Health Net 1998 Annual Report Download

Download and view the complete annual report

Please find the complete 1998 Health Net annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOUNDATION HEALTH SYSTEMS, INC.

1998 Annual Repor t

Focusing on

the basics

Table of contents

-

Page 1

FOUND ATION HEALTH S Y STEMS , INC . 1998 Ann ual Repor t Focusing on the basics -

Page 2

... our partners to provide high quality, innovative and affordable solutions to our members' health care needs The FHS Mission For Our Cust ome r s â- Eliminate worries and complexities from the process of accessing and receiving quality health care services Provide affordable health care products... -

Page 3

... 18,434 $ 101,533 $ 0.73 0.16 Health plan services Government contracts health care services Specialty services Selling, general and administrative Amortization and depreciation Interest Asset impairment,merger, restructuring and other charges Total expenses Income (loss) from continuing operations... -

Page 4

... health plans in California,Arizona and the Northeast.We also have interesting oppotunities in Florida, O regon and Washington. O ur specialty operations include Managed Health Network, one of the nation's leading mental health management organizations,as well as growing dental and vision companies... -

Page 5

... Louisiana,O klahoma and Texas. We also sold our call center operations for $36 million. After the year-end, we entered into a definitive agreement to sell our pharmacy processing operations for $70 million and also entered into agreements to sell health plans in Colorado and New Mexico.We intend to... -

Page 6

... restructuring and other charges. In 1998, revenues and health care costs were both up. Enrollment was essentially flat overall, as we did not sacrifice sound pricing economics for the sake of growth. Health care costs rose more quickly than we had planned, prompting management to implement various... -

Page 7

... and software, was approximately $150 million.While sophisticated information systems are vital to our business, the 1998 level was too high.Thanks to our more rigorous review process,1999 capital expenditures should be less than half the 1998 level.The central planning and budgeting team launched... -

Page 8

...marketplace and our members. T he health care environment in California is changing. How has Health Net reacted? We have listened to the marketplace and we've responded.In early 1998, we introduced an open access product that gives consumers greater choice.We've enhanced our direct referral program... -

Page 9

..., we have the processes and contingency plans in place which we believe will be sufficient to keep as many physicians as we can in our network and ensure our members have access to health care services. How did rising medical costs impact Health Net in 1998? Health Net continues to share financial... -

Page 10

... the Northeast market? The Northeast market is an area of tremendous growth opportunity for FHS - in particular, the New York City metropolitan area.Managed care is still fairly new to this area, yet the demand for sensibly priced health care products is very strong. Physicians Health Services (PHS... -

Page 11

...to offer seniors comprehensive benefits. In addition, we are establishing strong provider relationships with some of New York's finest health care organizations.These groups are centrally located in the areas where we have great growth opportunities and can offer a competitively priced product. Most... -

Page 12

... care delivery system,the DoD could better manage costs and enhance quality.We were right. We now serve as the contractor for three DoD contracts that provide health care services to 1.5 million beneficiaries and generate approximately $1 billion in annual revenue for FHS. O ur TR ICAR E business... -

Page 13

... manage pharmacy benefits,formularies and rising pharmacy costs. This helps FHS provide consumers a benefit that is both comprehensive and affordable, giving our members greater access to medications through new benefit plans and increased manufacturer discounts. How did dental and vision do in 1998... -

Page 14

... physician and hospital network is critical to Intergroup's future. How do medical groups fit with Intergroup's future? We believe the position of medical groups is waning in Arizona.O ver the last few years, we've seen several groups experience financial difficulties that put them out of business... -

Page 15

.... We've managed our Y2K costs as part of our ongoing information technology budget,and that's good news. Dale Te rre l l Dale Terrell joined the company in January of 1998. For the last year, he has focused on integrating multiple information technology systems, applications and platforms. He... -

Page 16

..., and 1998 was no exception.The Florida Medicare market is extremely competitive, yet we were still able to offer excellent benefit packages to seniors and maintain favorable MCR s. In addition, we made significant progress in bringing commercial pricing in line with actual medical cost trends.In... -

Page 17

Mar ke t f or Regist ra nt 's Com m on Equit y a nd Re la ted Stoc kholde r Ma tt e rs ...1 6 M a n a g e m e n t 's Disc ussion a nd Ana lysis of Fina nc ia l Condit io n an d Result s of Ope ra tions ...1 7 Qua nt itat ive a nd Qu ... -

Page 18

... nd Re l ate d Stoc k holde r Ma tte r s The following table sets forth the high and low sales prices of the Company's Class A Common Stock, par value $.001 per share (the "Class A Common Stock"), on The New York Stock Exchange, Inc. ("NYSE") since January 2,1996. High Calendar Q uarter - 1996 First... -

Page 19

....These health plans are located in Arizona, California,Colorado, Connecticut, Florida,Idaho, Louisiana,N ew Jersey, New Mexico, New York, O hio, O klahoma, O regon, Pennsylvania,Texas,Utah, Washington and West Virginia.The Company's health plans provide a wide range of managed health care services... -

Page 20

...nt I nf or m a t i o n Year Ended December 31, (Amounts in thousands) 1998 1997 Percent Change 1996 Percent Change Health Plan Services: Commercial Medicare R isk Medicaid Government Contracts: CHAMPUS PPO and Indemnity CHAMPUS HMO 3,287 326 586 4,199 784 783 1,567 3,522 308 442 4,272 1,090... -

Page 21

... was primarily due to higher pharmacy costs in all divisions,benefit cost increases which exceeded premium rate increases, increased utilization and continued pricing pressures through out the Company's health plans.Excluding the 1998 Charges,the MCR was 85.0%. The overall MCR for the year ended... -

Page 22

... July 19,1998, FPA Medical Management,Inc. ("FPA") filed for bankruptcy protection under Chapter 11 of the Federal Bankruptcy Code. FPA, through its affiliated medical groups,provided services to approximately 190,000 of the Company's affiliated members in Arizona and California.FPA has discontinued... -

Page 23

... MCR was 86.6%. Health plan health care costs increased by 6.8% for the year ended December 31, 1997 as compared to 1996.In the California market,health care costs increased as a result of higher pharmacy costs for both the commercial and Medicare lines of business, increased provider contracting... -

Page 24

...in commercial HMO markets in California and the health plans in the western and central states. Commercial health care costs on a per member per month basis have increased 8.1% during the year ended December 31,1998 as compared to the year ended December 31,1997. The Company's Medicare product lines... -

Page 25

... its ability to maintain effective control over health care costs while providing members with quality care. Factors such as health care reform,integration of acquired companies, regulatory changes,utilization,new technologies,hospital costs,major epidemics and numerous other external influences may... -

Page 26

... software isYear 2000 compliant.The remaining systems'compliance with Year 2000 will be addressed by internal technical staff.The Company has engaged IBM Global Services to assist in the program management of the project.In addition, the Company is in the process of assessing its third party... -

Page 27

... as well as on-line files of its members to avoid disruption in the verification of membership and eligibility for the provision of health care services to its members. Risks - The Company is highly dependent upon its own information technology systems and that of its providers and customers.Failure... -

Page 28

... of $125.9 million in the prior year.This change was due primarily to the timing of payments of accounts payable and other liabilities, including payments for merger, restructuring and other costs associated with the 1998 Charges. Net cash provided by investing activities was $147.0 million during... -

Page 29

... R plus 1.50%. In February 1999,the Company entered into an agreement to sell its pharmacy benefits management business to an unrelated third party for $70 million in cash.The Company intends to use the net proceeds from the sale to reduce corporate debt. T he Company has initiated a formal plan to... -

Page 30

... affect asset performance; that is,economic activity, inflation and interest rates, as well as regional and industry factors. In addition, the Company has some interest rate market risk due to its borrowings. Notes payable, capital leases and other financing arrangements total $1,256 million and... -

Page 31

...with the independent auditors providing for full and free access to the Committee. Earl B. Fowler, Chairman Audit Committee March 31,1999 R e p o r t of I nde pe nde nt Auditor s To the Board of Directors and Stockholders of Foundation Health Systems,Inc. Woodland Hills,California We have audited... -

Page 32

...Healt h Systems, Inc. (Amounts in thousands) December 31, ASSETS: 1998 1997 Current Assets: Cash and cash equivalents Investments - available for sale Premium receivables,net of allowance for doubtful accounts (1998 - $28,522;1997 - $22,900) Amounts receivable under government contracts Deferred... -

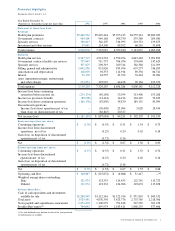

Page 33

...0.20 0.16 0.67 124,453 124,966 Health plan services Government contracts health care services Specialty services Selling,general and administrative Amortization and depreciation Interest Asset impairment,merger, restructuring and other charges Total expenses Income (loss) from continuing operations... -

Page 34

...ther changes Changes in assets and liabilities,net of effects of acquisitions: Premium receivable and unearned subscriber premiums O ther assets Amounts receivable/ payable under government contracts Reserves for claims and other settlements Accounts payable and accrued liabilities Net cash provided... -

Page 35

... on sale of Medical Practices Transfer of investment as consideration for PACC acquisition Conversion of FO HP convertible debentures to equity Profit sharing plan shares issued Acquisition of Busine sse s: Fair value of assets acquired Liabilities assumed Issuance of common stock Cash paid for... -

Page 36

... comprehensive income Redemption of common stock Retirement of treasury stock,net Exercise of stock options including related tax benefit Conversion of Class B to Class A Employee stock purchase plan Balance at December 31,1997 Comprehensive income: Net income Change in unrealized depreciation on... -

Page 37

... comprehensive income Redemption of common stock Retirement of treasury stock,net Exercise of stock options including related tax benefit Conversion of Class B to Class A Employee stock purchase plan Balance at December 31,1997 Comprehensive income: Net income Change in unrealized depreciation on... -

Page 38

....These health plans are located in Arizona, California,Colorado, Connecticut, Florida,Idaho, Louisiana,New Jersey, New Mexico, New York,O hio, O klahoma,O regon, Pennsylvania,Texas,Utah, Washington, and West Virginia.The Company's health plans provide a wide range of managed health care services... -

Page 39

... plan services premium revenues include HMO and PPO premiums from employer groups and individuals and from Medicare recipients who have purchased supplemental benefit coverage, which premiums are based on a predetermined prepaid fee, Medicaid revenues based on multi- year contracts to provide care... -

Page 40

... certain hospitals to provide hospital care to enrolled members on a capitation basis.The HMO s also contract with hospitals, physicians and other providers of health care, pursuant to discounted fee-for-service arrangements,hospital per diems,and case rates under which providers bill the HMO s for... -

Page 41

... with respect to premium receivables are limited due to the large number of payers comprising the Company's customer base.The Company's 10 largest employer groups accounted for 17% and 36% of receivables and 12% and 16% of premium revenue as of December 31,1998 and 1997, respectively, and for the... -

Page 42

... Accounting Principles Board O pinion No. 25,"Accounting for Stock Issued to Employees." Under the intrinsic value method,compensation cost for stock options is measured at the date of grant as the excess,if any, of the quoted market price of the Company's stock over the exercise price of the option... -

Page 43

... PACC HMO and PACC Health Plans (collectively, "PACC"), which are managed health care companies based near Portland,O regon, for a purchase price of approximately $43.7 million in cash. The acquisition was recorded using purchase accounting and the excess of the purchase price over the fair value of... -

Page 44

... 14, 1997,the Business Insurance Group, Inc., a subsidiary of the Company, acquired the Christiania General Insurance Corporation of New York ("CGIC") for $12.7 million in cash.The acquisition has been recorded using purchase accounting and the excess of the purchase price over the fair value of the... -

Page 45

... - I nve st m ent s As of December 31,the amortized cost, gross unrealized holding gains and losses and fair value of the Company's available-for-sale investments were as follows (in thousands): 1998 Gross Unrealized Holding Gains Gross Unrealized Holding Losses Amortized Cost Fair Value $137,900... -

Page 46

... stock option plan,the Company grants options at prices at or above the fair market value of the stock on the date of grant.The options carry a maximum term of up to 10 years and in general vest ratably over three to five years. The Company has reserved a total of 23.2 million shares of its Class... -

Page 47

... were estimated using the Black-Scholes option-pricing model.The following weighted average assumptions were used in the fair value calculation for 1998, 1997 and 1996, respectively:(i) risk-free interest rate of 4.57%, 5.71% and 6.23%;(ii) expected option lives of 1.9 years,3.7 years and 2.7 years... -

Page 48

... $11.70 to $35.25 were exchanged for options representing approximately 1.4 million shares of stock at an exercise price of $12.94,which was the fair market value of the underlying shares at the grant date. As fair value criteria was not applied to option grants and employee purchase rights prior to... -

Page 49

... of medical, dental and vision benefits during retirement.The plans include certain cost-sharing features such as deductibles,co insurance and maximum annual benefit amounts which vary based principally on years of credited service. O n December 31,1998,the Company adopted SFAS No. 132 "Employers... -

Page 50

... Service cost Interest cost Plan amendments Benefits paid Actuarial loss (gain) Projected benefit obligation,end of year Change in fair value of plan assets: Plan assets, beginning of year Actual return on plan assets Employer contribution Benefits paid Plan assets,end of year Funded status of plans... -

Page 51

....The account for the FHC plan anticipates future cost-sharing changes to the plan consistent with the Company's expressed intent to increase retiree contributions at the same rate as the Company's premium increases. A one-percentage-point change in assumed health care cost trend rates would... -

Page 52

... accounting and reporting practices. Under the California Knox Keene Health Care Service Plan Act of 1975,as amended,California plans must comply with certain minimum capital or tangible net equity requirements.The Company's non-California health plans, as well as its health and life insurance... -

Page 53

... costs Provider network consolidation costs Asset impairment costs Real estate lease termination costs Total restructuring costs Asset impairments and other charges related to FPA Medical Management Asset impairment charges and other Merger related costs Gem costs O ther costs Total 1998 Charges... -

Page 54

... locations where office space is duplicated, the consolidation of overlapping provider networks, and the consolidation of information systems at all locations to standardized systems.The June 1997 Plan,which is substantially completed as of December 31,1998, resulted in a restructuring charge... -

Page 55

... loss contract accruals related to governmental employer groups in the Company's non-California markets, consulting and other costs. If not for their unusual nature, approximately $8.5 million of these costs would have been recorded as health plan services and $8.2 million as selling, general and... -

Page 56

... classes of customers.T h e C ompany has two reportable segments: Health Plan Services and Government Contracts/ Specialty Services.The Health Plan Services segment provides a comprehensive range of health care services through HMO and PPO networks.The Government Contracts/ Specialty Services... -

Page 57

...significant items for the three years in the period ended December 31, 1998 (amounts in thousands): 1998 1997 1996 Revenues: Total external revenues Total intersegment revenues Eliminations Consolidated Profit or Loss: Total for reportable segments O ther Total income before taxes Assets: Total for... -

Page 58

...benefit management subsidiary, Foundation Health Pharmaceutical Services, Inc.,for $70 million in cash.Completion of the transaction is subject to certain closing conditions, and is expected to close in the first half of 1999. In March 1999, the Company signed a letter of intent to sell its Colorado... -

Page 59

... charge, a copy of the Foundation Health Systems,Inc. Annual R eport on Form 10-K for the year ended December 31,1998,filed with the Securities and Exchange Commission by writing to the following: Investor R elations, Foundation Health Systems,Inc., 21650 O xnard Street, Woodland Hills,California... -

Page 60

FOUND ATION HEALTH S Y STEMS , INC . 21650 Oxnard Street, Woodland Hills, California 91367