Hamilton Beach 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

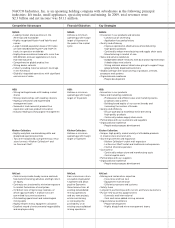

in the beginning of 2009 before reaching

a bottom in mid-2009, where it remained

almost through year end. As a result of these

market conditions, NMHG experienced a

52 percent drop in lift truck unit shipments

and a corresponding 48 percent decline in

revenues in 2009 compared with 2008.

The company reported a significant net loss

for the year ended December 31, 2009.

However, as a result of aggressive programs

to reduce inventories and receivables,

NMHG generated significant cash flow

before financing activities of $121.7 million

in 2009.

NMHG acted early and aggressively to

counteract the market decline. In late 2008,

NMHG implemented cost containment

measures that included reduced salaries and

other employee-related benefits, capital

expenditure restraints, and travel restrictions,

all of which remained in place throughout

2009. In addition, in late 2008 and through-

out 2009, the company implemented

reductions-in-force and plant restructurings

to properly size the organization for the

reduced market levels. Over the year, NMHG

restructured its American and European

sales and marketing work forces to enhance

the effectiveness of these organizations while

at the same time reducing expenses. In

October 2009, the company announced the

shutdown of its Modena, Italy, manufacturing

plant and the transfer of production to its

Masate, Italy, manufacturing plant. These

restructurings were essentially complete

by the end of 2009.

NMHG was fortunate that some key

programs undertaken well in advance of the

downturn were completed in the first quarter

of 2009. A manufacturing restructuring

program, which included the transfer of

the 2.0 to 3.5 ton internal combustion

engine pneumatic lift truck to the Berea,

Kentucky, plant, the closure of the plant in

Irvine, Scotland, and a plant consolidation

in Greenville, North Carolina, all produced

a smaller total plant footprint with

significant efficiencies and enhanced

throughput capacity.

Unlike prior years, currency exchange

rates and material costs had a significant

favorable effect on operating results in 2009

as the dollar strengthened against the British

pound and Australian dollar for the greater

part of the year and as commodity costs

declined compared with 2008. These

benefits were compounded by the favorable

effects of price increases implemented in

prior periods. In addition, current-year

results benefited from the effect of LIFO

liquidations at lower prior-year inventory

costs compared with current-year purchases.

During 2009, NMHG sold its

Australian fleet rental business and the

majority of its Australian retail dealerships,

which has resulted in retail becoming a very

small portion of overall NMHG results. The

company will continue to look to divest

its remaining retail dealerships to strong

independent dealers in the coming year.

NMHG’s market share of factory

bookings declined in 2009 in each area

of the world, largely due to NMHG’s

commitment to reducing dealer inventories

as quickly as possible to market-appropriate

levels and to the disproportionate decline

in the internal combustion engine counter-

balanced truck market in which NMHG has

a more significant share.

Market Outlook for 2010

Global market levels for units and

parts volumes appear to have stabilized in

the second half of 2009. However, NMHG

is not anticipating a market upturn of any

significance in the first half of 2010. The

Chinese market, in which NMHG is not a

significant player, is the only market to

have recovered to pre-recession levels. The

Brazilian market also appears to be turning

up. Latin America and the critical North

American market, as well as European

The new European Hyster®

pneumatic tire, J3.5XN electric lift

truck, with all-weather cab, shown

above, has a lifting capacity

of up to 3.5 metric tons.

The new Yale®GP170-190 Veracitor™

VX, with lifting capacities from

17,000 to 19,000 pounds, features

a 3.3L high output turbo diesel

engine and custom transmission

for maximum performance.