HollyFrontier 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 HollyFrontier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

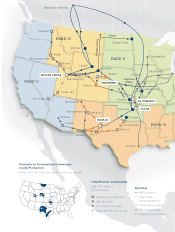

PADD I

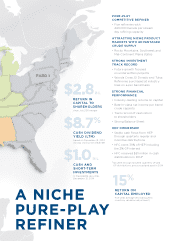

A NICHE

PURE-PLAY

REFINER

PURE-PLAY

COMPETITIVE REFINER

• Five refineries with

443,000 barrels per stream

day refining capacity

ATTRACTIVE NICHE PRODUCT

MARKETS WITH ADVANTAGED

CRUDE SUPPLY

• Rocky Mountains, Southwest and

Mid-Continent Plains states

STRONG INVESTMENT

TRACK RECORD

• Future growth focused

on underwritten projects

• Woods Cross, El Dorado and Tulsa

Refineries purchased at industry

lows on a per barrel basis

STRONG FINANCIAL

PERFORMANCE

• Industry-leading returns on capital

• Best-in-class net income per barrel

crude capacity

• Track record of cash return

to shareholders

• Strong Balance Sheet

HEP OWNERSHIP

• Stable cash flows from HEP

through quarterly regular and

incentive distributions

• HFC owns 39% of HEP including

the 2% GP interest

• HFC received $81 million in cash

distributions in 2014*

* Q4 2013 through Q3 2014 quarterly LP and

GP distributions, announced and paid in 2014

RETURN ON

CAPITAL EMPLOYED

Five-year average (excluding 2014

inventory valuation adjustment)

15%

RETURN IN

CAPITAL TO

SHAREHOLDERS

since July 2011 merger

$2.8 BIL

$8.7%

CASH DIVIDEND

YIELD (LTM)

based on December 31, 2014

closing stock price of $37.48

$1.0 BIL

CASH AND

SHORT-TERM

INVESTMENTS

in marketable securities

December 31, 2014