Hamilton Beach 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

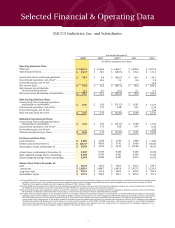

Selected Financial & Operating Data

c c c 1c c c

NACCO Industries, Inc. and Subsidiaries

Year Ended December 31

2010(4) 2009(4) 2008(1)(4) 2007 2006

(In millions, except per share data)

Operating Statement Data:

Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Operating profit (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income (loss) from continuing operations . . . . . . . . . . . . .

Discontinued operations, net-of-tax(2) . . . . . . . . . . . . . . . . .

Extraordinary gain, net-of-tax(3) . . . . . . . . . . . . . . . . . . . . . .

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net (income) loss attributable

to noncontrolling interest . . . . . . . . . . . . . . . . . . . . . . . . .

Net income (loss) attributable to stockholders . . . . . . . . . .

Basic Earnings (Loss) per Share:

Income (loss) from continuing operations

attributable to stockholders . . . . . . . . . . . . . . . . . . . . . . .

Discontinued operations, net-of-tax(2) . . . . . . . . . . . . . . . . .

Extraordinary gain, net-of-tax(3) . . . . . . . . . . . . . . . . . . . . . .

Basic earnings (loss) per share . . . . . . . . . . . . . . . . . . . . . . .

Diluted Earnings (Loss) per Share:

Income (loss) from continuing operations

attributable to stockholders . . . . . . . . . . . . . . . . . . . . . . .

Discontinued operations, net-of-tax(2) . . . . . . . . . . . . . . . . .

Extraordinary gain, net-of-tax(3) . . . . . . . . . . . . . . . . . . . . . .

Diluted earnings (loss) per share . . . . . . . . . . . . . . . . . . . . .

Per Share and Share Data:

Cash dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Market value at December 31 . . . . . . . . . . . . . . . . . . . . . . .

Stockholders’ equity at December 31 . . . . . . . . . . . . . . . . .

Actual shares outstanding at December 31 . . . . . . . . . . . .

Basic weighted average shares outstanding . . . . . . . . . . . .

Diluted weighted average shares outstanding . . . . . . . . . .

Balance Sheet Data at December 31:

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 2,310.6

$ 59.1

$ 8.4

22.6

–

$ 31.0

0.1

$ 31.1

$ 1.03

2.72

–

$ 3.75

$ 1.03

2.72

–

$ 3.75

$ 2.068

$ 49.80

$ 47.82

8.294

8.290

8.296

$ 256.2

$ 1,488.7

$ 377.6

$ 396.6

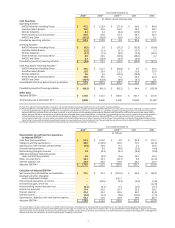

$ 3,665.1

$ (389.5)

$ (439.7)

2.3

–

$ (437.4)

(0.2)

$ (437.6)

$ (53.12)

0.28

–

$ (52.84)

$ (53.12)

0.28

–

$ (52.84)

$ 2.045

$ 37.41

$ 43.05

8.286

8.281

8.281

$ 138.2

$ 1,687.9

$ 400.3

$ 356.7

$ 3,590.0

$ 139.2

$ 89.7

0.6

–

$ 90.3

0.1

$ 90.4

$ 10.87

0.07

–

$ 10.94

$ 10.86

0.07

–

$ 10.93

$ 1.980

$ 99.69

$ 107.80

8.269

8.263

8.272

$ 281.2

$ 2,427.3

$ 439.3

$ 891.4

$ 3,327.6

$ 171.1

$ 90.5

2.8

12.8

$ 106.1

0.7

$ 106.8

$ 11.07

0.34

1.56

$ 12.97

$ 11.06

0.34

1.56

$ 12.96

$ 1.905

$ 136.60

$ 96.05

8.238

8.234

8.242

$ 196.7

$ 2,154.5

$ 359.9

$ 791.3

(1) During 2008, NACCO’s stock price significantly declined compared with previous periods and the Company’s market value of equity was below its book value of tangible assets

and book value of equity. The Company performed an impairment test, which indicated that goodwill and certain other intangibles were impaired at December 31, 2008.

Therefore, the Company recorded a non-cash impairment charge of $435.7 million in 2008.

(2) During 2009, the Company’s North American Coal subsidiary completed the sale of certain assets of the Red River Mining Company. The results of operations of Red River

for 2009 and all prior periods have been reclassified to reflect Red River’s operating results as discontinued operations.

(3) An extraordinary gain was recognized in 2006 as a result of a reduction to Bellaire Corporation’s estimated closed mine obligations relating to amounts owed to the United

Mine Workers of America Combined Benefit Fund arising as a result of the Coal Industry Retiree Health Benefit Act of 2006.

(4) In 2006, NACCO initiated litigation in the Delaware Chancery Court against Applica Incorporated (“Applica”) and individuals and entities affiliated with Applica’s shareholder,

Harbinger Capital Partners Master Fund, Ltd. The litigation alleged a number of contract and tort claims against the defendants related to the failed transaction with Applica,

which had been previously announced. On February 14, 2011, the parties to this litigation entered into a settlement agreement. The settlement agreement provides for,

among other things, the payment of $60 million to NACCO and dismissal of the lawsuit with prejudice. The payment was received in February 2011. Litigation costs related to

the failed transaction with Applica were $18.8 million, $1.1 million and $0.8 million in 2010, 2009 and 2008, respectively. The Company expects to incur additional litigation

costs for the first two months of 2011 in the range of approximately $2.5 million to $3.0 million for services rendered prior to entering into the settlement agreement. As a

result of the settlement, no further litigation costs in relation to this matter will be incurred.

$ 2,687.5

$ 140.3

$ 79.4

–

–

$ 79.4

0.1

$ 79.5

$ 9.55

–

–

$ 9.55

$ 9.53

–

–

$ 9.53

$ 2.085

$ 108.37

$ 53.69

8.333

8.328

8.344

$ 261.9

$ 1,658.3

$ 355.3

$ 447.4