Health Net 1998 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1998 Health Net annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F O U N D ATIO N H EALTH SYST EM S, I N C . 5

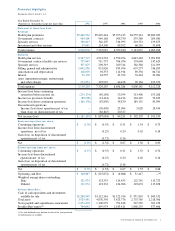

Government contracts revenue did rise during the year while the overall financial performance of

this unit remained relatively stable. Specialty Services revenue climbed 7 percent in 1998 as our

mental health and certain other specialty operations continued to grow.The margins and returns in

mental health are especially attractive and we intend to support its growth in the future.

Selling,General and Administrative (SG&A) expenses rose substantially during 1998.Acquisitions

were the single largest reason for the increase, but management is focused on reducing overall

SG&A in the future. Interest expense also rose in 1998,a result of higher borrowings.

We all recognize that we must continue to strengthen the balance sheet.As it is, we did end the

year with $200 million more in cash compared with year-end 1997. Reserves for claims payable

were essentially flat with the level at December 31,1997.This is appropriate and consistent with

overall enrollment. Goodwill and stockholders’ equity did fall during the year, a direct consequence

of the many charges we took to aid in our strategic focus on core operations.

FHS recorded significant charges and write-offs in both the third and fourth quart e r s .W h at were they for?

The total charges for 1998 we r e approximately $411 million and comprised many items – rangi n g

f rom re s t ru c t u ring charges, to write-offs associated with divested bu s i n e s s e s , to re c ognizing asset

i m p a i rment charges.These we re ve ry difficult but necessary actions to refocus the company for the

f u t u re. I m p o rt a n t l y, the cash impact of these charges will be less than the total amount of the charges.

FHS is a highly leveraged company.W hat are you doing to reduce debt?

Debt reduction is a high pri o rity for FHS. Our debt levels rose during the ye a r, but fell at ye a r -

end due to $200 million in proceeds from the sale of the wo r ke rs ’compensation operations.

We are currently divesting a number of other assets and the funds raised in these asset sales will

be used to further reduce debt. I might add that our banking group has been ve ry support ive

d u ring this pro c e s s .

W h a t other initiat ives have been implemented in the financial area and wh a t do you plan for next ye a r ?

This past year I centralized the finance function at corporate headquarters and installed a new

financial discipline company-wide.We also implemented a much more detailed review of capital

expenditures.In 1998,capital expenditures,primarily computers and software, was approximately

$150 million.While sophisticated information systems are vital to our business, the 1998 level was

too high.Thanks to our more rigorous review process,1999 capital expenditures should be less

than half the 1998 level.The central planning and budgeting team launched a thorough monthly

forecasting process for both cash and operating results,and we implemented a monthly operating

review process with our operating units. On the accounting side, the corporate controller’s team is

leading a thorough examination of our closing processes to accelerate our monthly closing cycle.

Treasury operations will centralize cash management.Finally, the operating chief financial officers

(CFOs) have elevated their involvement and presence in their businesses while maintaining an

independent financial perspective in our new matrix organizational structure for finance.

We are also instituting a more thorough review of our internal rates of return, examining each of

our core operations to be certain that they are achieving,or have the potential to achieve, returns

in excess of our cost of capital.This is a vital discipline for FHS going forward and one that is

directly in line with the best interests of our stockholders.

I am tremendously proud of the high caliber finance group that was assembled at corporate head-

quarters and the operating CFOs, all of whom continue to make a significant difference for FHS.