International Paper 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 International Paper annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

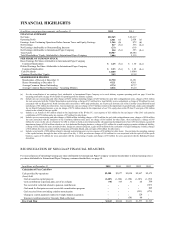

In millions, at December 31 2015 2014 2013

Reconciliation of Operating Earnings Before Net Interest Expense to Net Earnings

Before Taxes and Equity Earnings

Earnings (Loss) From Continuing Operations Before Income Taxes and Equity Earnings $1,266 $872 $1,228

Add back: Net Interest Expense 555 607 612

Add back: Special Items Before Taxes 559 1,052 344

Add back: Non-Operating Pension Expense Before Taxes 258 212 323

Operating Earnings Before Interest, Taxes and Equity Earnings 2,638 2,743 2,507

Tax Rate 33% 31% 26%

Operating Earnings Before Interest and Equity Earnings 1,767 1,901 1,855

Equity Earnings, Net of Tax 117 (200) (39)

Operating Earnings Before Interest $1,884 $1,701 $1,816

The Company considers return on invested capital (“ROIC”) to be a meaningful indicator of our operating performance, and we evaluate this

metric because it measures how effectively and efficiently we use the capital invested in our business. ROIC is not a measure of financial

performance under U.S. generally accepted accounting principles (“GAAP”) and may not be defined and calculated by other companies in the

same manner. The Company defines and calculates ROIC using in the numerator Operating Earnings Before Interest, the most directly

comparable GAAP measure to which is Earnings Before Income Taxes and Equity Earnings. The Company calculates Operating Earnings

Before Interest by excluding net interest expense, the after-tax effect on non-operating pension expense and items considered by management to

be unusual from the earnings reported under GAAP. Management uses this measure to focus on on-going operations and believes that it is useful

to investors because it enables them to perform meaningful comparisons of past and present operating results.

ROIC = Operating Earnings Before Interest / Average Invested Capital

Invested Capital = Equity adjusted to remove pension-related amounts in OCI, net of taxes + interest-bearing debt