Hamilton Beach 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

we believe to be a key advantage of our

operating holding company organization

structure. In 2009, additional capital

contributions of $79.7 million and $3.2

million were made to NMHG and Kitchen

Collection, respectively.

Subsidiary Financial Objectives

Each of NACCO’s subsidiary

companies has specific long-term financial

objectives (see sidebar for specific goals).

In 2009, NACoal and HBB achieved their

targets. However, if HBB had not suspended

certain employee benefits, the company

would have been short of its operating

profit margin target. Looking forward,

HBB is expected to continue to do very well,

but it will need additional sales volume to

achieve its target. Kitchen Collection made

substantial progress toward its financial

objectives in 2009. Kitchen Collection

®

stores were at target, but the Le Gourmet

Chef

®

stores are not expected to achieve

the target objective until 2012 to 2013

as sales volume increases and certain

underperforming stores are closed. Due

to the unprecedented depressed market

conditions in the forklift truck market and

the continuing uncertainty regarding the

timing of an upturn in that market, it is

difficult to provide a timetable for achieving

NMHG’s target. However, NMHG’s

programs created substantial operating

leverage, establishing a strong position to

achieve its operating profit margin target

when the market does peak. Each of

NACCO’s subsidiaries is proceeding with

specific programs designed to achieve its

targets. As market conditions improve, the

Company expects that the subsidiaries’

operating fundamentals and the maturation

of the programs that have been put in place

will position each of them to achieve their

long-term financial goals.

• NACoal: Earn a minimum return on

capital employed of 13 percent and

attain positive Economic Value

Income from all existing consolidated

mining operations and any new

projects while maintaining or

increasing the profitability of all

existing unconsolidated mining

operations

• NMHG: Achieve a minimum

operating profit margin of 9 percent

at the peak of the market cycle

• HBB: Achieve a minimum operating

profit margin of 10 percent

• Kitchen Collection: Achieve a

minimum operating profit margin

of 5 percent

•All subsidiaries: Generate

substantial cash flow before

financing activities

Subsidiary

Financial Objectives:s

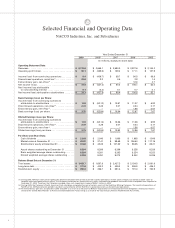

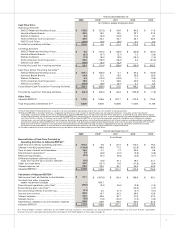

In late 2009, NACoal completed the sale of certain

assets of the Red River Mining Company for cash proceeds of

$41.4 million. Because of this sale, the financial information in

this Annual Report has been reclassified to reflect the Red River

Mining Company operating results as discontinued operations.

As a result, net income(1) for 2009 includes earnings from

discontinued operations of $22.6 million, comprised of the after-

tax gain on the sale of $22.3 million and Red River’s full-year

after-tax earnings of $0.3 million.

Overall, NACCO reported consolidated income from

continuing operations of $8.5 million in 2009, compared with

a consolidated loss from continuing operations of $439.9 million

in 2008. Results for 2008 were negatively affected by a non-cash

write-off of goodwill and certain other intangible assets at

NMHG, HBB and Kitchen Collection totaling $435.7 million,

or $431.6 million net of taxes of $4.1 million, and the recognition

of non-cash charges totaling $29.8 million against certain

accumulated deferred tax assets at NMHG. Including these

charges, in 2008 NMHG incurred a net loss of $376.0 million,

HBB reported a net loss of $73.3 million and Kitchen Collection

reported a net loss of $10.0 million.

Excluding these charges, consolidated adjusted net income

for the year ended December 31, 2008 was $23.8 million, or

$2.87 per share, which includes earnings from discontinued

operations of $2.3 million. “Adjusted net income or loss” in this

letter refers to net income or net loss results that exclude the

goodwill and intangible assets impairment charges as well as

the charges against the accumulated deferred tax assets. (For

reconciliations from 2008 GAAP results to the adjusted 2008

non-GAAP results, see page 16.) The remaining discussion of

2008 results in this letter relates only to adjusted net income or

adjusted net loss unless otherwise noted. Management believes

a discussion of adjusted net income or adjusted net loss is more

reflective of NACCO’s underlying business operations and assists

investors and the subsidiaries' lenders in better understanding the

results of operations of NACCO and its subsidiaries.

During 2009, NACoal reported income from continuing

operations of $30.6 million compared with income from

continuing operations of $19.8 million in 2008. NMHG had a net

loss of $43.1 million in 2009 compared with adjusted net income

of $1.1 million in 2008. HBB had 2009 net income of $26.1

million compared with 2008 adjusted net income of $7.4 million.

Finally, in 2009 Kitchen Collection reported net income of $3.9

million compared with an adjusted net loss of $6.4 million in

2008. Further discussion of these results is contained in each

subsidiary’s section of this letter.

(1) For purposes of this annual report, discussions about income/loss from continuing operations and net income/loss refer to income/loss from continuing

operations attributable to stockholders and net income/loss attributable to stockholders.

Discussion of Results