Eversource 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

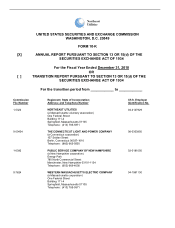

The following table shows the sources of 2010 electric franchise retail revenues for CL&P based on categories of customers:

Sources of

Revenue

% of Total

Revenues

Residential 61%

Commercial 32%

Industrial 6%

Other 1%

Total 100%

Rates

CL&P is subject to regulation by the Connecticut DPUC, which, among other things, has jurisdiction over its rates, accounting

procedures, certain dispositions of property and plant, mergers and consolidations, issuances of long-term securities, standards of

service, management efficiency and construction and operation of facilities. CL&P's present general rate structure consists of various

rate and service classifications covering residential, commercial and industrial services. CL&P's retail rates include a delivery service

component, which includes distribution, transmission, conservation, renewables, CTA, SBC and other charges that are assessed on all

customers.

The CTA is a charge assessed to recover stranded costs associated with electric industry restructuring as well as various IPP

contracts. The SBC recovers costs associated with various hardship and low income programs as well as payments to municipalities to

compensate them for losses in property tax revenue due to decreases in the value of electric generating facilities resulting directly from

electric industry restructuring. The CTA and SBC are annually reconciled to actual costs incurred, with any difference refunded to, or

recovered from, customers.

Under state law, all of CL&P's customers are entitled to choose their energy suppliers, while CL&P remains their electric distribution

company. Under "Standard Service" rates for customers with less than 500 KW of demand and "Supplier of Last Resort Service" rates

for customers with 500 KW of demand or greater, CL&P purchases power for those customers who do not choose a competitive energy

supplier and passes the cost to such customers through a combined GSC and FMCC on customers' bills. The combined GSC and

FMCC charges for both types of service recover all of the costs of procuring energy from CL&P's wholesale suppliers and are adjusted

periodically and reconciled semi-annually in accordance with the directives of the DPUC.

Although more CL&P customers chose competitive energy suppliers in 2010 than in 2009, CL&P continues to supply approximately 40

percent of its customer load at Standard Service or Supplier of Last Resort Service rates while the other 60 percent of its customer load

has migrated to competitive energy suppliers. Because this customer migration is only for energy supply service, it has no impact on

CL&P’s delivery business or its operating income.

Distribution Rates: On June 30, 2010, the DPUC issued a final order in CL&P’s most recent retail rate case approving annualized

distribution rate increases of $63.4 million effective July 1, 2010 and an incremental $38.5 million effective July 1, 2011. The 2010

increase was deferred from customer bills until January 1, 2011 to coincide with the decline in revenue requirements associated with

the final payment of CL&P’s RRBs. In its decision, the DPUC also maintained CL&P’s authorized distribution segment regulatory ROE

of 9.4 percent. In 2010, CL&P earned a distribution segment regulatory ROE of 7.9 percent, compared to 7.3 percent in 2009, and

expects to earn a distribution segment regulatory ROE of approximately 9 percent in 2011.

In May 2010, the Connecticut Legislature approved a state budget for the 2010-2011 fiscal year, which calls for the issuance by the

state of Connecticut of up to $760 million of economic recovery revenue bonds (ERRBs) that would be amortized over eight years.

These bonds will be repaid through a charge on the bills of customers of CL&P and other Connecticut electric distribution companies.

For CL&P, the revenue to pay interest and principal on the bonds would come from a continuation of a portion of its CTA, which would

have otherwise ended by December 31, 2010 with the final payment of the principal and interest on its RRBs, and the diversion of

about one-third of the annual funding for C&LM programs beginning in April 2012. A lawsuit pending against the DPUC to prevent the

issuance of the ERRBs is pending and several bills seeking to modify or prevent the issuance have been proposed before the state

legislature.

On March 31, 2010, CL&P filed with the DPUC an AMI and dynamic pricing plan concluding that a full deployment of AMI meters

accompanied by dynamic pricing options for all CL&P customers would be cost beneficial under a set of reasonable assumptions,

identified as the "base case scenario." Under the base case scenario, capital expenditures associated with the installation of the

meters are estimated at $296 million. CL&P has proposed beginning installation of meters in late 2012 and finishing in 2016.

CL&P has a transmission adjustment clause as part of its retail distribution rates, which reconciles on a semi-annual basis the

transmission revenues billed to customers against the transmission costs of acquiring such services, thereby recovering all of its

transmission expenses on a timely basis.

Sources and Availability of Electric Power Supply

As noted above, CL&P does not own any generation assets and purchases energy to serve its Standard Service and Supplier of Last

Resort Service loads from a variety of competitive sources through periodic RFPs. CL&P enters into supply contracts for Standard

Service periodically for periods of up to three years to mitigate price volatility for its residential and small and medium load commercial