that were transferred (i.e., trustee, paying agent, loan agency and document management services... -

Page 99

...fund manager Highbridge Capital Management, LLC ("Highbridge"). Note 3 - Discontinued operations The transfer of selected corporate trust businesses to The Bank of New York (see Note 2 above) includes the trustee, paying agent, loan agency and document management services businesses. JPMorgan Chase... -

Page 100

... paper Debt securities issued by non-U.S. governments Corporate securities and other Total debt and equity instruments Derivative receivables:(a)(b) Interest rate Foreign exchange Equity Credit derivatives Commodity Total derivative receivables Total trading assets 2006 2005 Average Trading assets... -

Page 101

... mortgage-related risk management activities are not included in Mortgage fees and related income. For a further discussion of MSRs, see Note 16 on pages 121-122 of this Annual Report. Interest income Loans $ 33,121 Securities 4,147 Trading assets 10,942 Federal funds sold and securities purchased... -

Page 102

...plans is The JPMorgan Chase 401(k) Savings Plan (the "401(k) Savings Plan"), which covers substantially all U.S. employees. The 401(k) Savings Plan allows employees to make pretax contributions to tax-deferred investment portfolios. The JPMorgan Chase Common Stock Fund, which is an investment option... -

Page 103

...of plan assets, end of year Funded (unfunded) status Unrecognized amounts: Net actuarial loss Prior service cost (credit) Net amount recognized in the Consolidated balance sheets(b) Accumulated benefit obligation, end of year (a) (b) (c) (d) (e) (f) (g) U.S. 2006 $ (8,054) - (281) (452) - - NA (200... -

Page 104

..., before tax, in 2007 are as follows: Defined benefit pension plans Year ended December 31, 2007 (in millions) U.S. $ $ - 5 5 $ Non-U.S. $ 52 - 52 $ $ U.S. 34 (16) 18 OPEB plans Non-U.S. $ - - $ - Net actuarial loss Prior service cost (credit) Total 102 JPMorgan Chase & Co. / 2006 Annual Report -

Page 105

... government bonds and AA-rated long-term corporate bonds, plus an equity risk premium above the risk-free rate. In 2006 and 2005, the discount rate used in determining the benefit obligation under the U.S. defined benefit pension and OPEB plans was selected by reference to the yield on a portfolio... -

Page 106

...U.S. large and small capitalization and international equities), fixed income (including corporate and government bonds), Treasury inflation-indexed and high-yield securities, real estate, cash equivalents, and alternative investments. Non-U.S. defined benefit pension plan assets are held in various... -

Page 107

... stock units ("RSUs"), stock options, and stock-settled SARs to certain of its employees. In 2006, JPMorgan Chase granted long-term stock-based awards under the 2005 Long-Term Incentive Plan (the "2005 Plan"). In 2005, JPMorgan Chase granted long-term stock-based awards under the 1996 Long-Term... -

Page 108

... employee's retirement eligibility date or the vesting date of the respective tranche. The Firm's policy for issuing shares upon settlement of employee share-based payment awards is to issue either new shares of common stock or treasury shares. During 2006, the Firm issued new shares of common stock... -

Page 109

...for at fair value. All 2006 awards were accounted for at fair value. Year ended December 31, (in millions, except per share data) 2005 2004(a) $ 4,466 Net income as reported $ 8,483 Add: Employee stock-based compensation expense included in reported Net income, net of related tax effects 938 Deduct... -

Page 110

...HTM") or Trading. Trading securities are discussed in Note 4 on page 98 of this Annual Report. Securities are classified primarily as AFS when purchased as part of the Firm's management of its structural interest rate risk. AFS securities are carried at fair value on the Consolidated balance sheets... -

Page 111

...securities were as follows for the dates indicated: 2006 Amortized cost Gross unrealized gains Gross unrealized losses Fair value Amortized cost 2005 Gross unrealized gains Gross unrealized losses Fair value December 31, (in millions) Available-for-sale securities U.S. government and federal agency... -

Page 112

... overall increases in market interest rates and not concerns regarding the underlying credit of the issuers. The majority of the securities with unrealized losses aged greater than 12 months are obligations of U.S. government-sponsored enterprises and have a fair value at December 31, 2006, that is... -

Page 113

... are reported on a net basis in accordance with FIN 41. JPMorgan Chase takes possession of securities purchased under resale agreements. On a daily basis, JPMorgan Chase monitors the market value of the underlying collateral, primarily U.S. and non-U.S. government and agency securities that... -

Page 114

... in Noninterest revenue. Interest income is recognized using the interest method, or on a basis approximating a level rate of return over the term of the loan. Loans are transferred from the retained portfolio to the held-for-sale portfolio when management decides to sell the loan. Transfers to held... -

Page 115

.... For risk-rated loans (generally loans originated by the wholesale lines of JPMorgan Chase & Co. / 2006 Annual Report 3,153 - 3,153 78(a) $ 7,279(b) 3,575 - 3,575 14 $ 7,090(c) 1,798 1,085 2,883 (110)(f) $ 7,320(g) (a) Primarily relates to loans acquired in The Bank of New York transaction in... -

Page 116

...loans that are originated or purchased by Retail Financial Services ("RFS"), and Card Services ("CS"). Wholesale activities include securitizations of purchased residential real estate loans and commercial loans (primarily real estate-related) originated by the Investment Bank ("IB"). JPMorgan Chase... -

Page 117

... credit losses for prime residential mortgage and certain wholesale securitizations are minimal and are incorporated into other assumptions. (c) The auto securitization gain of $9 million does not include the write-down of loans transferred to held-for-sale in 2005 and risk management activities... -

Page 118

... transactions with the Government National Mortgage Association ("GNMA"), Federal National Mortgage Association ("FNMA") and Federal Home Loan Mortgage Corporation ("Freddie Mac"). For a discussion of mortgage servicing rights, see Note 16 on pages 121-122 of this Annual report. In addition to... -

Page 119

... losses plus projected net credit losses, divided by the original balance of the outstandings comprising the securitization pool. The table below displays the expected static-pool net credit losses for 2006, 2005 and 2004, based upon securitizations occurring in that year: Loans securitized in... -

Page 120

... below presents information about delinquencies, net charge-offs (recoveries) and components of reported and securitized financial assets at December 31, 2006 and 2005: Total Loans December 31, (in millions) Home Equity Mortgage Auto loans and leases All other loans Credit card receivables Total... -

Page 121

... companies fund their purchases and loans through the issuance of highly rated commercial paper. The primary source of repayment of the commercial paper is the cash flow from the pools of assets. JPMorgan Chase serves as the administrator and provides contingent liquidity support and limited credit... -

Page 122

... if issued directly by JPMorgan Chase. The Firm is involved with municipal bond vehicles for the purpose of creating a series of secondary market trusts that allow tax-exempt investors to finance their investments at short-term tax-exempt rates. The VIE purchases fixed-rate, longer-term highly rated... -

Page 123

... as held-for-sale. Goodwill attributed to the business segments was as follows: December 31, (in millions) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset Management Corporate (Private Equity) Total Goodwill 2006 $ 3,526 16,955... -

Page 124

... MSR activity for the years ended December 31, 2005 and 2004, during which MSRs were accounted for under SFAS 140. Year ended December 31, (in millions, except rates and where otherwise noted) Balance at January 1 Originations of MSRs Purchase of MSRs Total additions Bank One merger Sales Other... -

Page 125

... acquisition of The Bank of New York's consumer, business banking and middle-market banking businesses, and further purchase accounting adjustments related to the acquisition of the Sears Canada credit card business. Except for $513 million of indefinite-lived intangibles related to asset management... -

Page 126

... 19 - Long-term debt JPMorgan Chase issues long-term debt denominated in various currencies, although predominantly U.S. dollars, with both fixed and variable interest rates. The following table is a summary of long-term debt carrying values (including unamortized original issue discount, SFAS 133... -

Page 127

... discount. The principal amount of debentures issued to the trusts includes the impact of hedging and purchase accounting fair value adjustments that were recorded on the Firm's Consolidated financial statements. Note 20 - Preferred stock JPMorgan Chase is authorized to issue 200 million shares... -

Page 128

... issued: Employee benefits and compensation plans Employee stock purchase plans Purchase accounting acquisitions and other Total newly issued Cancelled shares Total issued - balance at December 31 Treasury - balance at January 1 Purchase of treasury stock Share repurchases related to employee stock... -

Page 129

... on AFS securities, foreign currency translation adjustments (including the impact of related derivatives), cash flow hedging activities and the net actuarial loss and prior service cost related to the Firm's defined benefit pension and OPEB plans. Net actuarial loss and prior service (credit) of... -

Page 130

... and certain tax benefits associated with the Firm's employee stock-based compensation plans. Also not reflected are the cumulative tax effects of implementing in 2006, SFAS 155, which applies to certain hybrid financial instruments; SFAS 156, which accounts for servicing financial assets; and SFAS... -

Page 131

... in tax rate resulting from: U.S. state and local income taxes, net of federal income tax benefit 2.1 Tax-exempt income (2.2) Non-U.S. subsidiary earnings (0.5) Business tax credits (2.5) Other, net (0.5) Effective tax rate 31.4% The principal sources of JPMorgan Chase's income (on a parent company... -

Page 132

... Corporation Improvement Act. There is no Tier 1 leverage component in the definition of a well-capitalized bank holding company. (f) The minimum Tier 1 leverage ratio for bank holding companies and banks is 3% or 4% depending on factors specified in regulations issued by the Federal Reserve... -

Page 133

... Other comprehensive income. JPMorgan Chase's fair value hedges primarily include hedges of fixed-rate long-term debt, loans, AFS securities and MSRs. Interest rate swaps are the most common type of derivative contract used to modify exposure to interest rate risk, converting fixed-rate assets and... -

Page 134

... of this Annual Report. Some of these asset purchase agreements can be exercised at any time by the SPE's administrator, while others require a triggering event to occur. Triggering events include, but are not limited to, a need for liquidity, a decline Off-balance sheet lending-related financial... -

Page 135

... third-party borrower to return the lent securities. To support these indemnification agreements, the Firm obtains cash or other highly liquid collateral with a market value exceeding 100% of the value of the securities on loan from the borrower. Collateral is marked to market daily to help assure... -

Page 136

... finance companies Real estate Healthcare State and municipal governments Consumer products All other wholesale Total wholesale-related Consumer-related: Home equity Mortgage Auto loans and leases All other loans Card Services-reported(a) Total consumer-related Total exposure (a) (b) (c) (d) Credit... -

Page 137

... characteristics, or discounted cash flows. Securities Fair values of actively traded securities are determined by quoted external dealer prices, while the fair values for nonactively traded securities are based upon independent broker quotations. JPMorgan Chase & Co. / 2006 Annual Report 135 -

Page 138

... value for long-term debt, including the junior subordinated deferrable interest debentures held by trusts that issued guaranteed capital debt securities, is based upon current market rates and is adjusted for JPMorgan Chase's credit quality. Lending-related commitments Although there is no liquid... -

Page 139

... Total financial assets Financial liabilities Liabilities for which fair value approximates carrying value Interest-bearing deposits Federal funds purchased and securities sold under repurchase agreements Trading liabilities Beneficial interests issued by consolidated VIEs Long-term debt-related... -

Page 140

...141 of this Annual Report. The Firm's long-lived assets for the periods presented are not considered by management to be significant in relation to total assets. The majority of the Firm's long-lived assets are located in the U.S. Income from continuing operations before income taxes $ 3,871 578 522... -

Page 141

... income to trading revenue. As a result of these changes, effective January 1, 2006, management has discontinued reporting on an "operating" basis. Business Segment Disclosures Various wholesale banking clients, together with the related balance sheet and income statement items, were transferred... -

Page 142

... are reported in the Corporate segment. Merger costs attributed to the business segments for 2006, 2005 and 2004 were as follows: Year ended December 31, (in millions) Investment Bank Retail Financial Services Card Services Commercial Banking Treasury & Securities Services Asset Management Corporate... -

Page 143

... interest in credit card securitizations, partially offset by a benefit of $584 million related to conforming wholesale and consumer provision methodologies for the combined Firm. (h) Segment managed results reflect revenues on a tax-equivalent basis with the corresponding income tax impact recorded... -

Page 144

... of long-term debt Repayments of long-term debt Net proceeds from the issuance of stock and stock-related awards Excess tax benefits related to stock-based compensation Redemption of preferred stock Treasury stock purchased Cash dividends paid Net cash provided by financing activities Net increase... -

Page 145

... Net income Return on assets ("ROA") Income from continuing operations Net income Tier 1 capital ratio Total capital ratio Tier 1 leverage ratio Overhead ratio Selected balance sheet data (period-end) Total assets Securities Loans Deposits Long-term debt Total stockholders' equity Credit quality... -

Page 146

... income Return on assets ("ROA"): Income from continuing operations Net income Tier 1 capital ratio Total capital ratio Overhead ratio Selected balance sheet data (period-end) Total assets Securities Loans Deposits Long-term debt Common stockholders' equity Total stockholders' equity Credit quality... -

Page 147

...JPMorgan Chase & Co. ACH: Automated Clearing House. APB 25: Accounting Principles Board Opinion No. 25. "Accounting for Stock Issued to Employees." Assets under management: Represent assets actively managed by Asset Management on behalf of institutional, private banking, private client services and... -

Page 148

... Developed or Obtained for Internal Use." Stress testing: A scenario that measures market risk under unlikely but plausible events in abnormal markets. Transactor loan: Loan in which the outstanding balance is paid in full by payment due date. Unaudited: The financial statements and information... -

Page 149

... the Firm's business; mergers and acquisitions, including the Firm's ability to integrate acquisitions; ability of the Firm to develop new products and services; acceptance of new products and services and the ability of the Firm to increase market share; the ability of the Firm to control expenses... -

Page 150

... Chase International New York, New York Tokyo Sexwale Executive Chairman Mvelaphanda Holdings Limited Johannesburg, South Africa Abdallah S. Jum'ah President and Chief Executive Officer Saudi Arabian Oil Company Dhahran, Saudi Arabia Michael A. Chaney Chairman National Australia Bank Limited... -

Page 151

...Executive Vice President and Chief Financial Officer Albany International Corp. Fred Wilpon Chairman Sterling Equities, Inc. Emil Duda Senior Executive Vice President and Chief Financial Officer Lifetime Healthcare Company/Excellus Health Plan Inc. Richard W. Kunes Executive Vice President, Chief... -

Page 152

...Johnson-Hadley Vice Chancellor for Administration Tarrant County College District Fort Worth, TX Randy Moore Executive Director Community Works in West Virginia, Inc. Charleston, WV Sarah Gerecke Chief Executive Officer Neighborhood Housing Services of NYC New York, NY Sylvia Brooks President/CEO... -

Page 153

... Agency Cincinnati, OH Thomas Stone Executive Director Mt. Pleasant Development Now Cleveland, OH Lloyd Williams President/CEO Greater Harlem Chamber of Commerce New York, NY James Paley Executive Director Neighborhood Housing Services of New Haven New Haven, CT Marcos Ronquillo Managing Partner... -

Page 154

... development) EXECUTIVE COMMITTEE James Dimon* Chairman and Chief Executive Officer (*denotes member of Operating Committee) Michael K. Clark Worldwide Securities Services Evelyn E. Guernsey Asset Management Melissa J. Moore Treasury Services Andrew D. Crockett JPMorgan Chase International... -

Page 155

.... Corporate headquarters 270 Park Avenue New York, New York 10017-2070 Telephone: 212-270-6000 http://www.jpmorganchase.com Principal subsidiaries JPMorgan Chase Bank, National Association Chase Bank USA, National Association J.P. Morgan Securities Inc. Annual report on Form 10-K The Annual Report... -

Page 156

JPMORGAN CHASE & CO. www.jpmorganchase.com