International Paper 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 International Paper annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

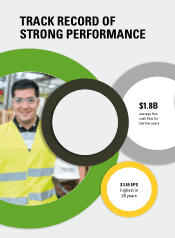

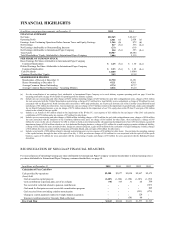

Strong free cash flow averaging $1.8B

Capital Allocation

Investing to improve our businesses, returning cash to

shareowners, and maintaining a strong balance sheet

are the priorities of our cash allocation strategy.

In 2015 we returned $1.2 billion to our shareowners using

our strong cash flow to fund a 10 percent increase in our

annual dividend. This was the fourth consecutive year of

double-digit percentage increases.

We strengthened our dividend policy by committing

to target 40 to 50 percent of free cash flow—a clear

indication of confidence in the sustainability of our

free cash flow and our commitment to returning cash

to shareowners.

We also continued our stock repurchase program,

acquiring more than $500 million worth of shares

during 2015. We have now repurchased $2.1 billion

of our $3 billion authorization.

Finally, we invested in cost reduction projects to

drive margin improvement and offset cost inflation,

and initiated strategic investments to generate

long-term value.

FREE CASH FLOW

5-Year Average: $1.8 billion

$1.8

2013

$1.6

2012

$1.7

2011

$2.1

2014

$1.8

2015

ANNUALIZED DIVIDEND

2011

$1.05 $1.20 $1.40 $1.60 $1.76

2012 2013 2014 2015

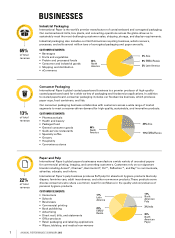

We announced plans to invest $300 million in 2016 and 2017 to further improve our

North American containerboard mill system, enhance product quality, and reduce

manufacturing and delivery costs. These projects are expected to have a collective

internal rate of return of 20 percent.

Industrial

Packaging

Optimization

We began converting our Riegelwood, N.C., coated paperboard mill to fluff pulp production;

this incremental 400,000 tons of fluff pulp capacity will allow us to meet our customers’

global growth demand. Production will ramp up mid-2016 with ongoing flexibility to shift

between softwood and fluff production based on market demand.

Fluff Pulp

Expansion

We doubled our manufacturing footprint for paper cups and food containers at our facility in

Kenton, Ohio. Production continues to ramp up to support the consumer-driven demand for

sustainable and renewable products.

Foodservice

Expansion

ANNUAL PERFORMANCE SUMMARY 2015 4