Freeport-McMoRan 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

As of December 31, 2010, FCX’s estimate of consolidated recoverable proven and

probable reserves totaled 120.5 billion pounds of copper, 35.5 million ounces of gold

and 3.39 billion pounds of molybdenum. Net reserve additions of 20.2 billion pounds

of copper and 0.87 billion pounds of molybdenum replaced approximately 5 times

FCX’s 2010 copper production and approximately 12 times FCX’s 2010 molybdenum

production. Estimated recoverable reserves were determined using long-term average

prices of $2.00 per pound for copper, $750 per ounce for gold and $10.00 per pound

for molybdenum.

At December 31, 2010, in addition to the estimated proven and probable reserves,

FCX identified estimated mineralized material (assessed using a long-term average

price of $2.20 per pound for copper) with incremental contained copper of 110 billion

pounds. FCX continues to pursue aggressively opportunities to convert this mineralized

material into reserves, future production volumes and cash flow.

Reserves and Mineralized Material

Investment in

Attractive

Development

Projects

Cash Flows/

Returns

Mineral

Resources

Reserve

Additions

Production

Growth

Value Creation Focus

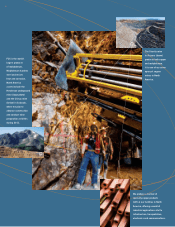

We were successful in

achieving a significant

increase in our mineral

reserves, and exploration

will continue to drive

our future plans. As

we seek new metals

deposits around the

world, we are primarily

focused on the proven

rich areas near our

existing operations.

(pictured: exploration

drilling near the Morenci

mine in Arizona).