Eversource 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

Appropriately, we capped a year of achievement with

the next step in the evolution of NU. On October 18,

2010, we announced plans to merge with the Boston-

area electric and gas utility, NSTAR. This transaction is

a natural fit of two companies with adjacent geographic

footprints and similar strategic goals. It will create a

premier regional energy company serving nearly

3.5 million customers in three states. Once the merger

is complete, we will provide electricity and natural gas

to over half of the energy customers in New England.

Simply put, this combination provides a better platform

for us to deliver on our promise for future growth

than we would have been able to achieve on a stand-

alone basis. Our shareholders and NSTAR shareholders

overwhelmingly approved the merger on March 4, and

we expect to secure the necessary approvals to complete

this transaction in the second half of 2011.

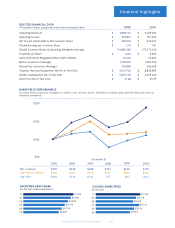

Solid financial results

For our shareholders, we delivered improved financial

performance for the year with our continued control

over costs, strong operating results in all of our

segments, and by strategically deploying capital for

transmission and distribution investments.

In 2010, we delivered earnings per share of $2.19,

compared with $1.91 per share in 2009. Company

earnings totaled $387.9 million in 2010, compared

with $330.0 million in 2009.

In an economic environment that saw many companies

cut dividends, we increased our dividend at a faster pace

than the utility industry average. We raised our dividend

in early 2010 from an annualized rate of $0.95 per

share to $1.025 per share. In the first quarter of 2011,

we raised the dividend again to an annualized rate of

$1.10 per share. This was the eleventh consecutive year

we increased our dividend. Our total shareholder return

during 2010 was 28.3 percent, including our dividend.

In fact, our total return was the highest of all similar

companies in the Edison Electric Institute’s Index of

Shareholder-Owned Electric Utilities for five years

ended September 30, 2010.

Operational excellence

Within our operations, employees of NU and its

companies in Connecticut, Massachusetts and New

Hampshire kept the lights on and the gas flowing by

delivering excellent performance in 2010. We delivered

greater certainty for our customers and shareholders

by successfully completing multiple-year rate cases for

The Connecticut Light and Power Company (CL&P),

Public Service Company of New Hampshire (PSNH) and

Western Massachusetts Electric Company (WMECo).

And we delivered on our promise of value for Yankee

Gas Services Company (Yankee Gas) customers with

a capital plan that has reduced supply constraints and

enhanced safety and reliability.

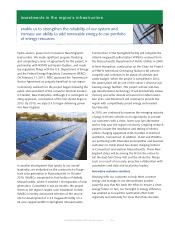

We invested $1 billion to further upgrade, strengthen

and modernize our energy distribution and transmission

systems. Over the next five years, we expect to invest

an additional $6.6 billion in New England’s energy

infrastructure.

In 2010, we completed or advanced several major

infrastructure projects on time, on budget and safely,

once again demonstrating a level of operational

excellence and responsibility that sets us apart.

will create a premier regional energy company serving

nearly 3.5 million customers in three states

our proposed merger with NSTAR

northeast utilities 2010 annual report | three