Hamilton Beach 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

c c c 5c c c

of continuing uncertainty regarding the pace and

sustainability of the market recovery. However, market

improvements, NMHG’s programs and substantial

operating leverage have established a strong platform

for achieving its operating profit margin target when

the market does peak. As each of NACCO’s subsidiaries

proceeds with specific programs designed to achieve

its targets and market conditions continue to improve,

the Company expects that its subsidiaries’ operating

fundamentals will position each to achieve its long-

term financial goals.

NACCO Materials Handling Group

2010 Results

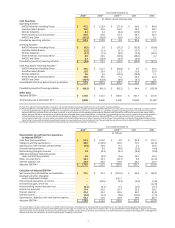

The lift truck market experienced unprecedented

declines in 2008 and the first half of 2009. In 2010,

however, the market turned up significantly. While

NMHG’s primary markets are still at lower-than-

prerecession levels, the upturn occurred earlier and

more vigorously than NMHG expected. The recovery

in 2010 resulted in a 22 percent increase in revenues

from $1.5 billion in 2009 to $1.8 billion, which was

driven by a 44 percent increase in new unit shipments,

as well as increased part sales. These improved

volumes, combined with the results of programs put in

place to counter the 2008-09 downturn and strategic

programs initiated earlier, helped drive the substantial

improvement in results from a net loss of $43.1 million

in 2009 to net income of $32.4 million in 2010. While

NMHG generated strong cash flow before financing

activities of $39.0 million in 2010, the amount was

significantly below 2009 since working capital needs

were increasing rather than declining.

The market turnaround resulted in a number of

other positive developments during the year. In the

first half of 2010, a substantial backlog developed and

lead times became longer than normal. In the second

half, increases in plant workforce levels and added

shifts for certain manufacturing operations increased

production, particularly in the fourth quarter, with

the result that the backlog and lead times were slightly

reduced by the end of the year. Although the company

continued to exert tight control of expenses and capital

expenditures throughout 2010, employees’ salaries,

which had been reduced in 2009, were gradually

restored during the course of the year. In 2010, NMHG

continued to strengthen its distribution network by

divesting all but one of its remaining owned retail

dealerships to independent owners, adding strong

independent dealers in the United Kingdom and

Russia and generally consolidating its global distribu-

tion network. Major enhancements were also made to

NMHG’s product lines. All of these factors, combined

with NMHG’s aggressive actions to help dealers

significantly reduce inventories at the beginning of

the downturn, allowed the company to gain market

Left: Yale’s new electric-rider lift truck series, the

Yale® ERP-VF four-wheel (left) and ERP-VT three-wheel

(right) pneumatic tire series, have lifting capacities of

3,000 to 4,000 pounds. These trucks have been designed

for overall productivity at lower costs.