Hamilton Beach 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

c c c 11 c c c

Hamilton Beach Brands

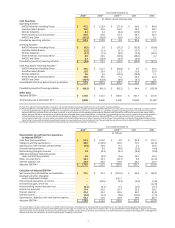

2010 Results

Hamilton Beach Brands had strong financial

results and solid cash flow before financing activities

in 2010. Revenues improved from $497.0 million in

2009 to $515.7 million in 2010 primarily as a result

of significantly higher unit sales volumes. However,

despite these higher volumes and lower product

costs in the first half of the year, net income declined

moderately to $24.4 million in 2010 from $26.1 million

in 2009. In 2009, margins were unusually strong in the

U.S. consumer market and the company had reduced

costs as a result of lower employee compensation and

benefits, all of which returned to more normal levels

in 2010. These factors, along with increased product

and transportation costs in the second half of 2010,

resulted in the slight decline in 2010 net income.

HBB generated cash flow before financing activities

of $12.8 million in 2010, down from the prior year

amount of $33.4 million as a result of higher finished

goods inventory levels at the end of 2010.

Outlook for 2011

The small kitchen appliance market in which

HBB participates has largely recovered. Nonetheless,

although consumer confidence and other key

indicators have improved compared with 2009,

the U.S. mass market is expected to remain soft

as mass-market consumers continue to struggle

with financial concerns and unemployment rates

remain high. International markets and commercial

product markets experienced a stronger recovery in

2010 and the momentum seen in these markets is

expected to continue into 2011.

In 2011, the company will continue to invest in

innovative products and value-added services for

its key customers to ensure HBB products maintain

their current strong market position. HBB continues

to focus on strengthening its market position with

all retailers through product innovation, promotions,

increased placements and branding programs,

as well as appropriate levels of advertising for the

company’s highly successful Brewstation®coffee maker

and Stay-or-Go®slow cooker lines. In addition, the

company expects to continue to introduce innovative

products in several small appliance categories. In

2011, HBB plans to continue to strengthen its focus

on the higher-end U.S. consumer market. The new

Melitta-branded beverage appliances, introduced in

late 2010, are expected to continue to gain position in

2011. The company also expects to launch the ScoopTM,

a single-serve coffee maker, and a new DurathonTM

iron product line. As a result of these new products,

HBB anticipates revenues in 2011 will increase

compared with 2010.

Bottom left: Hamilton Beach® products are designed

to fit every kitchen style and lifestyle. Featured -

Hamilton Beach® Stay or Go® slow cooker.

Bottom right: Hamilton Beach® slow cookers are

versatile for everyday meals or for entertaining in

the home. Featured - Hamilton Beach® 3-in-One

Slow Cooker.

At right: Hamilton Beach Brands’s newest products

include, clockwise at top: Hamilton Beach® Wave

Power® Plus blender, Hamilton Beach® BrewStation®

12-cup dispensing coffeemaker, Hamilton Beach®

FashionFirst™ iron, Hamilton Beach® Half Pint™ soft-

serve ice cream maker, Melitta® 12 cup coffee brewer.