Intel 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

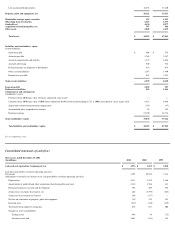

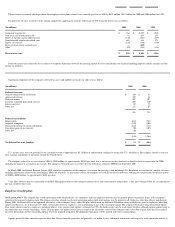

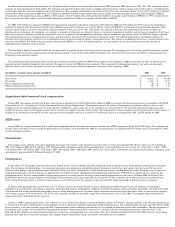

as follows:

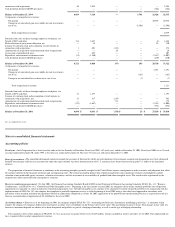

In March 2001, a supplemental stock grant was given to employees who had been previously granted options with an exercise price above $30 per share. These additional grants were

made in order to retain employees due to competitive market conditions and a decline in the company's stock price. The 2001 supplemental grants vest ratably over a two-year period from

the date of grant.

In October 2001, the company granted merit-based options that would have been granted in 2002 in order to enhance the potential long-term retention value of these stock options. The

company intends to reduce merit grants in 2002 by the shares in this early grant program. The 2002 merit grant vests in 2007, on about the same date it would vest if granted in 2002.

The range of option exercise prices for options outstanding at December 29, 2001 was $0.01 to $87.90. The range of exercise prices for options is wide, primarily due to the impact of

assumed options of acquired companies that had experienced significant price fluctuations.

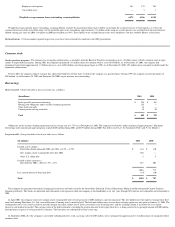

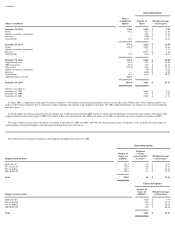

The following tables summarize information about options outstanding at December 29, 2001:

Outstanding options

(Shares in millions)

Shares

available for

options

Number of

shares

Weighted average

exercise price

December 26, 1998

534.4

625.0

$

9.07

Grants

(81.2

)

81.2

$

31.96

Options assumed in acquisitions

—

25.6

$

12.87

Exercises — (

96.0

) $

3.32

Cancellations

24.6

(24.6

) $

16.43

December 25, 1999

477.8

611.2

$

12.87

Grants

(162.8

)

162.8

$

54.68

Options assumed in acquisitions —

4.3

$

5.21

Exercises

—

(

107.5

)

$

4.66

Cancellations

32.6

(32.6

) $

26.28

December 30, 2000

347.6

638.2

$

24.16

Supplemental grant

(51.9

)

51.9

$

25.69

2002 merit grant

(67.6

)

67.6

$

24.37

Other grants

(118.6

)

118.6

$

25.48

Options assumed in acquisitions —

9.0

$

19.25

Exercises

—

(

68.0

)

$

6.06

Cancellations

45.1

(48.8

) $

35.01

Additional shares reserved

900.0

— —

December 29, 2001

1,054.6

768.5

$

25.33

Options exercisable at:

December 25, 1999

206.4

$

4.71

December 30, 2000

195.6

$

7.07

December 29, 2001

230.9

$

11.27

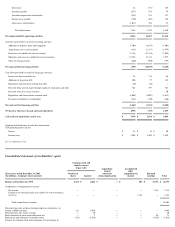

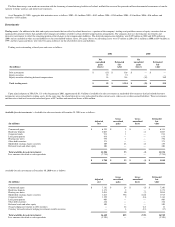

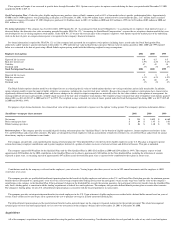

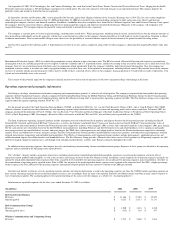

Outstanding options

Range of exercise prices

Number of

shares (in

millions)

Weighted

average

contractual life

(in years)

Weighted average

exercise price

$0.01-$17.40

187.3

3.2

$

6.32

$17.42-$24.20

155.9

6.0

$

18.86

$24.23

-

$30.66

216.5

9.3

$

24.98

$30.70-$87.90

208.8

8.1

$

47.57

Total

768.5

6.8

$

25.33

Exercisable options

Range of exercise prices

Number of

shares (in

millions)

Weighted average

exercise price

$0.01-$17.40

174.0

$

5.97

$17.42

-

$24.20

35.5

$

18.75

$24.23-$30.66

4.6

$

26.98

$30.70-$87.90

16.8

$

46.10

Total

230.9

$

11.27