Hamilton Beach 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Introduction

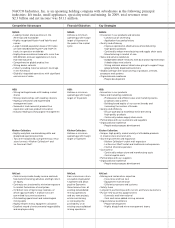

The global recession made 2009 very

challenging for NACCO Industries, Inc. and

its subsidiaries, particularly in the first half

of the year. NACCO’s lift truck business

faced extraordinarily depressed markets

worldwide. Consumer goods markets were

well below earlier peak levels. And while

lignite mining markets remained steady, the

limerock mining markets in Florida were

extremely depressed.

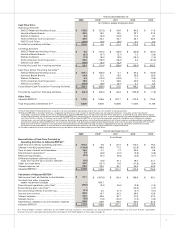

Given these market conditions,

consolidated revenues for NACCO

decreased substantially in 2009 to $2.3

billion compared with $3.7 billion in 2008.

As a result, NACCO Materials Handling

Group (“NMHG”) had a significant loss in

2009 as its revenue declined 48 percent

because global lift truck markets remained

very weak for the entire year. However, at

Hamilton Beach Brands (“HBB”), despite

a decrease in revenues, operating results

were exceptional. Kitchen Collection also

experienced a promising turnaround in

2009, reporting significantly improved

results. North American Coal (“NACoal”)

had an excellent year with improved

results. Overall, we implemented

aggressive actions in 2009 to combat the

recession and made sound progress on

our key improvement programs.

Economic and market conditions

appeared to stabilize in the second half of

2009, with some isolated signs of limited

recovery beginning to emerge. The forklift

truck market appears to have stabilized at

the end of 2009, but at very depressed

levels in NMHG’s largest markets. These

depressed levels are expected to continue

into 2010. NACCO continues to operate

on the assumption that the global lift truck

markets will not improve significantly in

the first half of 2010, and is cautiously

optimistic a moderate recovery in that

market will begin in the second half. The

consumer goods markets appear to be

recovering, although consumers continue

to struggle with high unemployment rates

and lower income levels. The lignite

market is expected to remain stable, and

the limerock market in South Florida is

expected to continue to be depressed by the

weak housing and construction markets.

Aggressive cost containment actions, such

as reduced employee salaries and benefits

and spending and travel restrictions,

remain in effect at NMHG and NACCO

headquarters, and will be phased back in

only as NMHG’s financial results permit.

At the consumer products subsidiaries,

employee-related benefit programs

suspended at the beginning of 2009 were

partially phased back in during the fourth

quarter of 2009 and have been fully

reinstated in 2010.

NACCO and its subsidiaries continue

to be financially secure. In 2009, NACoal

refinanced its credit agreement on favorable

terms. Each of the other subsidiaries

currently has attractive financing in place.

Further, each of NACCO’s subsidiaries

generated extraordinary cash flow before

financing activities in 2009, with

Consolidated NACCO in total generating

$180.1 million. We will continue to focus

on maximizing cash flow before financing

activities in 2010, although levels lower

than in 2009 are expected because 2009’s

significant reductions in working capital

are not expected to reoccur.

NACCO continues to have flexibility

in capitalizing its subsidiaries, an option

To Our Stockholders