Hamilton Beach 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 in the range of approximately $2.5 million to

$3.0 million pre-tax for services rendered prior to

entering into the settlement agreement. The payment

was received in February 2011. As a result of the

settlement, no further litigation costs in relation to

this matter will be incurred.

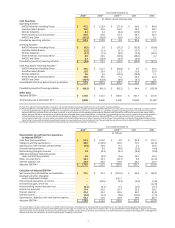

In 2008 and 2009, NACCO made capital contribu-

tions to several of its subsidiaries to help them navigate

the economic downturn. In 2010, only small capital

contributions were made to NMHG. During 2010,

both NMHG and Kitchen Collection renegotiated

certain credit agreements on favorable terms. All

other financing arrangements at the other subsidiaries

remain in place with attractive terms.

Importantly, each of NACCO’s subsidiaries

generated strong positive cash flow before financing

activities in 2010 totaling $57.3 million on a consoli-

dated basis. While cash flow before financing activities

was substantial in 2010, it was significantly lower than

the $180.1 million generated in 2009 when working

capital requirements contracted during the downturn

and the Company benefited from asset sales. NACCO

will continue to focus on maximizing cash flow before

financing activities and expects continued strong cash

flow generation at all subsidiaries in 2011.

Improved market conditions are expected to

continue into 2011, but all subsidiaries are proceeding

cautiously until market prospects become clearer.

The global lift truck market is improving, but the pace

of recovery is still unclear and periodic supply chain

constraints are likely as suppliers work to increase

volume levels. While continued improvement in

consumer confidence is expected, selling to the mass-

market consumer is expected to remain challenging

until the job market recovers. In addition, rising com-

modity costs are expected to create margin pressures

at HBB and NMHG since recovering these cost

increases through price increases will be challenging.

Lignite deliveries are expected to remain relatively

stable, but the limerock market in southern Florida is

expected to continue to be depressed by weak local

housing and construction markets. The Company

expects improved earnings at the subsidiaries in light

of these anticipated market conditions, but at lower

levels than might otherwise be expected due to the

full restoration in 2011 of employee compensation

and benefits at NACCO and all of its subsidiaries, as

well as the non-recurrence in 2011 of favorable foreign

currency contracts that benefited NMHG in 2010.

Subsidiary Financial Objectives

Each of NACCO’s subsidiary companies has

specific long-term financial objectives (see sidebar

for specific goals). In 2010, NACoal achieved all of its

financial targets. HBB had sound operating profit but

fell somewhat short of its long-term operating profit

margin target in 2010. Kitchen Collection made solid

progress in each of its store formats but also fell

below its target. At both HBB and Kitchen Collection,

operating profits declined compared with 2009 as a

result of the full reinstatement of employee benefits

that were suspended in 2009 and restored in 2010.

Looking forward, HBB is expected to continue to have

sound results but will need additional sales volume

to achieve its target. Kitchen Collection®stores

operated close to target in 2010 and are expected to

achieve their operating profit margin goal in 2011,

but the Le Gourmet Chef®stores are not expected

to achieve their target objective until sales volumes

increase and additional underperforming stores have

been closed. Improving market conditions in the lift

truck market have helped NMHG return to more

normal operating levels and allowed the company

to make substantial progress toward its financial

objectives. Nevertheless, actual results at NMHG

remain well below the target level. Because reaching

appropriate capacity utilization will require increased

market share and because reaching target margins

on certain products is necessary, particularly in

the smaller internal combustion engine products,

it is difficult to provide a timetable for achieving

NMHG’s financial target–particularly in the context

c c c 4c c c