International Paper 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 International Paper annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

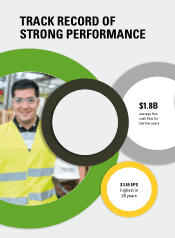

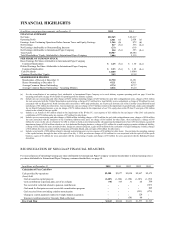

FINANCIAL HIGHLIGHTS

In millions, except per share amounts, at December 31 2015 2014

FINANCIAL SUMMARY

Net Sales $22,365 $ 23,617

Operating Profit 2,361 (a) 2,058 (a)

Earnings from Continuing Operations Before Income Taxes and Equity Earnings 1,266 (b) 872 (d)

Net Earnings 917 (b,c) 536 (d,e)

Net Earnings Attributable to Noncontrolling Interests (21) (19)

Net Earnings Attributable to International Paper Company 938 (b,c) 555 (d,e)

Total Assets 30,587 28,684

Total Shareholders’ Equity Attributable to International Paper Company 3,884 5,115

PER SHARE OF COMMON STOCK

Basic Earnings Per Share Attributable to International Paper Company

Common Shareholders

$ 2.25

(b,c)

$ 1.30

(d,e)

Diluted Earnings Per Share Attributable to International Paper Company

Common Shareholders

$ 2.23

(b,c)

$ 1.29

(d,e)

Cash Dividends 1.6400 1.4500

Common Shareholders’ Equity 9.43 12.18

SHAREHOLDER PROFILE

Shareholders of Record at December 31 12,730 13,351

Shares Outstanding at December 31 412.1 420.1

Average Common Shares Outstanding 417.4 427.7

Average Common Shares Outstanding – Assuming Dilution 420.6 432.0

(a) See the reconciliation of net earnings (loss) attributable to International Paper Company to its total industry segment operating profit on page 19 and the

operating profit table on page 81 for details of operating profit by industry segment.

(b) Includes pre-tax restructuring and other charges of $252 million including charges of $207 million for early debt extinguishment costs, charges of $16 million

for costs associated with the Timber Monetization restructuring, a charge of $15 million for a legal liability reserve adjustment, a charge of $8 million for costs

associated with our Riegelwood, North Carolina mill conversion to 100% pulp production, net of proceeds from the sale of the Carolina Coated Bristols brand

and charges of $6 million for other items. Also included are a pre-tax charge of $137 million related to the impairment of goodwill and a trade name intangible

for our Brazil Packaging business, a pre-tax charge of $174 million related to the impairment of our 55% equity share in the IP-Sun JV and gain of $4 million

related to the refund of state tax credits.

(c) Includes a tax benefit of $67 million related to the impairment of the IP-Sun JV, a tax expense of $23 million for the tax impact of the 2015 cash pension

contribution of $750 million and a tax expense of $7 million for other items.

(d) Includes pre-tax restructuring and other charges of $846 million including charges of $276 million for early debt extinguishment costs, charges of $554 million

for costs associated with the shutdown of our Courtland, Alabama mill, and a net charge of $16 million for other items. Also included are a charge of $47

million for a loss on the sale of a business by ASG in which we hold an investment and the subsequent partial impairment of our ASG investment, a goodwill

impairment charge of $100 million related to our Asia Industrial Packaging business, a charge of $35 million for a multi-employer pension withdrawal liability,

a charge of $32 million for costs associated with a foreign tax amnesty program, a gain of $20 million for the resolution of a legal contingency in India, charges

of $16 million for costs associated with the integration of Temple-Inland, and a net gain of $4 million for other items.

(e) Includes a tax benefit of $90 million related to internal restructurings and a net tax expense of $9 million for other items. Also includes the operating earnings

of the xpedx business through the date of the spin-off on July 1, 2014, net after-tax charges of $16 million for costs associated with the spin-off of the xpedx

business, a gain of $1 million for costs associated with the restructuring of xpedx and charges of $9 million for costs associated with the Building Products

divestiture.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

For reconciliations of Operating Earnings per share attributable to International Paper Company common shareholders to diluted earnings (loss)

per share attributable to International Paper Company common shareholders, see page 18.

In millions, at December 31 2015 2014 2013 2012 2011

Calculation of Free Cash Flow

Cash provided by operations $2,580 $3,077 $3,028 $2,967 $2,675

(Less)/Add:

Cash invested in capital projects (1,487) (1,366) (1,198) (1,383) (1,159)

Cash contribution to pension plan, net of tax refunds 750 353 31 44

300

Tax receivable collected related to pension contributions - - - -

(123)

Cash used for European account receivable securitization program - - - - 209

Cash received from unwinding a timber monetization - - -

(251) (175)

Change in control payments related to Temple-Inland acquisition - - - 120 -

Insurance reimbursement for Guaranty Bank settlement - - (30) 80

-

Free Cash Flow $1,843 $2,064 $1,831 $1,577 $1,727