Ingram Micro 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Progress on gross margins and operating costs in 2008

would not be sufficient given the significant downturn the

IT sector experienced coming into the new year. In early

2009, we announced further restructuring actions,

primarily in North America and Europe, which are

expected to yield additional annual savings of $100

million to $120 million by the end of the year. North

America is expected to generate a majority of these

savings through optimization efforts to reduce overhead

and restructure certain business units and facilities. The

European region is taking similar actions, including the

re-positioning of its Nordic

operations, whereby we intend

to sell our Danish operations and

exit those in Norway and

Finland. The Asia-Pacific and

Latin American regions are also

participating in this plan to

rationalize their expense struc-

tures in line with the decline

in revenues.

Step by step, we worked meticu-

lously to improve our profitability.

Even so, like many companies,

the volatile equity environment in

2008 negatively impacted our

market capitalization, triggering a

pre-tax goodwill impairment charge of $743 million in the

fourth quarter. Absent that charge, our hard work and

ingenuity enabled us to close the year with a respectable

operating margin. The underlying operating performance

of the company combined with our world-class balance

sheet puts us in a strong position relative to many sectors

in this economy. As the markets recover from the current

downturn, we feel we are well positioned with our

customers and vendors to take advantage of consolida-

tion opportunities this economy might present.

Building on Our Strengths

Our success in navigating through the economic

complexities of 2008 can be attributed to several

factors. Among them are our financial depth and flexi-

bility, geographic diversity, and excellent vendor and

customer relationships. These strengths continue to

fuel our market leadership.

Our global reach is unparalleled. With local presence

in more than 30 countries, we sell our products and serv-

ices to more than 170,000 customers in approximately

150 countries worldwide. By representing more than

1,500 suppliers, our well-diversified portfolio of offerings

allows us to mitigate risks associated with product

commoditization and obsolescence. We believe this

approach has served us and you, our partners, well.

This reach is fueled by solid financial assets, which

include a diverse portfolio of capital resources through-

out the world and a solid balance sheet — both of

which allow us to fare better than many peers in manag-

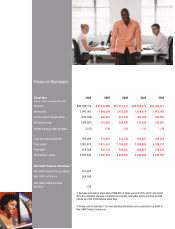

(1) 2007 gross margin includes net Brazilian commercial tax charge of $30.1 million or 0.09 percent of revenues.

(2) 2008 gross margin includes a benefit of $8.2 million or 0.02 percent of revenues related to the release of a portion of the Brazilian commercial tax reserve recorded in 2007.