JP Morgan Chase 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

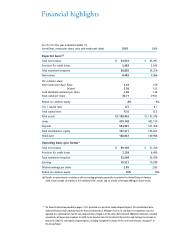

Market and trading risk, and interest rate and

liquidity risk

We need to manage our risk–return payoff better in .

In ,our trading volatilities were unacceptably high.

The $billion in trading revenues (not a bad result on its

own) was the result of two great quarters and two quarters

where we underperformed. We think that is too much

volatility, and reducing it is one of our priorities. I believe

we can accomplish this by continuing to diversify our trad-

ing business, by being more disciplined and precise in the

execution of our risk management practices, and by hiring

and retaining the best talent. We intend to deliver better,

more consistent results over time, while maintaining our

aggregate risk-taking appetite.

The good news is that we have aggressively invested to gener-

ate more diversified and consistent returns. For example, we

have added energy trading, and increased our activities in

mortgage- and asset-backed securities, and principal invest-

ing. Wehave leadership positions in credit markets and in

our derivatives franchises, and we will continue to invest in

order to sustain them. And while in the short run, some of

this has actually increased volatility,we are convinced that

our efforts – consistently applied – will succeed. However,

we caution our shareholders not to expect immediate results.

Interest rate exposure is another area in which financial

services companies can assume excess risk – often at great

peril. As with underwriting credit, good analysis of interest

rate exposure is rooted in facts and evaluations that are

based upon a variety of realistic assumptions and scenarios.

We devote substantial resources to understanding how

interest rate changes will affect our performance. This

analysis should be – and will be – an ongoing process. We

believe that our company has carefully managed its interest

rate risk so that even dramatic moves in rates of several per-

centage points cannot alone damage the company.

Ahealthy liquidity profile is essential to the ongoing via-

bility of any company, financial or otherwise. We use a vari-

ety of tools to maintain a strong liquidity position at the

parent and subsidiary companies, including stress scenarios,

collateral management and a conservative debt structure for

the company overall. We engage in a continual dialogue

with major rating agencies, and we are focused on main-

taining and improving our strong credit ratings.

Reputation and legal risk

The litigation costs in business are well known. We are

intensely focused on ways to safeguard the firm’s reputation

and exposure. They include:

•Senior management endorsement of a code of conduct

that all employees must sign and adhere to, as well as a

commitment to provide appropriate training.

•Astrong and independent compliance program that

encourages employees to assist in surfacing compliance

and ethical issues, and identifying money laundering and

terrorist financing activities.

•Amore robust due diligence process focused on securi-

ties underwriting transactions, where we have established

centralized oversight of our processes and standards.

•Adisciplined governance process to address conflicts and

review transactions that may present conflicts that could

harm the firm now or in the future.

•Aproductive and open dialogue with our regulators and

an ongoing emphasis on staying alert to changes in regu-

latory standards.

We believe that these actions will mitigate our exposure,

but we recognize, unfortunately, that they will not elimi-

nate it. We have also implemented a disciplined process to

continually review our liabilities and establish appropriate

litigation reserves. While we make every effort to properly

manage the company to reduce litigation and legal costs,

we believe that our shareholders should assume that high

legal costs will continue for the foreseeable future. They

should be viewed, unfortunately, as simply a higher, perma-

nent cost of doing business than in the past.

Operational and catastrophic risk

This year, we also made progress in strengthening our oper-

ational risk management programs. We have a consistent

approach across all businesses for defining and aggregating