First Data 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3) Check verification, settlement and guarantee; and

(4) Other services including output, remittance processing and government services.

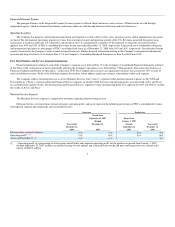

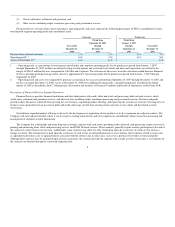

Financial Services revenues from external customers, operating profit, and assets represent the following percentages of FDC's consolidated revenues,

total reported segment operating profit and consolidated assets:

Successor Predecessor

Year ended

December 31,

2008

Period from

September 25, 2007

through

December 31,

2007

Period from

January 1, 2007

through

September 24,

2007

Year ended

December 31,

2006

Revenue from external customers 31% 33% 36% 37%

Operating profit 1, 2 59% 47% 51% 39%

Assets (at December 31)2 16% 16% 14%

1 – Operating profit, as a percentage of total segment and all other and corporate operating profit, for the predecessor period from January 1, 2007

through September 24, 2007 includes accelerated vesting of stock options and restricted stock awards and units and transaction costs related to the

merger of $265.2 million that were recognized in All Other and Corporate. The exclusion of these costs from the calculation would decrease Financial

Services operating profit percentage shown above by approximately 12 percentage points for the predecessor period from January 1, 2007 through

September 24, 2007.

2 – Operating profit and assets were impacted by purchase accounting in the successor period from September 25, 2007 through December 31, 2007 and

for the year ended December 31, 2008. Assets at December 31, 2008 were additionally impacted by a goodwill impairment recorded in the fourth

quarter of 2008 as described in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this Form 10-K.

Description of Financial Services Segment Operations

Financial Services provides financial institutions and other third parties with credit, debit and retail card processing; debit network services; check

verification, settlement and guarantee services; and other services including output, remittance processing and government services. Revenue and profit

growth in these businesses is derived from growing the core business, expanding product offerings, and improving the overall cost structure. Growing the core

business comes primarily from an increase in debit and credit card usage, growth from existing clients and sales to new clients and the related account

conversions.

Growth from expanded product offerings is driven by the development or acquisition of new products as well as expansion into adjacent markets. The

Company will enter adjacent markets where it can leverage its existing infrastructure and core competencies around high volume transaction processing and

management of customer account information.

The Company has relationships and many long-term customer contracts with card issuers providing credit and retail card processing, output services for

printing and embossing items, debit card processing services and STAR Network services. These contracts generally require a notice period prior to the end of

the contract if a client chooses not to renew. Additionally, some contracts may allow for early termination upon the occurrence of certain events such as a

change in control. The termination fees paid upon the occurrence of such events are designed primarily to cover balance sheet exposure related to items such

as capitalized conversion costs or signing bonuses associated with the contract and, in some cases, may cover a portion of lost future revenue and profit.

Although these contracts may be terminated upon certain occurrences, the contracts provide the segment with a steady revenue stream since a vast majority of

the contracts are honored through the contracted expiration date.

8