Ingram Micro 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

ITEM 1. BUSINESS

The following discussion includes forward-looking statements, including but not limited to, management’s

expectations of competition; revenues, margin, expenses and other operating results or ratios; operating efficien-

cies; economic conditions; cost savings; capital expenditures; liquidity; capital requirements; acquisitions and

integration costs; operating models; exchange rate fluctuations and rates of return. In evaluating our business,

readers should carefully consider the important factors discussed under “Risk Factors.” We disclaim any duty to

update any forward-looking statements.

Introduction

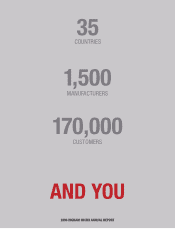

Ingram Micro, a Fortune 100 company, is the largest global information technology (“IT”) wholesale

distributor by net sales, providing sales, marketing, and logistics services for the IT industry worldwide. Ingram

Micro provides a vital link in the IT supply chain by generating demand and developing markets for our technology

partners. While we remain focused on continuing to build our IT distribution business, we also are developing an

increasing presence in adjacent technology categories, such as automatic identification and data capture (“AIDC”);

point-of-sale (“POS”); managed, professional and warranty maintenance services; and consumer electronics

(“CE”) to broaden our product lines and market presence. We create value in the market by extending the reach

of our technology partners, capturing market share for resellers and suppliers, creating innovative solutions

comprised of both technology products and services, offering credit, and providing efficient fulfillment of IT

products and services. With a broad range of products and an array of services, we create operating efficiencies for

our partners around the world.

History

We began business in 1979, operating as Micro D Inc., a California corporation. Through a series of

acquisitions, mergers and organic growth, Ingram Micro’s global footprint and product breadth have expanded and

strengthened in North America; Europe, Middle East and Africa (“EMEA”); Asia-Pacific; and Latin America. In

2004, we acquired Techpac Holding Limited (“Tech Pacific”) to significantly boost our market share in

Asia-Pacific. From 2004 through 2007 we acquired several companies to build our presence in AIDC/POS, CE

and network security products and solutions. During 2008, we invested further in the AIDC/POS market with three

European acquisitions (Paradigm Distribution, Eurequat SA and Intertrade A.F. AG) and the acquisition of the

distribution business of the Cantechs Group, a market leader in China.

Industry

The worldwide information technology products and services distribution industry generally consists of two

types of business: traditional distribution and fee-based supply chain services. Within the traditional distribution

model, the distributor buys, holds title to, and sells products and/or services to resellers who, in turn, typically sell

directly to end-users, or other resellers. While some vendors have elected to sell directly to resellers or end-users for

particular customer and product segments, we believe that vendors continue to embrace traditional distributors that

have a global presence and proven ability to manage multiple products and resellers worldwide, provide access to

fragmented markets, and deliver products to market in an efficient manner. Resellers in the traditional distribution

model are able to build efficiencies and reduce costs by depending on distributors for a number of services,

including product availability, marketing, credit, technical support, and inventory management, which includes

direct shipment to end-users and, in some cases, provides end-users with distributors’ inventory availability. During

periods of constrained credit, distributors with strong balance sheets and ample credit capacity are especially valued

by suppliers. Those distributors that work with resellers to offer enhanced value-added solutions and services

customized to the needs of their specific end-user customer base are better able to succeed in this environment. As

the world’s leading broad-based distributor, we also offer to both suppliers and resellers fee-based supply chain

services, encompassing the end-to-end functions of the supply chain. We charge fees to suppliers for providing

logistics, fulfillment, and marketing services, as well as third-party products. Likewise, we charge fees to retailers

and Internet resellers seeking fulfillment services, inventory management, reverse logistics, and other supply chain

1