Hamilton Beach 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

North American Coal

2009 Results

NACoal has had strong, stable

performance over the years and 2009 was

no exception. The long-term nature of

NACoal’s coal supply agreements and the

low cost of power provided by the power

plants it serves resulted in minimal effect

from the recession on the company’s coal

mining operations. Positive financial

developments in 2009 included the sale of

the Red River Mining Company for cash

proceeds of $41.4 million and an after-tax

gain of $22.3 million, the receipt of lease

bonus payments of $7.1 million pre-tax for

leasing certain oil and gas mineral rights

controlled by NACoal to a third party

and significantly improved deliveries and

operations at the Mississippi Lignite Mining

Company compared with 2008. As a result

of the favorable events of 2009, NACoal

generated cash flow before financing

activities of $76.5 million compared with

cash flow before financing activities of

$7.3 million in 2008.

Nevertheless, 2009 did have challenges.

Minimal limerock was mined as a result of

the downturn in the Florida housing and

construction markets and an unfavorable

legal ruling for the Florida lake belt region

that terminated NACoal’s customers’, as

well as others’, existing mining permits at

most of the limerock dragline mining

operations. The nature of the company’s

limerock mining services agreements did,

however, limit the financial impact on

NACoal. In addition, inclement weather in

Mississippi in the fourth quarter reduced

efficiency at that mine and unscheduled

outages throughout the year at the Sabine

Mining Company’s customer’s power plant

resulted in fewer deliveries at that mine.

NACoal entered into a number of

new coal mining contracts in 2009. These

projects are in development phases and

will not be fully operational for several

years. NACoal’s new subsidiary, Camino

Real Fuels, entered into a contract mining

services agreement to mine approximately

2.7 million tons of coal annually with initial

deliveries expected to commence in 2012.

NACoal’s new subsidiary, the Demery

Resources Company, entered into a

contract mining services agreement to

Above: One of the draglines

at The Falkirk Mining Company

in North Dakota.

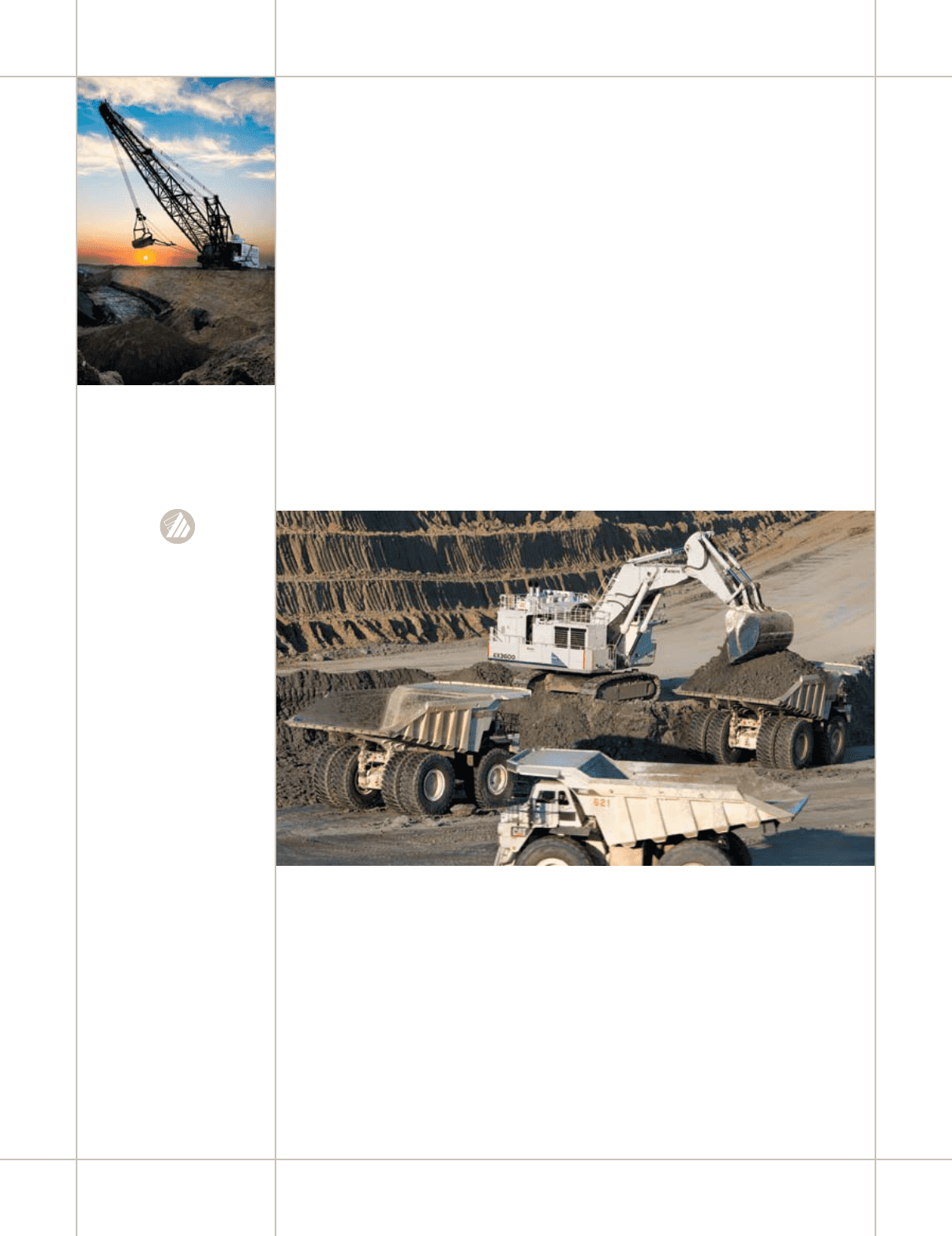

Right: At the Falkirk Mine in

North Dakota, an electric shovel

loads overburden into a fleet of

Caterpillar end dump trucks

to expose the coal for extraction.