Henry Schein 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Henry Schein annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Dental Customers: Serves approximately 80% of the estimated 135,000 U.S. and Canadian office-based dental practices and 15,000 dental

laboratories; has approximately 38% share of the estimated $5 billion U.S. and Canadian dental distribution market.

Dental Market Dynamics: Dental service expenditures are expected to increase 6% in each of the next 5 years driven by a number of

factors, including an increase in the percentage of the U.S. population with dental insurance coverage. Those with dental insurance visit the dentist more

often and have more procedures performed. There also is greater emphasis on cosmetic dentistry, and a growing awareness of the correlation between oral

health and overall well-being. In addition, there is a growing use of dentistry in pharmaceutical therapies and diagnostic procedures. As demand for dental

procedures increases, there are fewer practicing dentists. Therefore, greater practice productivity is required. This trend is a strong driver for dental

equipment and technology sales as dental practices are looking to expand their capacity.

Medical Customers: Serves approximately 45% of the estimated 250,000 U.S. office-based physician practices, as well as surgical centers,

and other alternate-care sites; has approximately 17% of the estimated $8 billion medical distribution market.

Medical Market Dynamics: Demand for physician and clinical services are expected to increase over 6% in each of the next 5 years.

A variety of tests, screenings, and other elective and surgical procedures traditionally done in hospitals or acute-care settings are now being performed in

less expensive in-office or alternate-care settings. It is estimated that 63% of all surgeries are now outpatient procedures. In addition, there is continued

growth in the use of vaccines, injectables, and other pharmaceuticals in the alternate-care setting.

Veterinary Customers: Serves over 70% of the estimated 26,000 U.S. veterinary clinics.

Veterinary Market Dynamics: It is estimated that the companion animal market (which is comprised primarily of dogs and cats) is

approximately $2–3 billion and growing at 6–7% annually. This growth is due to favorable demographics, including the growing number of U.S. households

(1.2 million new households each year), a higher proportion of households who own pets (60% today versus 56% in 1988), a growing pet population

(142 million cats and dogs in 2003 versus 107 million in 1989) and increasing annual expenditures per pet (8% growth in annual spending per pet for

veterinary services). As a result of the combination of an increase in the use of advanced technology in companion animal treatments and the willingness

of pet owners to spend money on preventative and wellness programs for their pets due to strong emotional connections, the companion animal segment

is poised to continue growing.

International Customers: Serves approximately 230,000 office-based dental, medical, and veterinary practices in 17 countries outside of the United States and Canada, including:

Austria, Australia, Belgium, the Czech Republic, France, Germany, Iceland, Ireland, Israel, Italy, Luxembourg, the Netherlands, New Zealand, Portugal, Spain, Switzerland, and the United Kingdom.

In addition, practitioners in over 200 countries are served through Schein Direct®, which provides door-to-door air package delivery service. The Company currently holds approximately 20% share

of the estimated $5 billion European dental distribution market; and approximately 5% share of the estimated European medical and veterinary distribution market.

International Market Dynamics: Practitioners around the globe have similar needs and face many of the same challenges as they look to operate efficient and profitable

practices, while providing a high quality of patient care. Henry Schein is uniquely positioned to serve these practitioners and take a leadership role in the European dental, medical, and veterinary

distribution markets, estimated to be growing at approximately 5% annually, by continuing to develop an infrastructure based on its state-of-the-art U.S. model. The Company will continue to

explore expansion opportunities abroad in countries where it currently has a presence, as well as potential expansion into new markets.

Technology Customers: Serves dental and medical practices, and veterinary clinics. More than 50,000 proprietary software systems are installed, including DENTRIX®and Easy Dental®

for dental practices; LabNet for dental laboratories; AVImark®for veterinary clinics; and EMR solutions for physician practices. These software solutions provide practitioners with an array of clinical and

practice management features, including patient treatment history, billing, accounts receivable management, appointment calendars, electronic claims processing, and much more. Other Value-Added

Services offered by Henry Schein include an array of financial services and continuing education programs for healthcare professionals.

Technology Market Dynamics: There is opportunity to cross-sell a number of additional products through relationships with practice management software customers. These

products include core consumables; equipment and services; high-tech products that interface with practice management software, such as digital X-ray and intraoral imaging; and other add-on products

and services, such as e-claims, statement processing, and continuing education. At Henry Schein we are truly committed to providing customers with the tools needed to manage more efficient practices.

In an independent survey, DENTRIX software was ranked number one in customer satisfaction with superior clinical features, and was deemed to be the fastest growing in the marketplace.

HENRY SCHEIN

BY THE NUMBERS

YEAR END 2005

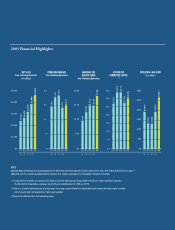

▲Sales of $4.6 billion

▲Nearly 11,000 Team Schein

Members

▲More than 500,000 customers

▲Operations in 19 countries

▲More than 170,000 products

available

▲More than 50,000 practice

management software

systems installed

▲33 million health insurance

claims processed electronically

▲99% customer order

fulfillment rate

▲Over 10 million customer

orders shipped