ING Direct 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

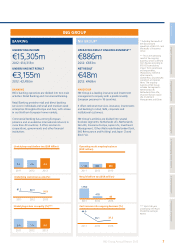

Our strong funding position enabled us to continue supporting

ourcustomers through lending in 2013.

Strong cost control continues to be a priority at the Bank in order

toremain competitive and to be able to face external factors, such

as high regulatory costs and bank taxes. The underlying cost/

income ratio improved from 60.3% in 2012 to 56.8% in 2013.

Results at NN Group showed significant improvement in 2013, on

an operating basis. The improvement reflects a higher investment

margin following the partial transfer of assets and liabilities from

WestlandUtrecht Bank to Nationale-Nederlanden Bank, lower

expenses resulting from the transformation programme in the

Benelux, improved results in the non-life business and lower

funding costs.

STRONG PROGRESS ON RESTRUCTURING PLAN AND

REVISION OF TIMELINES

During 2013, ING made progress on its Restructuring Plan to fully

separate its banking and insurance and investment management

activities. We reached several milestones, for example:

• A successful initial public offering (IPO) of the US insurance

business (ING U.S.).

• Completion of the divestment of ING Insurance/IM Asia.

• An agreement in November 2013 with the EC on revised

timelines for the European and Japanese Insurance divestments,

which together formed ING Insurance and were renamed

NNGroup on 1 March 2014.

The preparations for the base case IPO of NN Group are

progressing well, which is expected to allow us to go to the market

in 2014.

DELIVERING ON RESTRUCTURING

ING continued to make strong progress on its restructuring

programme in 2013, entering the end-phase of its transformation.

To meet the agreement with the European Commission (EC) of

November 2012, ING had to divest more than 50% of its Asian and

25% of its US insurance and investment management activities by

2013. Both requirements were met:

• The divestment of the Asian insurance and investment

management activities was effectively completed in 2013.

INGLife Japan will be included in the scope of the NN Group

base case IPO in 2014. In May 2013 ING U.S. started trading on

the New York Stock Exchange under the ticker symbol VOYA.

The successful sale of 38 million ING U.S. shares in October 2013

brought ING’s stake down to 57%. The divested 43% was more

than the required 25% and moved ING closer to meeting the

required divestment of over 50% by the end of 2014. 100% has

to be reached by year-end 2016.

ING was also able to reduce the core debt from EUR 7.1 billion at

year-end 2012 to EUR 5.0 billion at year-end 2013. This was due to

strong capital generation within ING Bank, allowing an upstream

payment to the Group, as well as to proceeds from the US IPO and

the sale of part of the direct stake in the Brazilian insurer Sul

América S.A. (SulAmérica).

As ING has committed to eliminate core debt, proceeds from the

divestments will be used to that end, provided they are not needed

to maintain the leverage of the remaining insurance businesses. The

value of the remaining 57% stake in ING U.S., the remaining stake

Strengths Weaknesses

• Positive recognition from

customers in many countries

for its banking and insurance

services.

• Solid financial position.

• Multi-channel distribution

strategy.

• International network.

• Sustainability leader in its sector.

Bank-specific

• Pioneer in digital banking.

• Well-known, strong brand.

• Subdued economic growth in

some of the core markets.

• Financial sector has an

unfavourable public image in

many countries.

Opportunities Threats

• Regaining trust and

demonstrating care, especially

towards customers.

• Transparency. Explaining better

why strategic choices are made.

• Cultural change. Tapping more

into the talents of employees.

Further developing a transparent

no-nonsense culture.

Bank-specific

• Frontrunner position in digital

solutions give the Bank an edge in

innovation.

• Ongoing uncertainty about

regulatory changes. Lack of

an international level playing field.

Bank-specific

• Possibly from new entrants from

outside of the industry.

ING’s solid foundations, based on a long legacy as a financial

institution, give us an excellent starting position to face existing and

future challenges, and to grasp opportunities to become a better

company for all our stakeholders. Specifically on the banking side

of the business, we strive to make optimal use of our leading

position in digital banking.

STRENGTHENING THE FINANCIAL POSITION

ING places great importance on strengthening its financial position

in order to put itself in the best position to facilitate the economy.

In 2013 we gained financial strength. Capital and funding

improved, our liquidity position remained strong, earnings

remained resilient. However, risk costs went up slightly in a weak

economic year in many of the markets in which we operate.

In January 2012, the Bank unveiled Ambition 2015, a set of

aspirations that included increasing our capital. Attaining a core

Tier 1 capital ratio under Basel III of at least 10% by 2013 was a

target we managed to sustain throughout 2013. At year-end, it

stood at 11.7% under Basel II and 10.0% on a fully loaded

pro-forma basis under Basel III. The leverage ratio under Basel III

was 3.9%, which is also in line with Ambition 2015 (4.0%) and

already complies with the CRD IV threshold of 3.0% by 2015.

ING Bank is making clear progress on meeting the other regulatory

CRD IV-requirements, and other aspects of Ambition 2015. For

example, ING maintained a liquidity coverage ratio of more than

100% in 2013; a level we aimed at for 2015. Also, the targeted

balance sheet optimisation at ING Bank is substantially complete.

ING Bank’s underlying result before tax was mainly driven by a

strengthening of the interest margin, less volatility in credit and

debt valuation adjustments (“CVA/DVA”) in Commercial Banking

and the Corporate Line, and the absence of de-risking losses in

2013. The profitability of ING Bank went up: the underlying return

on IFRS-EU equity was 9.0% in 2013, which is higher than it was in

2012 (7.0%) and brings our 2015 target within reach (10 to 13%).

17ING Group Annual Report 2013

1 Who we are 2 Report of the Executive Board 3 Corporate governance 4 Consolidated annual accounts 5 Parent company annual accounts 6 Other information 7 Additional information