Intel 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

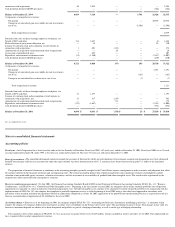

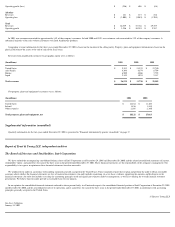

The tax benefit associated with dispositions from employee stock plans reduced taxes currently payable for 2001 by $435 million ($887 million for 2000 and $506 million for 1999).

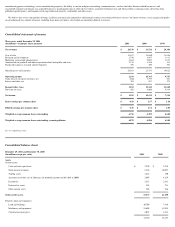

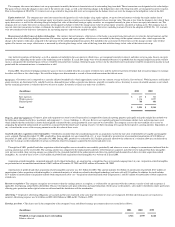

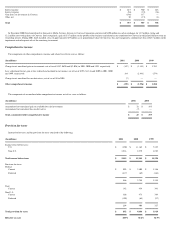

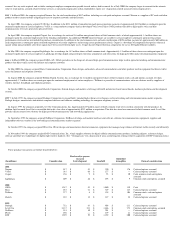

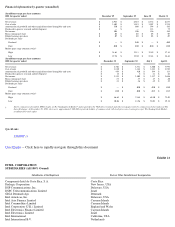

The provision for taxes reconciles to the amount computed by applying the statutory federal rate of 35% to income before taxes as follows:

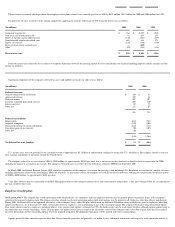

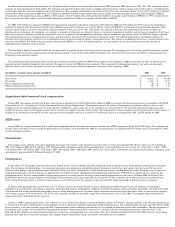

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of assets and liabilities for financial reporting purposes and the amounts used for

income tax purposes.

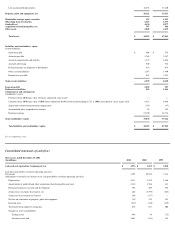

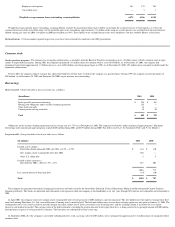

Significant components of the company's deferred tax assets and liabilities at fiscal year-ends were as follows:

U.S. income taxes were not provided for on a cumulative total of approximately $5.5 billion of undistributed earnings for certain non-U.S. subsidiaries. The company intends to reinvest

these earnings indefinitely in operations outside the United States.

The company reduced its tax provision for 2001 by $100 million, or approximately $0.015 per share, due to an increase in the calculated tax benefit related to export sales for 2000,

including the impact of a revision in the tax law. This change in estimated taxes was reflected in the federal tax return for 2000 filed in September 2001.

In March 2000, the Internal Revenue Service (IRS) closed its examination of the company's tax returns for years up to and including 1998. Resolution was reached on a number of issues,

including adjustments related to the intercompany allocation of profits. As part of this closure, the company reversed previously accrued taxes, reducing the tax provision for the first quarter

of 2000 by $600 million, or approximately $0.09 per share.

Years after 1998 are open to examination by the IRS. Management believes that adequate amounts of tax and related interest and penalties, if any, have been provided for any adjustments

that may result for these years.

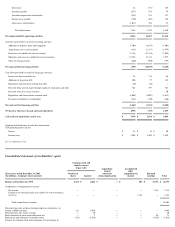

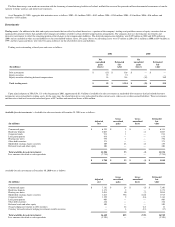

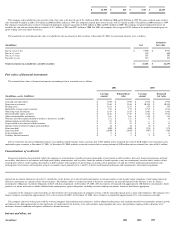

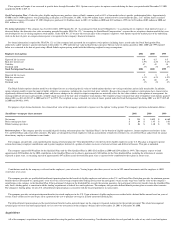

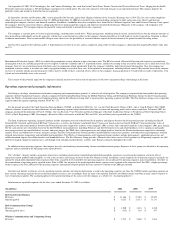

Employee benefit plans

Stock option plans >

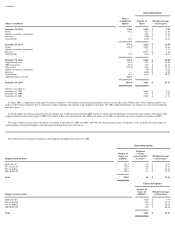

The company has a stock option plan under which officers, key employees and non-employee directors may be granted options to purchase shares of the company's

authorized but unissued common stock. The company also has a broad-based stock option plan under which stock options may be granted to all employees other than officers and directors.

During 2001, the Board of Directors approved an increase to the authorized shares under this plan, which made an additional 900 million shares available for grant to employees other than

officers and directors. As of December 29, 2001, substantially all of our employees were participating in one of the stock option plans. The company's Executive Long-Term Stock Option

Plan, under which certain key employees, including officers, were granted stock options, terminated in 1998. No further grants may be made under this plan, although options granted prior to

the termination may remain outstanding. Under all of the plans, the option exercise price is equal to the fair market value of Intel common stock at the date of grant. Intel has also assumed

the stock option plans and the outstanding options of certain acquired companies. No additional stock grants will be granted under these assumed plans.

Options granted by Intel currently expire no later than 10 years from the grant date and generally vest within 5 years. Additional information with respect to stock option plan activity is

(In millions)

2001

2000

1999

Computed expected tax $

764

$

5,299

$

3,930

State taxes, net of federal benefits

92

295

255

Non

-U.S. income taxed at different rates

(336

)

(363

)

(239

)

Non

-deductible acquisition-related costs

667

444

274

Export sales benefit

(245

)

(230

)

(170

)

Reversal of previously accrued taxes — (

600

) —

Other

(50

)

(239

)

(136

)

Provision for taxes

$

892

$

4,606

$

3,914

(In millions)

2001

2000

Deferred tax assets

Accrued compensation and benefits $

120

$

87

Accrued advertising

102

88

Deferred income

207

307

Inventory valuation and related reserves

209

120

Interest and taxes

89

52

Other, net

231

67

958

721

Deferred tax liabilities

Depreciation

(461

)

(721

)

Acquired intangibles

(280

)

(309

)

Unremitted earnings of certain subsidiaries

(164

)

(131

)

Unrealized gains on investments

(30

)

(105

)

Other, net

(10

)

—

(945

)

(1,266

)

Net deferred tax asset (liability) $

13

$

(545

)