Haier 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

海爾電器集團有限公司 135

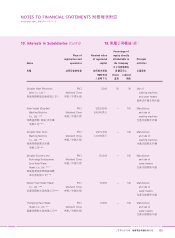

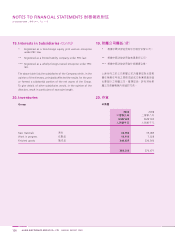

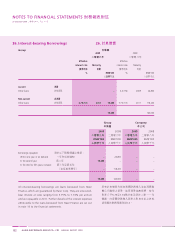

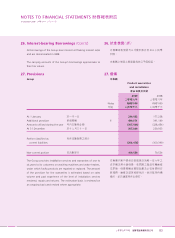

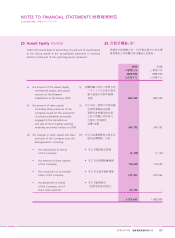

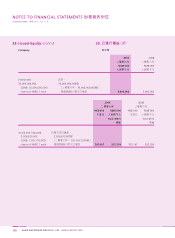

28. Deferred Tax (Cont’d)

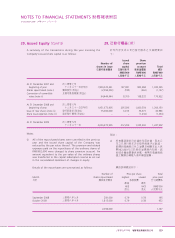

The Group has tax losses arising in Hong Kong of RMB31,782,000

(2008: RMB31,782,000) that are available indefinitely for offsetting

against future taxable profits of the companies in which the losses

arose. The Group also has tax losses arising in Mainland China of

RMB180,278,000 (2008: RMB178,059,000) that will expire in one

to five years for offsetting against future taxable profit. Deferred

tax assets have not been recognised in respect of these losses as

they have arisen in the Company and subsidiaries that have been

loss-making for some time and it is not considered probable that

taxable profits will be available against which the tax losses can

be utilised.

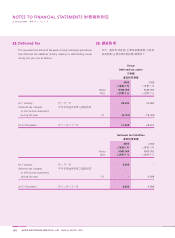

Pursuant to the PRC Corporate Income Tax Law, a 10% withholding

tax is levied on dividend declared to foreign investors from the

foreign investment enterprises established in Mainland China. The

requirement is effective from 1 January 2008 and applies to earnings

after 31 December 2007. A lower withholding tax rate may be

applied if there is a tax treaty between Mainland China and the

jurisdiction of the foreign investors. For the Group, the applicable

rate is 10%. The Group is therefore liable to withholding taxes on

dividends distributed by those subsidiaries established in Mainland

China in respect of earnings generated from 1 January 2008.

Except for the deferred tax liabilities of RMB9,588,000 (2008:

RMB9,588,000), which represents the withholding taxes for the

earnings of the PRC subsidiaries to be remitted, as at 31 December

2009, no deferred tax has been recognised for withholding taxes

that would be payable on the unremitted earnings that are subject

to withholding taxes of the Group’s subsidiaries established in

Mainland China. In the opinion of the directors, it is not probable

that these subsidiaries will distribute such earnings in the

foreseeable future. The aggregate amount of temporary differences

associated with investments in subsidiaries in Mainland China for

which deferred tax liabilities have not been recognised totalled

approximately RMB824,190,000 at 31 December 2009 (2008:

RMB184,928,000).

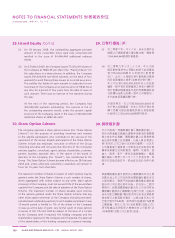

There are no income tax consequences attaching to the payment

of dividends by the Company to its shareholders.

28.

31,782,00031,782,000

180,278,000

178,059,000

10%

10%

9,588,000

9,588,000

)

824,190,000

184,928,000