Haier 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

HAIER ELECTRONICS GROUP CO., LTD ANNUAL REPORT 2009

144

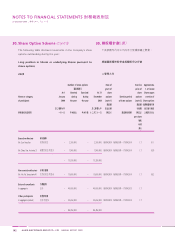

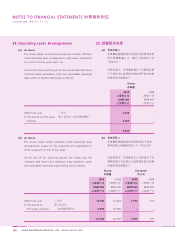

30. Share Option Scheme (Cont’d)

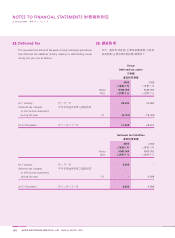

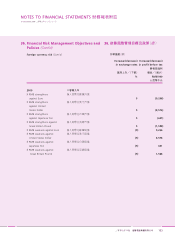

The fair value of equity-settled share options granted during the

year was estimated as at the date of grant, taking into account the

terms and conditions upon which the options were granted. The

following table lists the inputs to the model used:

Executive directors, non-directors and other participants

Dividend yield (%) % 2.38

Historical volatility (%) % 65.10

Risk-free interest rate (%) % 1.731

Contractual life of options (year) 5

Exercise multiple 150%

Weighted average share price (HK$ per share) 1.70

External Consultants

Dividend yield (%) % 2.38

Historical volatility (%) % 67.61

Risk-free interest rate (%) % 1.475

Contractual life of options (year) 4

Exercise multiple 150%

Weighted average share price (HK$ per share) 1.70

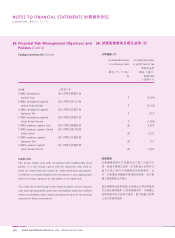

The expected volatility reflects the assumption that the historical

volatility is indicative of future trends, which may also not necessarily

be the actual outcome.

No other feature of the options granted was incorporated into the

measurement of fair value.

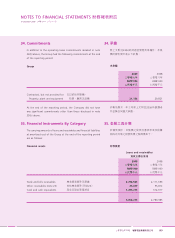

At the end of the reporting period, the Company had 84,450,000

share options outstanding under the Share Option Scheme. The

exercise in full of the outstanding share options would, under

the present capital structure of the Company, result in the

issue of 84,450,000 additional ordinary shares of the Company

and additional share capital of RMB7,431,600 (equivalent to

HK$8,445,000) and share premium of RMB118,905,600 (equivalent

to HK$135,120,000) (before issue expenses).

At the date of approval of these financial statements, the Company

had 84,450,000 share options outstanding under the Share Option

Scheme, which represented approximately 4.2% of the Company’s

shares in issue as at that date.

30.

84,450,000

84,450,000

7,431,600 8,445,000

118,905,600

135,120,000

84,450,000

4.2%