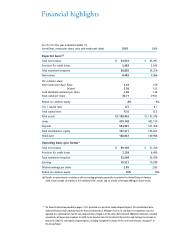

JP Morgan Chase 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

make life much simpler for our customers by linking credit

and debit cards and by offering them other products. The

results of recent efforts are promising: credit card sales in

our retail branches are up nearly %from two years ago.

Commercial Banking and Retail. A strong connection

already exists between our Commercial Bank and our retail

branches. In fact, there are few successful commercial banks

in America that do not have a retail bank – and for good

reason. A large share of retail business comes from small

businesses and mid-sized companies. Many use branches as

their financial back offices for cash, payroll processing and

wire transfer services. This interdependency is cost effective

for us and beneficial to our customers. In addition, business

accounts often lead to new personal accounts and vice versa.

Investment Banking and Commercial Banking. Anatural con-

nection exists between an investment bank, which essen-

tially serves large public companies, and a commercial

bank, which essentially serves mid-sized to small public

and non-public companies. Our Commercial Bank already

generates hundreds of millions of dollars in revenues from

offering its clients traditional investment banking services

(e.g., advisory, debt and equity underwriting). Over the

next few years, we believe that we can double Commercial

Banking’s revenues from these activities. In cities like

Indianapolis, Austin, Denver and Tucson – where our

Investment Bank does not have a physical presence – local

businesses have strong relationships with our commercial

bankers. These bankers know when their clients are con-

templating transactions and need access to investment

banking expertise. The connection is valuable for clients

and beneficial to us. It enables our Investment Bank to

generate revenues from its product expertise that it could

not have previously produced without the client relation-

ship. And it enables the Commercial Bank to better serve

its clients by providing them with the additional products

that they need.

Treasury & Securities Services; Asset & Wealth Management.

Another important connection exists between Treasury &

Securities Services and our other businesses. Many of our

major customers (institutional, middle market, small busi-

ness and retail) use TSS for activities such as cash, checks,

ACH payments, wire transfer and custody. TSS generates

approximately $billion of annual revenue by serving these

customers. Asset & Wealth Management also benefits from

working with other businesses, including managing assets

for corporate clients, helping them meet their complex pen-

sion and investment needs, and offering products from

across the company to individual clients.

Plenty of other examples exist, but the critical point

remains: while each business should do well on its own, it

should also be able to capitalize on our company’s extensive

and unique set of products and services to more fully and

profitably meet customer needs. There is certainly no rea-

son why they should do worse because they are part of this

institution. The key,of course, is that the customers must

be the winners.

The size and scale of the company are a competitive

strength

The size, scale and scope of JPMorgan Chase also offer huge

advantages: economies of scale in operations and systems;

diversification of capital, risk and earnings; a great global

brand; and the capability to make large investments at a

lower cost of capital. In particular, the benefits of size and

scale in operations and systems are vast, and they are real.

Our diversified earning streams lower our risk, increase our

credit ratings and reduce the cost of our capital. And since

one of our major costs is the cost of money, the ability to

raise funds cheaper, better, faster and more effectively around

the world than other companies is a major advantage.

But size alone is not enough to win. In fact, if not properly

managed, it can bring many negatives. Huge companies

operating in complex, consolidating and fiercely competi-

tive industries like ours can only achieve and sustain their

success by competing where the “rubber hits the road” –at

the level of the store, the product and the banker – not at

corporate headquarters. We must equip those employees on

the front lines to be responsive and responsible. The way

we manage our size will reflect how much we recognize and

respect this imperative. Bureaucracy and waste are lethal.

To remain healthy and vibrant, we must constantly and

consistently minimize bureaucracy, eliminate waste and

insist upon excellent execution.