Fifth Third Bank 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

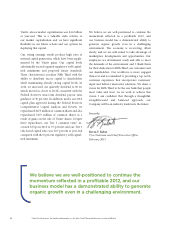

2010 2011 2012

$503

$1,094

$1,541

$1,800

$1,200

$600

$0

2010 2011 2012

3.02%

1.49%

0.85%

4.0%

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0%

2010 2011 2012

7.5%

9.4% 9.5%

10%

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

4 * Non-GAAP measure. For further information, see the Non-GAAP Financial Measures section of MD&A.

age of revenue) of 61.7 percent also remains higher

than our longer-term expectation for a more normal

operating environment. We will continue to carefully

manage expenses in the context of the business and

revenue environment.

Credit metrics continued to improve across the

board. Full year net charge-os of $704 million

declined 40 percent to 85 bps of average portfolio

loans and leases, the lowest level in ve years. Non-

performing assets, including those held-for-sale, of

$1.3 billion declined $639 million, or 33 percent. At

year-end, total delinquencies excluding nonaccrual

of $525 million were at their lowest level since the

second quarter of 2004. is improvement in credit

trends led to a reduction in our loan loss reserves of

$401 million during 2012, while at the same time

producing strong coverage ratios, at 2.16 percent of

portfolio loans and 180 percent of nonperforming

portfolio loans.

Net interest income remained stable despite the

challenging interest rate environment, up 1 percent

compared with 2011, and beneted from our focus

on growing interest earning assets while we manage

interest rate risk. Net interest margin was 3.55

percent and, although we expect additional margin

compression given the interest rate environment, we

expect it to remain manageable due to our relatively

neutral interest rate risk prole.

Total loan growth at year-end of 6 percent was

driven by higher origination volume particularly

in commercial and industrial (C&I), residential

mortgage and automobile loans. Average commercial

loans increased 6 percent from 2011, with average

C&I loan growth of $4 billion, up 15 percent. In 2012,

we expanded our Commercial capabilities by estab-

lishing a specialized energy industry lending group

and remained focused on the healthcare industry,

with our continued investment in new products to

help hospitals and medical practices streamline their

collection cycles and accelerate their cash ows.

Average consumer loans increased 5 percent from

2011, largely due to average residential mortgage

loan growth of 18 percent. Our mortgage business

beneted from increased renancing due to low

rates and originations related to the government’s

HARP 2.0 program, which represented nearly 20

percent of total mortgage originations. We continue

to see opportunities in the mortgage business with

NET INCOME AVAILABLE

TO COMMON SHAREHOLDERS

NET CHARGE-OFF RATIO

TIER 1 COMMON EQUITY*