HollyFrontier 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

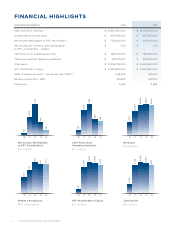

FINANCIAL RESULTS

In 2014 we achieved:

• Net Income attributable to HFC stockholders

of $281 million, $525 million excluding the lower

of cost or market “LOCM” adjustment

• Gross refining margins of $13.98 per produced barrel

• Operating cash flow of $758.6 million

• $1 billion in cash and short-term investments as

of December 31, 2014, compared to approximately

$187 million in long-term debt (exclusive of HEP debt)

• Over $780 million of capital returned to shareholders

In 2014, HollyFrontier delivered improved operational perfor-

mance across our refineries. We are seeing the benefit of

past and ongoing investments being made across our refining

system. Our consolidated refinery utilization rate in 2014 was

91.7%, above our five-year average utilization rate and nearly

a 5% improvement relative to 2013 levels due to a combination

of less planned maintenance activity and lower unplanned

downtime. In 2015 and beyond, we will continue to focus on

improving our operational efficiency, reliability, advantaged

crude access and refinery yield improvement.

STRONG TRACK RECORD OF RETURNING

CAPITAL TO STOCKHOLDERS

HollyFrontier remains committed to generating shareholder

value by returning cash to shareholders. In 2014, HollyFrontier

returned over $780 million to stockholders through regular

quarterly dividends, special dividends and share repurchases.

On an annualized basis, the Company’s cash dividend yield was

8.7% as of year-end 2014. In February 2015, the Board of Direc-

tors authorized a new $500 million share repurchase program

reflecting our renewed focus on share repurchases to augment

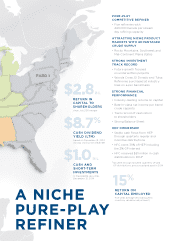

our dividend program. Since completing the HollyFrontier

merger in July 2011, the Company has returned approximately

$2.8 billion in capital to stockholders.

INVESTING IN OUR OPERATIONS

In 2014, we invested $485 million in our facilities improving

our refining capabilities, safety and refinery reliability and

minimizing our environmental impact. Several of our investments

are scheduled to complete in 2015 and once operational will

augment HollyFrontier’s margins and drive sustainable long-term

value. Our 2014 capital investment projects included:

2 HollyFrontier Corporation 2014 Annual Report

HollyFrontier Corporation reported

Net Income attributable to HollyFrontier

stockholders of $281 million, or

$525 million excluding a $397 million

non-cash, pre-tax charge for inventory

valuation adjustment. We were not

immune to commodity price volatility

in 2014, during which domestic

crude prices plummeted 46% and

the WTI/Brent crude differential

compressed 40%. Our reported

gross margin per barrel declined only

13% to $13.98 per barrel reflecting

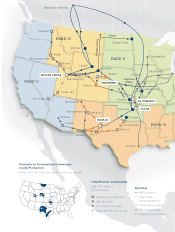

our advantaged geographic location

close to inland crude production

and niche product markets.

DEAR STOCKHOLDERS