Freeport-McMoRan 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FREEPORT-McMoRan COPPER & GOLD INC. 2010 Annual Report

9

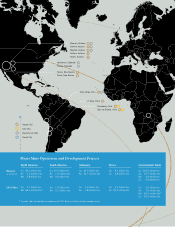

North America

FCX leads the metals industry in North America in the production of copper and

molybdenum. FCX operates seven open-pit copper mines in the United States

(Morenci, Sierrita, Bagdad, Safford and Miami in Arizona, and Tyrone and Chino

in New Mexico). FCX conducts molybdenum mining operations at the Henderson

underground mine in Colorado. Molybdenum is also produced by FCX’s Sierrita and

Bagdad mines.

FCX has restarted the Morenci mill to process available sulfide material currently

being mined and has commenced a staged ramp-up of the mining rate at the Morenci

mine. These activities at Morenci are expected to enable copper production to

increase by approximately 125 million pounds per year. Additionally, FCX is evaluating

further increases to Morenci’s mining rate and the potential of a new mill at Morenci.

FCX has also initiated limited mining activities at the Miami mine and has initiated

a restart of mining and milling activities at the Chino mine.

Construction activities at the Climax molybdenum mine are ongoing; FCX plans to

advance construction and conduct mine preparation activities during 2011. The

timing for start-up of mining and milling activities is dependent on market conditions.

FCX believes that this project is one of the most attractive primary molybdenum

development projects in the world, with large-scale production capacity, attractive

cash costs and future growth options.

Consolidated copper sales in North America totaled 1.1 billion pounds in 2010,

compared to 1.2 billion pounds in 2009. Consolidated molybdenum sales totaled

67 million pounds in 2010, compared to 58 million pounds in 2009. FCX expects

2011 sales from North America copper mines to approximate 1.2 billion pounds of

copper, which reflects increased mining and milling rates at the Morenci mine, and

molybdenum sales to approximate 70 million pounds.

Operational Overview

2010 2011e

Cash Unit Costs (1)

Site Production & Delivery $ 1.50 $ 1.73

By-product Credits (0.35) (0.44)

Treatment Charges 0.09 0.10

Unit Net Cash Costs $ 1.24 $ 1.39

(1) Estimates assume average prices of $4.25/lb for copper and $15/lb for molybdenum for 2011.

Unit net cash costs for 2011 would change by approximately $0.05/lb for each $2/lb change in molybdenum.

(2) Includes copper reserves from Safford, Miami, Tyrone, Chino and Cobre.

Note: e=estimate.

North America Unit Production Costs

per lb of copper

North America Copper

Reserves by Mine

42.2 billion

consolidated lbs

34% Morenci

29% Sierrita

20% Bagdad

17% Other (2)

North America

Copper Sales

in billion lbs

2011e2010

0.75

1.25

1.00

0.50

0.25

Molybdenum Sales+

in million lbs

2011e2010

40

80

60

20

+ Includes sales of

molybdenum produced

at FCX’s North and

South America copper

mines.